Verdence Capital Advisors LLC purchased a new stake in Alexandria Real Estate Equities, Inc. (NYSE:ARE - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 5,608 shares of the real estate investment trust's stock, valued at approximately $666,000.

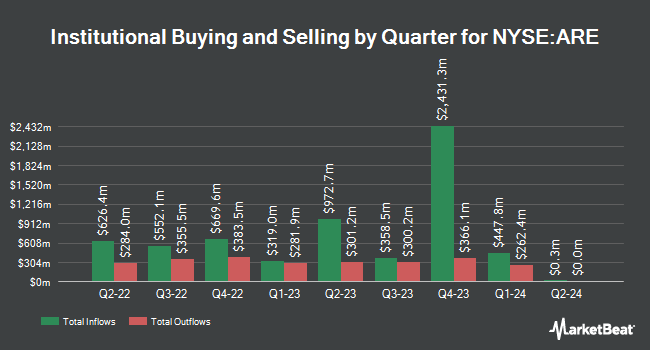

Several other large investors also recently bought and sold shares of the stock. Arbor Capital Management Inc. ADV increased its stake in Alexandria Real Estate Equities by 1.1% in the 2nd quarter. Arbor Capital Management Inc. ADV now owns 8,639 shares of the real estate investment trust's stock valued at $1,000,000 after buying an additional 93 shares during the period. Oregon Public Employees Retirement Fund boosted its position in shares of Alexandria Real Estate Equities by 0.7% during the 2nd quarter. Oregon Public Employees Retirement Fund now owns 13,544 shares of the real estate investment trust's stock worth $1,584,000 after purchasing an additional 100 shares in the last quarter. Presima Securities ULC grew its stake in shares of Alexandria Real Estate Equities by 0.9% during the 3rd quarter. Presima Securities ULC now owns 11,725 shares of the real estate investment trust's stock worth $1,392,000 after purchasing an additional 100 shares during the period. GAMMA Investing LLC increased its holdings in shares of Alexandria Real Estate Equities by 7.9% in the 2nd quarter. GAMMA Investing LLC now owns 1,414 shares of the real estate investment trust's stock valued at $165,000 after purchasing an additional 103 shares in the last quarter. Finally, PFG Investments LLC boosted its holdings in Alexandria Real Estate Equities by 5.1% during the second quarter. PFG Investments LLC now owns 2,392 shares of the real estate investment trust's stock worth $280,000 after buying an additional 115 shares in the last quarter. Institutional investors and hedge funds own 96.54% of the company's stock.

Alexandria Real Estate Equities Trading Down 2.3 %

Shares of ARE stock traded down $2.65 during mid-day trading on Monday, reaching $111.39. The company's stock had a trading volume of 850,549 shares, compared to its average volume of 987,675. The company has a quick ratio of 0.20, a current ratio of 0.20 and a debt-to-equity ratio of 0.56. The firm has a market capitalization of $19.47 billion, a PE ratio of 69.54, a price-to-earnings-growth ratio of 4.23 and a beta of 1.16. The company's 50 day simple moving average is $118.04 and its 200-day simple moving average is $118.14. Alexandria Real Estate Equities, Inc. has a 12-month low of $93.17 and a 12-month high of $135.45.

Alexandria Real Estate Equities (NYSE:ARE - Get Free Report) last issued its earnings results on Monday, October 21st. The real estate investment trust reported $0.96 earnings per share for the quarter, missing the consensus estimate of $2.38 by ($1.42). The company had revenue of $791.60 million during the quarter, compared to analysts' expectations of $766.97 million. Alexandria Real Estate Equities had a return on equity of 1.31% and a net margin of 9.62%. Alexandria Real Estate Equities's quarterly revenue was up 10.9% on a year-over-year basis. During the same period in the previous year, the company earned $2.26 EPS. On average, research analysts predict that Alexandria Real Estate Equities, Inc. will post 9.48 EPS for the current fiscal year.

Alexandria Real Estate Equities Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were paid a dividend of $1.30 per share. This represents a $5.20 annualized dividend and a yield of 4.67%. The ex-dividend date was Monday, September 30th. Alexandria Real Estate Equities's dividend payout ratio (DPR) is 317.07%.

Analyst Ratings Changes

Several equities research analysts have recently commented on the company. Royal Bank of Canada reissued a "sector perform" rating and set a $125.00 price target (down previously from $130.00) on shares of Alexandria Real Estate Equities in a research note on Thursday, October 24th. Citigroup downgraded Alexandria Real Estate Equities from a "buy" rating to a "neutral" rating and cut their price objective for the stock from $130.00 to $125.00 in a research report on Friday, September 13th. Robert W. Baird lowered their target price on Alexandria Real Estate Equities from $137.00 to $130.00 and set an "outperform" rating on the stock in a report on Friday. Jefferies Financial Group lowered Alexandria Real Estate Equities from a "buy" rating to a "hold" rating and decreased their price objective for the company from $136.00 to $127.00 in a research note on Friday, August 2nd. Finally, Wedbush cut their price objective on shares of Alexandria Real Estate Equities from $130.00 to $120.00 and set a "neutral" rating for the company in a research report on Wednesday, October 23rd. Eight research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $131.10.

View Our Latest Analysis on ARE

About Alexandria Real Estate Equities

(

Free Report)

Alexandria Real Estate Equities, Inc NYSE: ARE, an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. As the pioneer of the life science real estate niche since our founding in 1994, Alexandria is the preeminent and longest-tenured owner, operator, and developer of collaborative life science, agtech, and advanced technology mega campuses in AAA innovation cluster locations, including Greater Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland, and Research Triangle.

Recommended Stories

Before you consider Alexandria Real Estate Equities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alexandria Real Estate Equities wasn't on the list.

While Alexandria Real Estate Equities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.