Verdence Capital Advisors LLC raised its position in shares of Fidelity National Information Services, Inc. (NYSE:FIS - Free Report) by 309.5% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 11,568 shares of the information technology services provider's stock after buying an additional 8,743 shares during the period. Verdence Capital Advisors LLC's holdings in Fidelity National Information Services were worth $969,000 as of its most recent filing with the Securities and Exchange Commission.

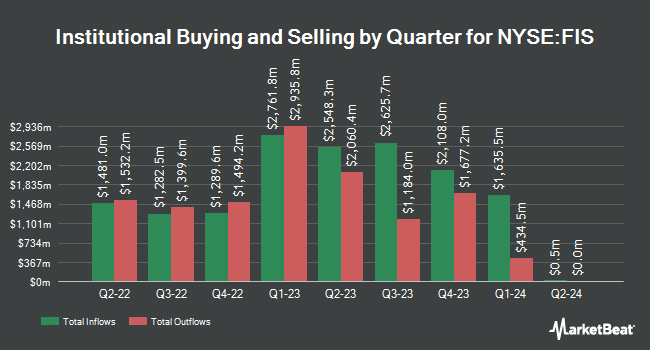

Other institutional investors and hedge funds have also modified their holdings of the company. GSA Capital Partners LLP raised its holdings in Fidelity National Information Services by 11.8% during the 1st quarter. GSA Capital Partners LLP now owns 6,407 shares of the information technology services provider's stock worth $475,000 after purchasing an additional 677 shares during the last quarter. Empowered Funds LLC grew its holdings in Fidelity National Information Services by 289.3% during the 1st quarter. Empowered Funds LLC now owns 24,486 shares of the information technology services provider's stock worth $1,816,000 after acquiring an additional 18,196 shares during the period. Sei Investments Co. raised its position in shares of Fidelity National Information Services by 2.1% during the 1st quarter. Sei Investments Co. now owns 478,979 shares of the information technology services provider's stock valued at $35,531,000 after acquiring an additional 9,782 shares during the last quarter. NorthRock Partners LLC acquired a new position in shares of Fidelity National Information Services in the 1st quarter valued at $218,000. Finally, Meeder Advisory Services Inc. grew its stake in shares of Fidelity National Information Services by 10.9% during the first quarter. Meeder Advisory Services Inc. now owns 9,266 shares of the information technology services provider's stock worth $687,000 after purchasing an additional 914 shares during the period. 96.23% of the stock is owned by institutional investors and hedge funds.

Fidelity National Information Services Stock Performance

Shares of FIS stock traded up $0.76 during trading on Monday, reaching $88.83. 2,216,118 shares of the company's stock were exchanged, compared to its average volume of 3,770,553. The firm's fifty day moving average price is $86.07 and its 200-day moving average price is $79.50. Fidelity National Information Services, Inc. has a twelve month low of $52.14 and a twelve month high of $91.98. The stock has a market capitalization of $47.82 billion, a PE ratio of 35.45, a PEG ratio of 0.74 and a beta of 1.06. The company has a quick ratio of 1.35, a current ratio of 1.18 and a debt-to-equity ratio of 0.63.

Fidelity National Information Services (NYSE:FIS - Get Free Report) last posted its earnings results on Monday, November 4th. The information technology services provider reported $1.40 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.29 by $0.11. Fidelity National Information Services had a net margin of 14.37% and a return on equity of 15.35%. The company had revenue of $2.57 billion during the quarter, compared to analysts' expectations of $2.56 billion. During the same quarter last year, the company posted $0.94 EPS. Fidelity National Information Services's quarterly revenue was up 3.1% compared to the same quarter last year. As a group, sell-side analysts anticipate that Fidelity National Information Services, Inc. will post 5.18 EPS for the current year.

Fidelity National Information Services Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, December 23rd. Investors of record on Monday, December 9th will be issued a dividend of $0.36 per share. The ex-dividend date is Monday, December 9th. This represents a $1.44 annualized dividend and a yield of 1.62%. Fidelity National Information Services's payout ratio is currently 57.37%.

Insider Activity at Fidelity National Information Services

In other Fidelity National Information Services news, Director Jeffrey A. Goldstein acquired 626 shares of the business's stock in a transaction on Tuesday, October 15th. The stock was purchased at an average price of $88.25 per share, with a total value of $55,244.50. Following the acquisition, the director now directly owns 10,397 shares of the company's stock, valued at approximately $917,535.25. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.20% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of equities analysts have issued reports on FIS shares. JPMorgan Chase & Co. raised their target price on Fidelity National Information Services from $89.00 to $99.00 and gave the stock an "overweight" rating in a report on Tuesday, November 5th. Royal Bank of Canada upped their target price on shares of Fidelity National Information Services from $95.00 to $104.00 and gave the company an "outperform" rating in a research note on Tuesday, November 5th. Bank of America boosted their price target on shares of Fidelity National Information Services from $90.00 to $96.00 and gave the company a "buy" rating in a report on Tuesday, September 17th. Deutsche Bank Aktiengesellschaft increased their price target on Fidelity National Information Services from $70.00 to $73.00 and gave the stock a "hold" rating in a report on Wednesday, August 7th. Finally, Robert W. Baird lifted their price target on shares of Fidelity National Information Services from $92.00 to $94.00 and gave the company a "neutral" rating in a research note on Tuesday, November 5th. Ten analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $89.68.

Get Our Latest Stock Report on FIS

About Fidelity National Information Services

(

Free Report)

Fidelity National Information Services, Inc engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. It operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments. The company provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions.

Recommended Stories

Before you consider Fidelity National Information Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelity National Information Services wasn't on the list.

While Fidelity National Information Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.