Victory Capital Management Inc. trimmed its position in Verint Systems Inc. (NASDAQ:VRNT - Free Report) by 9.6% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,743,915 shares of the technology company's stock after selling 399,312 shares during the period. Victory Capital Management Inc. owned approximately 6.04% of Verint Systems worth $94,833,000 at the end of the most recent quarter.

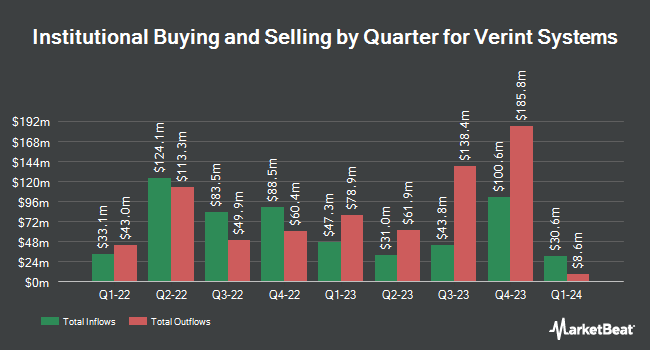

Several other institutional investors and hedge funds also recently made changes to their positions in VRNT. Vanguard Group Inc. lifted its holdings in shares of Verint Systems by 2.6% in the first quarter. Vanguard Group Inc. now owns 7,367,685 shares of the technology company's stock valued at $244,239,000 after purchasing an additional 185,105 shares in the last quarter. Dimensional Fund Advisors LP raised its holdings in Verint Systems by 4.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,918,925 shares of the technology company's stock valued at $61,792,000 after acquiring an additional 73,441 shares during the period. Fort Washington Investment Advisors Inc. OH grew its stake in shares of Verint Systems by 35.1% in the second quarter. Fort Washington Investment Advisors Inc. OH now owns 814,959 shares of the technology company's stock valued at $26,242,000 after acquiring an additional 211,570 shares in the last quarter. Mesirow Institutional Investment Management Inc. lifted its position in shares of Verint Systems by 20.7% during the 2nd quarter. Mesirow Institutional Investment Management Inc. now owns 534,447 shares of the technology company's stock valued at $17,209,000 after acquiring an additional 91,762 shares during the period. Finally, DekaBank Deutsche Girozentrale raised its stake in Verint Systems by 3.2% during the third quarter. DekaBank Deutsche Girozentrale now owns 189,512 shares of the technology company's stock worth $4,822,000 after acquiring an additional 5,928 shares in the last quarter. Institutional investors and hedge funds own 94.95% of the company's stock.

Insider Activity at Verint Systems

In other news, CEO Dan Bodner sold 16,932 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $25.85, for a total transaction of $437,692.20. Following the completion of the transaction, the chief executive officer now directly owns 592,832 shares of the company's stock, valued at $15,324,707.20. This trade represents a 2.78 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, insider Peter Fante sold 6,330 shares of Verint Systems stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $25.85, for a total value of $163,630.50. Following the transaction, the insider now owns 91,334 shares of the company's stock, valued at $2,360,983.90. This represents a 6.48 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 33,811 shares of company stock worth $874,014 over the last three months. 1.70% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

VRNT has been the subject of several recent analyst reports. Needham & Company LLC reaffirmed a "buy" rating and set a $40.00 price objective on shares of Verint Systems in a research report on Wednesday, September 25th. StockNews.com upgraded shares of Verint Systems from a "hold" rating to a "buy" rating in a research note on Thursday, September 5th. Jefferies Financial Group decreased their price objective on Verint Systems from $32.00 to $28.00 and set a "hold" rating on the stock in a report on Thursday, September 5th. Wedbush reissued an "outperform" rating and set a $38.00 price objective on shares of Verint Systems in a research note on Thursday, September 26th. Finally, TD Cowen reduced their target price on Verint Systems from $40.00 to $36.00 and set a "buy" rating on the stock in a research note on Thursday, September 5th. Three equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $34.67.

Get Our Latest Stock Analysis on Verint Systems

Verint Systems Trading Down 4.0 %

Verint Systems stock traded down $1.03 during mid-day trading on Thursday, hitting $24.67. The company's stock had a trading volume of 892,230 shares, compared to its average volume of 673,864. The company has a current ratio of 1.41, a quick ratio of 1.36 and a debt-to-equity ratio of 0.49. The firm has a market capitalization of $1.53 billion, a PE ratio of 38.36, a price-to-earnings-growth ratio of 1.05 and a beta of 1.25. Verint Systems Inc. has a 1 year low of $21.27 and a 1 year high of $38.17. The stock's fifty day moving average is $24.06 and its two-hundred day moving average is $29.62.

Verint Systems (NASDAQ:VRNT - Get Free Report) last posted its quarterly earnings data on Wednesday, September 4th. The technology company reported $0.49 earnings per share for the quarter, missing analysts' consensus estimates of $0.53 by ($0.04). Verint Systems had a return on equity of 16.17% and a net margin of 6.78%. The company had revenue of $210.17 million for the quarter, compared to analyst estimates of $212.81 million. During the same period in the previous year, the business posted $0.22 earnings per share. The firm's revenue was up .0% compared to the same quarter last year. On average, analysts anticipate that Verint Systems Inc. will post 1.97 EPS for the current year.

About Verint Systems

(

Free Report)

Verint Systems Inc provides customer engagement solutions worldwide. It offers forecasting and scheduling, channels and routing, knowledge management, fraud and security solutions, quality and compliance, analytics and insights, real-time assistance, self-services, financial compliance, and voice pf the consumer solutions.

Featured Stories

Before you consider Verint Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verint Systems wasn't on the list.

While Verint Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.