FMR LLC boosted its position in Veris Residential, Inc. (NYSE:VRE - Free Report) by 5,945.2% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 224,278 shares of the company's stock after acquiring an additional 220,568 shares during the quarter. FMR LLC owned 0.24% of Veris Residential worth $4,006,000 as of its most recent filing with the Securities and Exchange Commission.

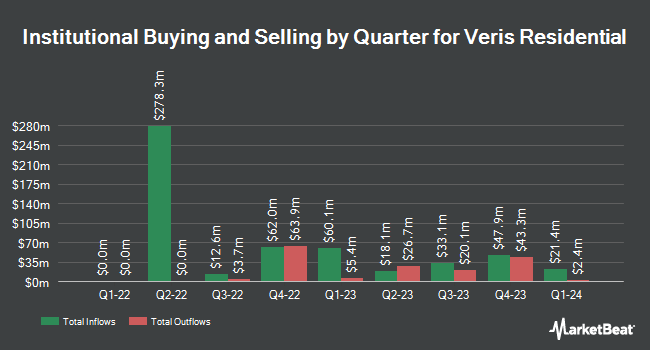

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Lighthouse Investment Partners LLC acquired a new position in Veris Residential in the second quarter valued at $2,175,000. Renaissance Technologies LLC boosted its holdings in Veris Residential by 387.4% in the second quarter. Renaissance Technologies LLC now owns 84,800 shares of the company's stock valued at $1,272,000 after acquiring an additional 67,400 shares during the last quarter. Van ECK Associates Corp boosted its holdings in Veris Residential by 5.8% in the second quarter. Van ECK Associates Corp now owns 12,011 shares of the company's stock valued at $180,000 after acquiring an additional 663 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in Veris Residential by 3.5% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,470,536 shares of the company's stock valued at $26,264,000 after acquiring an additional 49,378 shares during the last quarter. Finally, DigitalBridge Group Inc. acquired a new position in Veris Residential in the second quarter valued at $13,673,000. Institutional investors and hedge funds own 93.04% of the company's stock.

Veris Residential Stock Down 0.5 %

Shares of NYSE VRE traded down $0.08 during midday trading on Friday, reaching $17.50. 303,891 shares of the company's stock were exchanged, compared to its average volume of 581,814. Veris Residential, Inc. has a 52-week low of $13.84 and a 52-week high of $18.85. The stock has a market capitalization of $1.63 billion, a PE ratio of -102.94, a price-to-earnings-growth ratio of 2.91 and a beta of 1.27. The company has a debt-to-equity ratio of 1.34, a quick ratio of 0.73 and a current ratio of 0.73. The business's fifty day moving average price is $17.60 and its two-hundred day moving average price is $16.65.

Veris Residential Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 10th. Investors of record on Tuesday, December 31st will be issued a $0.08 dividend. This is a positive change from Veris Residential's previous quarterly dividend of $0.07. This represents a $0.32 annualized dividend and a yield of 1.83%. The ex-dividend date is Tuesday, December 31st. Veris Residential's payout ratio is currently -188.24%.

Analyst Ratings Changes

Several research firms have commented on VRE. Evercore ISI raised their price objective on Veris Residential from $17.00 to $19.00 and gave the company an "outperform" rating in a research report on Wednesday, August 28th. Bank of America raised Veris Residential from a "neutral" rating to a "buy" rating and raised their price objective for the company from $20.00 to $23.00 in a research report on Tuesday, November 12th. Finally, JPMorgan Chase & Co. lifted their target price on Veris Residential from $13.00 to $14.00 and gave the stock an "underweight" rating in a research report on Monday, September 16th.

Read Our Latest Research Report on VRE

Veris Residential Profile

(

Free Report)

Veris Residential, Inc is a forward-thinking, environmentally and socially conscious real estate investment trust (REIT) that primarily owns, operates, acquires and develops holistically-inspired, Class A multifamily properties that meet the sustainability-conscious lifestyle needs of today's residents while seeking to positively impact the communities it serves and the planet at large.

Featured Stories

Before you consider Veris Residential, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veris Residential wasn't on the list.

While Veris Residential currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.