KBC Group NV lifted its stake in shares of VeriSign, Inc. (NASDAQ:VRSN - Free Report) by 56.3% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 17,495 shares of the information services provider's stock after purchasing an additional 6,303 shares during the quarter. KBC Group NV's holdings in VeriSign were worth $3,323,000 as of its most recent filing with the Securities and Exchange Commission.

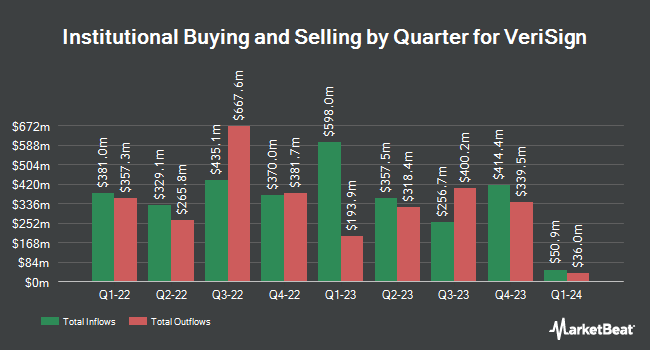

Several other institutional investors also recently modified their holdings of VRSN. Blue Trust Inc. raised its position in shares of VeriSign by 291.1% during the second quarter. Blue Trust Inc. now owns 176 shares of the information services provider's stock worth $33,000 after purchasing an additional 131 shares during the period. UMB Bank n.a. boosted its stake in VeriSign by 117.2% in the second quarter. UMB Bank n.a. now owns 202 shares of the information services provider's stock valued at $36,000 after acquiring an additional 109 shares during the last quarter. Rothschild Investment LLC purchased a new position in VeriSign in the second quarter valued at approximately $38,000. Migdal Insurance & Financial Holdings Ltd. purchased a new position in shares of VeriSign in the second quarter worth about $39,000. Finally, Concord Wealth Partners raised its holdings in VeriSign by 93.2% during the 3rd quarter. Concord Wealth Partners now owns 226 shares of the information services provider's stock valued at $43,000 after acquiring an additional 109 shares during the period. 92.90% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at VeriSign

In other VeriSign news, EVP Thomas C. Indelicarto sold 1,228 shares of the business's stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $190.00, for a total value of $233,320.00. Following the completion of the transaction, the executive vice president now owns 33,593 shares of the company's stock, valued at approximately $6,382,670. The trade was a 3.53 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 0.84% of the company's stock.

VeriSign Trading Down 0.9 %

Shares of VeriSign stock traded down $1.62 on Monday, hitting $179.26. 426,545 shares of the company traded hands, compared to its average volume of 662,026. The firm's 50-day simple moving average is $183.91 and its 200 day simple moving average is $179.66. VeriSign, Inc. has a 12-month low of $167.04 and a 12-month high of $220.91. The company has a market cap of $17.23 billion, a P/E ratio of 21.03 and a beta of 0.91.

VeriSign (NASDAQ:VRSN - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The information services provider reported $2.07 earnings per share for the quarter, beating the consensus estimate of $2.01 by $0.06. The firm had revenue of $390.60 million during the quarter, compared to the consensus estimate of $390.19 million. VeriSign had a negative return on equity of 45.59% and a net margin of 55.74%. The business's revenue was up 3.8% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.83 earnings per share.

VeriSign Company Profile

(

Free Report)

VeriSign, Inc, together with its subsidiaries, provides domain name registry services and internet infrastructure that enables internet navigation for various recognized domain names worldwide. The company enables the security, stability, and resiliency of internet infrastructure and services, including providing root zone maintainer services, operating two of thirteen internet root servers; and offering registration services and authoritative resolution for the .com and .net domains, which supports global e-commerce.

Recommended Stories

Before you consider VeriSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VeriSign wasn't on the list.

While VeriSign currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.