State of New Jersey Common Pension Fund D reduced its stake in shares of VeriSign, Inc. (NASDAQ:VRSN - Free Report) by 7.9% during the 4th quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 28,922 shares of the information services provider's stock after selling 2,474 shares during the period. State of New Jersey Common Pension Fund D's holdings in VeriSign were worth $5,986,000 at the end of the most recent reporting period.

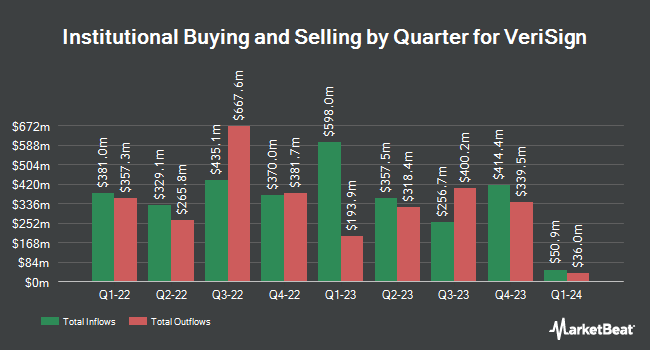

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Crewe Advisors LLC purchased a new position in VeriSign during the fourth quarter worth $26,000. Concord Wealth Partners boosted its stake in shares of VeriSign by 93.2% during the third quarter. Concord Wealth Partners now owns 226 shares of the information services provider's stock valued at $43,000 after acquiring an additional 109 shares during the last quarter. Spire Wealth Management increased its position in VeriSign by 69.8% during the 4th quarter. Spire Wealth Management now owns 253 shares of the information services provider's stock worth $52,000 after purchasing an additional 104 shares in the last quarter. Blue Trust Inc. raised its stake in VeriSign by 138.6% in the 3rd quarter. Blue Trust Inc. now owns 420 shares of the information services provider's stock valued at $75,000 after purchasing an additional 244 shares during the last quarter. Finally, Intact Investment Management Inc. purchased a new position in VeriSign in the 3rd quarter valued at about $76,000. 92.90% of the stock is owned by institutional investors and hedge funds.

Insider Activity at VeriSign

In other VeriSign news, EVP Danny R. Mcpherson sold 2,092 shares of VeriSign stock in a transaction that occurred on Monday, December 2nd. The shares were sold at an average price of $192.43, for a total transaction of $402,563.56. Following the transaction, the executive vice president now directly owns 26,157 shares of the company's stock, valued at $5,033,391.51. The trade was a 7.41 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. 0.84% of the stock is owned by insiders.

VeriSign Stock Down 0.9 %

Shares of VRSN stock traded down $2.01 during trading hours on Friday, hitting $231.87. 978,529 shares of the company were exchanged, compared to its average volume of 762,660. VeriSign, Inc. has a 1 year low of $167.04 and a 1 year high of $236.20. The firm has a fifty day moving average of $211.65 and a 200 day moving average of $193.50. The firm has a market cap of $21.93 billion, a PE ratio of 28.98 and a beta of 0.90.

VeriSign (NASDAQ:VRSN - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The information services provider reported $2.00 earnings per share for the quarter, hitting analysts' consensus estimates of $2.00. VeriSign had a net margin of 50.47% and a negative return on equity of 43.01%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently commented on VRSN shares. Robert W. Baird upgraded shares of VeriSign from a "neutral" rating to an "outperform" rating and lifted their price target for the stock from $200.00 to $250.00 in a report on Monday, December 9th. Citigroup lifted their target price on shares of VeriSign from $246.00 to $250.00 and gave the stock a "buy" rating in a research note on Tuesday, February 4th. Baird R W upgraded VeriSign from a "hold" rating to a "strong-buy" rating in a report on Monday, December 9th. Finally, StockNews.com upgraded VeriSign from a "hold" rating to a "buy" rating in a report on Tuesday, January 7th.

Get Our Latest Analysis on VRSN

VeriSign Company Profile

(

Free Report)

VeriSign, Inc, together with its subsidiaries, provides domain name registry services and internet infrastructure that enables internet navigation for various recognized domain names worldwide. The company enables the security, stability, and resiliency of internet infrastructure and services, including providing root zone maintainer services, operating two of thirteen internet root servers; and offering registration services and authoritative resolution for the .com and .net domains, which supports global e-commerce.

See Also

Before you consider VeriSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VeriSign wasn't on the list.

While VeriSign currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.