Verition Fund Management LLC bought a new stake in shares of Xometry, Inc. (NASDAQ:XMTR - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund bought 20,857 shares of the company's stock, valued at approximately $383,000.

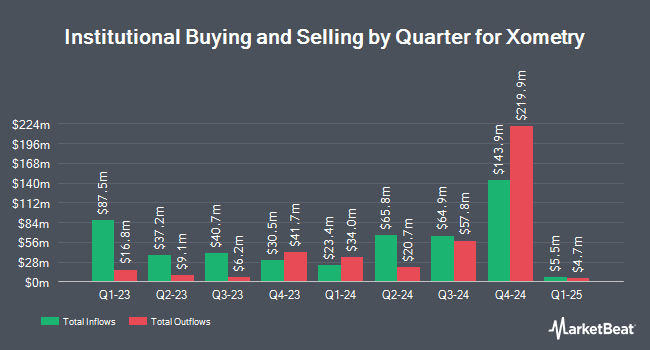

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the business. Primecap Management Co. CA increased its position in Xometry by 1.7% in the third quarter. Primecap Management Co. CA now owns 6,918,252 shares of the company's stock worth $127,088,000 after buying an additional 113,264 shares in the last quarter. FMR LLC increased its holdings in Xometry by 40.2% in the 3rd quarter. FMR LLC now owns 4,078,462 shares of the company's stock worth $74,921,000 after acquiring an additional 1,169,778 shares in the last quarter. Sylebra Capital LLC raised its stake in Xometry by 134.2% during the 2nd quarter. Sylebra Capital LLC now owns 1,508,716 shares of the company's stock worth $17,441,000 after acquiring an additional 864,454 shares during the period. Bellecapital International Ltd. purchased a new position in Xometry during the second quarter valued at approximately $6,281,000. Finally, Dimensional Fund Advisors LP boosted its position in shares of Xometry by 44.9% in the second quarter. Dimensional Fund Advisors LP now owns 493,847 shares of the company's stock worth $5,712,000 after purchasing an additional 153,107 shares during the period. 97.31% of the stock is owned by hedge funds and other institutional investors.

Xometry Price Performance

Shares of NASDAQ:XMTR traded up $0.01 during mid-day trading on Friday, reaching $34.76. The stock had a trading volume of 556,885 shares, compared to its average volume of 592,665. The company has a market cap of $1.72 billion, a P/E ratio of -33.10 and a beta of 0.83. The business's 50 day moving average price is $26.42 and its 200 day moving average price is $19.45. The company has a current ratio of 4.59, a quick ratio of 4.55 and a debt-to-equity ratio of 0.90. Xometry, Inc. has a 1 year low of $11.08 and a 1 year high of $38.74.

Wall Street Analysts Forecast Growth

XMTR has been the topic of several recent analyst reports. The Goldman Sachs Group raised their price objective on shares of Xometry from $24.00 to $28.00 and gave the company a "buy" rating in a research report on Wednesday, November 6th. JMP Securities raised their price target on Xometry from $34.00 to $42.00 and gave the company a "market outperform" rating in a report on Thursday, November 14th. UBS Group upped their price objective on Xometry from $20.00 to $22.00 and gave the stock a "neutral" rating in a research note on Wednesday, November 6th. Cantor Fitzgerald reiterated an "underweight" rating and set a $12.00 target price on shares of Xometry in a research report on Wednesday, November 6th. Finally, Citigroup boosted their price target on Xometry from $25.00 to $33.00 and gave the stock a "buy" rating in a report on Wednesday, November 6th. One analyst has rated the stock with a sell rating, two have assigned a hold rating and four have assigned a buy rating to the company. According to MarketBeat.com, Xometry presently has an average rating of "Hold" and a consensus price target of $27.71.

View Our Latest Stock Analysis on XMTR

Insider Transactions at Xometry

In other Xometry news, Director Emily Rollins sold 3,729 shares of the business's stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $29.49, for a total transaction of $109,968.21. Following the sale, the director now directly owns 12,457 shares of the company's stock, valued at $367,356.93. The trade was a 23.04 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, CTO Matthew Leibel sold 16,564 shares of the company's stock in a transaction that occurred on Tuesday, November 12th. The shares were sold at an average price of $30.08, for a total value of $498,245.12. Following the sale, the chief technology officer now owns 77,856 shares in the company, valued at approximately $2,341,908.48. This trade represents a 17.54 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 38,233 shares of company stock valued at $1,139,000 in the last ninety days. Corporate insiders own 16.79% of the company's stock.

Xometry Company Profile

(

Free Report)

Xometry, Inc operates an online marketplace that enables buyers to source custom-manufactured parts and assemblies in the United States and internationally. It provides computer numerical control manufacturing, sheet metal forming, and sheet cutting; 3D printing, including fused deposition modeling, direct metal laser sintering, PolyJet, stereolithography, selective laser sintering, binder jetting, carbon digital light synthesis, multi jet fusion, and lubricant sublayer photo-curing; and die casting, stamping, injection molding, urethane casting, tube cutting, and tube bending, as well as finishing services, rapid prototyping, and high-volume production services.

See Also

Before you consider Xometry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xometry wasn't on the list.

While Xometry currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.