Verition Fund Management LLC lifted its stake in Minerals Technologies Inc. (NYSE:MTX - Free Report) by 161.2% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 10,332 shares of the basic materials company's stock after purchasing an additional 6,377 shares during the quarter. Verition Fund Management LLC's holdings in Minerals Technologies were worth $798,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

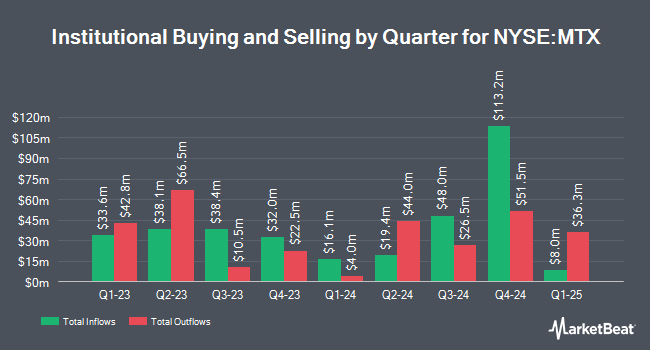

Several other institutional investors have also made changes to their positions in the stock. Picton Mahoney Asset Management bought a new stake in shares of Minerals Technologies in the 2nd quarter valued at approximately $52,000. Blue Trust Inc. raised its holdings in shares of Minerals Technologies by 2,418.2% during the 3rd quarter. Blue Trust Inc. now owns 831 shares of the basic materials company's stock valued at $69,000 after purchasing an additional 798 shares in the last quarter. Innealta Capital LLC acquired a new stake in shares of Minerals Technologies in the 2nd quarter valued at $76,000. Quarry LP boosted its holdings in Minerals Technologies by 1,857.4% in the second quarter. Quarry LP now owns 920 shares of the basic materials company's stock worth $77,000 after purchasing an additional 873 shares in the last quarter. Finally, CWM LLC raised its holdings in Minerals Technologies by 585.6% during the second quarter. CWM LLC now owns 1,330 shares of the basic materials company's stock valued at $111,000 after buying an additional 1,136 shares in the last quarter. 97.29% of the stock is currently owned by institutional investors and hedge funds.

Minerals Technologies Stock Performance

Shares of NYSE:MTX traded down $0.62 during trading on Tuesday, reaching $79.38. The stock had a trading volume of 128,913 shares, compared to its average volume of 159,114. The stock has a fifty day simple moving average of $79.23 and a two-hundred day simple moving average of $79.10. The company has a quick ratio of 1.72, a current ratio of 2.46 and a debt-to-equity ratio of 0.51. Minerals Technologies Inc. has a 52 week low of $63.01 and a 52 week high of $90.29. The firm has a market capitalization of $2.53 billion, a price-to-earnings ratio of 16.82 and a beta of 1.30.

Minerals Technologies Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, December 5th. Investors of record on Thursday, October 31st were given a dividend of $0.11 per share. This represents a $0.44 annualized dividend and a dividend yield of 0.55%. The ex-dividend date was Thursday, October 31st. This is a boost from Minerals Technologies's previous quarterly dividend of $0.10. Minerals Technologies's payout ratio is currently 9.32%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com downgraded Minerals Technologies from a "buy" rating to a "hold" rating in a research note on Wednesday, October 30th.

Check Out Our Latest Stock Report on MTX

Minerals Technologies Company Profile

(

Free Report)

Minerals Technologies Inc develops, produces, and markets various mineral, mineral-based, and related systems and services. The company operates through two segments, Consumer & Specialties, and Engineered Solutions segments. The Consumer & Specialties segment offers household and personal care products, such as pet litter, personal care, fabric care, edible oil and other fluid purification, animal health, and agricultural products; and specialty additives products, including precipitated calcium carbonate and ground calcium carbonate products that are used in the paper, paperboard, and fiber based packaging industries, as well as automotive, construction, and table and food applications.

Further Reading

Before you consider Minerals Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Minerals Technologies wasn't on the list.

While Minerals Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.