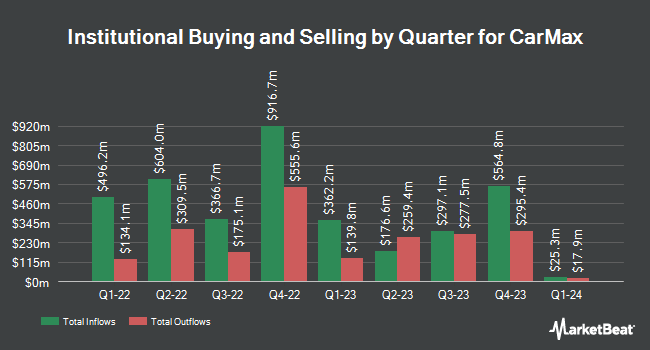

Verition Fund Management LLC lessened its holdings in CarMax, Inc. (NYSE:KMX - Free Report) by 74.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 52,987 shares of the company's stock after selling 157,265 shares during the quarter. Verition Fund Management LLC's holdings in CarMax were worth $4,100,000 at the end of the most recent reporting period.

A number of other institutional investors also recently bought and sold shares of KMX. Baker Tilly Wealth Management LLC increased its stake in shares of CarMax by 4.6% in the second quarter. Baker Tilly Wealth Management LLC now owns 2,959 shares of the company's stock worth $217,000 after acquiring an additional 130 shares during the period. Peoples Bank KS lifted its stake in shares of CarMax by 10.0% in the 2nd quarter. Peoples Bank KS now owns 1,479 shares of the company's stock valued at $108,000 after purchasing an additional 135 shares during the period. Northwestern Mutual Wealth Management Co. grew its position in CarMax by 2.3% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 6,220 shares of the company's stock valued at $456,000 after buying an additional 142 shares during the period. Allegheny Financial Group LTD increased its holdings in CarMax by 4.1% in the second quarter. Allegheny Financial Group LTD now owns 3,597 shares of the company's stock valued at $264,000 after buying an additional 143 shares in the last quarter. Finally, Sompo Asset Management Co. Ltd. increased its holdings in CarMax by 1.6% in the third quarter. Sompo Asset Management Co. Ltd. now owns 10,602 shares of the company's stock valued at $820,000 after buying an additional 170 shares in the last quarter.

Analysts Set New Price Targets

Several equities analysts recently weighed in on the company. Truist Financial lifted their price target on CarMax from $70.00 to $75.00 and gave the company a "hold" rating in a research note on Monday, September 23rd. BNP Paribas upgraded CarMax to a "strong sell" rating in a research report on Friday, September 27th. Wedbush reissued an "outperform" rating and issued a $95.00 price target on shares of CarMax in a research note on Wednesday, October 16th. Oppenheimer restated an "outperform" rating and set a $105.00 price objective on shares of CarMax in a research report on Friday, October 4th. Finally, Evercore ISI boosted their target price on shares of CarMax from $81.00 to $83.00 and gave the stock an "in-line" rating in a research note on Tuesday. Four equities research analysts have rated the stock with a sell rating, four have assigned a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $80.09.

Get Our Latest Report on KMX

CarMax Trading Down 0.7 %

Shares of KMX stock traded down $0.60 on Wednesday, hitting $83.62. 1,680,269 shares of the stock traded hands, compared to its average volume of 1,900,320. The company has a debt-to-equity ratio of 2.93, a quick ratio of 0.68 and a current ratio of 2.25. CarMax, Inc. has a twelve month low of $64.72 and a twelve month high of $88.22. The firm's 50-day moving average price is $76.22 and its two-hundred day moving average price is $76.36. The stock has a market capitalization of $12.95 billion, a PE ratio of 31.66, a PEG ratio of 1.69 and a beta of 1.71.

CarMax (NYSE:KMX - Get Free Report) last posted its quarterly earnings results on Thursday, September 26th. The company reported $0.85 earnings per share for the quarter, missing the consensus estimate of $0.86 by ($0.01). The firm had revenue of $7.01 billion during the quarter, compared to analysts' expectations of $6.83 billion. CarMax had a net margin of 1.61% and a return on equity of 6.83%. The business's quarterly revenue was down .9% on a year-over-year basis. During the same period last year, the company earned $0.75 EPS. As a group, analysts anticipate that CarMax, Inc. will post 2.99 EPS for the current year.

CarMax Profile

(

Free Report)

CarMax, Inc, through its subsidiaries, operates as a retailer of used vehicles and related products in the United States. It operates in two segments: CarMax Sales Operations and CarMax Auto Finance. The CarMax Sales Operations segment offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services.

Featured Articles

Before you consider CarMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarMax wasn't on the list.

While CarMax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.