Verition Fund Management LLC grew its holdings in shares of PENN Entertainment, Inc. (NASDAQ:PENN - Free Report) by 367.2% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 452,988 shares of the company's stock after purchasing an additional 356,029 shares during the period. Verition Fund Management LLC owned approximately 0.30% of PENN Entertainment worth $8,543,000 at the end of the most recent reporting period.

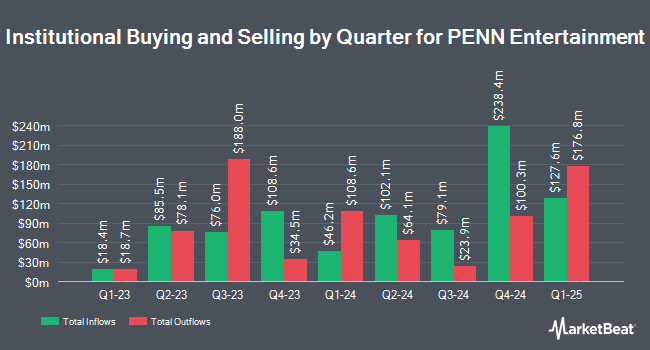

Several other institutional investors and hedge funds also recently added to or reduced their stakes in PENN. Price T Rowe Associates Inc. MD increased its holdings in PENN Entertainment by 5.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 88,958 shares of the company's stock valued at $1,620,000 after buying an additional 4,493 shares in the last quarter. Cetera Investment Advisers raised its holdings in PENN Entertainment by 186.2% during the first quarter. Cetera Investment Advisers now owns 126,807 shares of the company's stock worth $2,309,000 after purchasing an additional 82,494 shares during the last quarter. Cetera Advisors LLC boosted its position in PENN Entertainment by 184.3% during the first quarter. Cetera Advisors LLC now owns 60,708 shares of the company's stock worth $1,105,000 after purchasing an additional 39,356 shares in the last quarter. GAMMA Investing LLC grew its holdings in PENN Entertainment by 233.6% in the second quarter. GAMMA Investing LLC now owns 1,441 shares of the company's stock valued at $28,000 after purchasing an additional 1,009 shares during the last quarter. Finally, Harbor Capital Advisors Inc. increased its position in shares of PENN Entertainment by 192.5% in the second quarter. Harbor Capital Advisors Inc. now owns 303,089 shares of the company's stock valued at $5,866,000 after buying an additional 199,465 shares in the last quarter. Institutional investors and hedge funds own 91.69% of the company's stock.

Analysts Set New Price Targets

Several research firms recently commented on PENN. Benchmark reiterated a "hold" rating on shares of PENN Entertainment in a research report on Friday, November 8th. Truist Financial reduced their price target on shares of PENN Entertainment from $25.00 to $23.00 and set a "buy" rating on the stock in a report on Wednesday, October 23rd. Needham & Company LLC reissued a "buy" rating and set a $26.00 price objective on shares of PENN Entertainment in a research note on Friday, November 8th. Bank of America began coverage on PENN Entertainment in a research note on Wednesday, November 13th. They issued a "neutral" rating and a $22.00 target price on the stock. Finally, Craig Hallum reiterated a "buy" rating and set a $30.00 target price on shares of PENN Entertainment in a report on Tuesday, October 8th. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $23.29.

View Our Latest Stock Analysis on PENN

PENN Entertainment Trading Up 3.5 %

Shares of PENN traded up $0.75 during mid-day trading on Monday, hitting $22.34. The company had a trading volume of 3,407,858 shares, compared to its average volume of 4,940,273. PENN Entertainment, Inc. has a 1-year low of $13.50 and a 1-year high of $27.20. The company has a quick ratio of 0.94, a current ratio of 0.94 and a debt-to-equity ratio of 2.34. The business's 50-day simple moving average is $19.66 and its 200-day simple moving average is $18.89. The stock has a market cap of $3.41 billion, a PE ratio of -6.29 and a beta of 2.09.

PENN Entertainment (NASDAQ:PENN - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported ($0.24) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.28) by $0.04. The company had revenue of $1.64 billion during the quarter, compared to analysts' expectations of $1.65 billion. PENN Entertainment had a negative net margin of 8.51% and a negative return on equity of 14.44%. The business's quarterly revenue was up 1.2% compared to the same quarter last year. During the same period in the previous year, the company earned $1.21 EPS. Sell-side analysts forecast that PENN Entertainment, Inc. will post -1.53 earnings per share for the current year.

Insiders Place Their Bets

In other PENN Entertainment news, Director Anuj Dhanda purchased 15,000 shares of the firm's stock in a transaction that occurred on Friday, September 6th. The stock was purchased at an average cost of $18.40 per share, with a total value of $276,000.00. Following the transaction, the director now owns 31,523 shares in the company, valued at approximately $580,023.20. This trade represents a 90.78 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director David A. Handler purchased 10,000 shares of the stock in a transaction that occurred on Tuesday, September 10th. The stock was bought at an average price of $17.51 per share, with a total value of $175,100.00. Following the completion of the acquisition, the director now owns 293,450 shares in the company, valued at $5,138,309.50. This represents a 3.53 % increase in their position. The disclosure for this purchase can be found here. Insiders bought 79,200 shares of company stock worth $1,450,548 over the last three months. 2.19% of the stock is owned by insiders.

PENN Entertainment Profile

(

Free Report)

PENN Entertainment, Inc, together with its subsidiaries, provides integrated entertainment, sports content, and casino gaming experiences. The company operates through five segments: Northeast, South, West, Midwest, and Interactive. It operates online sports betting in various jurisdictions; and iCasino under Hollywood Casino, L'Auberge, ESPN BET, and theScore Bet Sportsbook and Casino brands.

See Also

Before you consider PENN Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PENN Entertainment wasn't on the list.

While PENN Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.