Verition Fund Management LLC lifted its holdings in shares of Clarivate Plc (NYSE:CLVT - Free Report) by 707.5% during the 3rd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 157,540 shares of the company's stock after acquiring an additional 138,031 shares during the period. Verition Fund Management LLC's holdings in Clarivate were worth $1,119,000 at the end of the most recent reporting period.

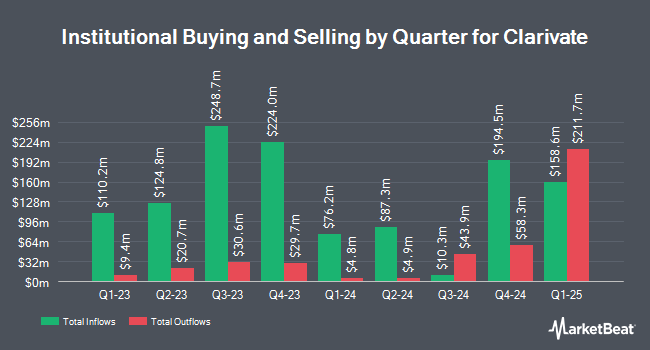

Several other institutional investors have also recently added to or reduced their stakes in CLVT. Capstone Investment Advisors LLC purchased a new stake in Clarivate in the 3rd quarter valued at $440,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its holdings in shares of Clarivate by 112.9% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,040,426 shares of the company's stock valued at $7,387,000 after buying an additional 551,838 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in shares of Clarivate by 9.9% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 78,006 shares of the company's stock worth $554,000 after buying an additional 7,014 shares during the period. FMR LLC grew its holdings in shares of Clarivate by 8.6% during the third quarter. FMR LLC now owns 5,088,942 shares of the company's stock worth $36,131,000 after buying an additional 401,920 shares during the last quarter. Finally, D.A. Davidson & CO. acquired a new position in Clarivate in the 3rd quarter valued at about $159,000. Hedge funds and other institutional investors own 85.72% of the company's stock.

Insider Activity at Clarivate

In related news, insider Bar Veinstein sold 60,000 shares of the stock in a transaction on Tuesday, October 15th. The stock was sold at an average price of $7.00, for a total transaction of $420,000.00. Following the sale, the insider now owns 916,583 shares of the company's stock, valued at $6,416,081. This trade represents a 6.14 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Michael J. Angelakis bought 765,000 shares of the business's stock in a transaction that occurred on Friday, November 22nd. The stock was purchased at an average cost of $5.19 per share, with a total value of $3,970,350.00. Following the purchase, the director now directly owns 3,465,000 shares in the company, valued at $17,983,350. The trade was a 28.33 % increase in their position. The disclosure for this purchase can be found here. 22.77% of the stock is owned by corporate insiders.

Clarivate Price Performance

Clarivate stock traded up $0.01 during mid-day trading on Friday, reaching $5.72. The company had a trading volume of 5,182,553 shares, compared to its average volume of 7,883,594. The stock's 50-day simple moving average is $5.97 and its 200-day simple moving average is $6.09. Clarivate Plc has a 1 year low of $4.25 and a 1 year high of $9.60. The company has a debt-to-equity ratio of 0.84, a current ratio of 0.88 and a quick ratio of 0.88. The company has a market capitalization of $4.06 billion, a P/E ratio of -2.87 and a beta of 1.12.

Clarivate (NYSE:CLVT - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The company reported $0.19 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.19. The firm had revenue of $622.20 million during the quarter, compared to analysts' expectations of $640.81 million. Clarivate had a positive return on equity of 9.69% and a negative net margin of 50.00%. Clarivate's revenue was down 3.9% on a year-over-year basis. During the same period in the previous year, the firm posted $0.18 earnings per share. On average, equities analysts predict that Clarivate Plc will post 0.63 EPS for the current year.

Analysts Set New Price Targets

A number of research firms have weighed in on CLVT. William Blair cut Clarivate from an "outperform" rating to a "market perform" rating in a research report on Wednesday, November 6th. Barclays decreased their price target on Clarivate from $5.00 to $4.00 and set an "underweight" rating for the company in a report on Thursday, November 7th. Finally, Royal Bank of Canada cut their price objective on shares of Clarivate from $7.00 to $6.00 and set a "sector perform" rating for the company in a research report on Thursday, November 7th. Two research analysts have rated the stock with a sell rating, three have issued a hold rating and two have given a buy rating to the stock. According to MarketBeat, Clarivate presently has a consensus rating of "Hold" and a consensus price target of $7.25.

Get Our Latest Stock Analysis on Clarivate

Clarivate Profile

(

Free Report)

Clarivate Plc operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific. It operates through three segments: Academia & Government, Life Sciences & Healthcare, and Intellectual Property. The company offers Web of Science and InCites, that analyzes and explores the academic research landscape and manages research information; ProQuest One and Ebook Central that provides comprehensive content collections to institutions in a cost-effective manner; and Alma and Polaris, that manages academic resources and services, connect users, and support research publications.

Read More

Before you consider Clarivate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clarivate wasn't on the list.

While Clarivate currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.