Verition Fund Management LLC lifted its stake in shares of Global Payments Inc. (NYSE:GPN - Free Report) by 388.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 54,692 shares of the business services provider's stock after acquiring an additional 43,500 shares during the quarter. Verition Fund Management LLC's holdings in Global Payments were worth $5,602,000 at the end of the most recent reporting period.

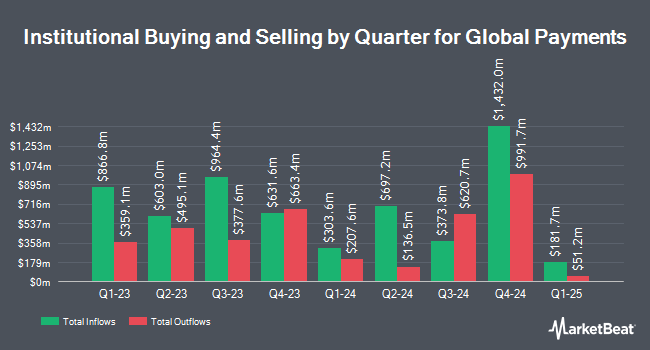

Other institutional investors and hedge funds also recently modified their holdings of the company. Pzena Investment Management LLC increased its position in shares of Global Payments by 194.2% in the second quarter. Pzena Investment Management LLC now owns 6,423,463 shares of the business services provider's stock worth $621,149,000 after acquiring an additional 4,240,388 shares in the last quarter. Massachusetts Financial Services Co. MA grew its holdings in shares of Global Payments by 65.6% during the third quarter. Massachusetts Financial Services Co. MA now owns 1,982,496 shares of the business services provider's stock valued at $203,047,000 after buying an additional 785,539 shares in the last quarter. AQR Capital Management LLC lifted its stake in Global Payments by 188.1% in the 2nd quarter. AQR Capital Management LLC now owns 1,157,728 shares of the business services provider's stock worth $109,857,000 after acquiring an additional 755,898 shares in the last quarter. D. E. Shaw & Co. Inc. boosted its holdings in shares of Global Payments by 316.7% during the second quarter. D. E. Shaw & Co. Inc. now owns 609,939 shares of the business services provider's stock worth $58,981,000 after purchasing an additional 463,568 shares during the period. Finally, Squarepoint Ops LLC grew its holdings in shares of Global Payments by 171.6% during the 2nd quarter. Squarepoint Ops LLC now owns 561,314 shares of the business services provider's stock valued at $54,279,000 after acquiring an additional 354,648 shares in the last quarter. 89.76% of the stock is owned by institutional investors and hedge funds.

Global Payments Price Performance

NYSE:GPN traded up $0.12 during trading hours on Tuesday, reaching $118.25. The company had a trading volume of 1,326,682 shares, compared to its average volume of 2,275,144. The firm has a market capitalization of $30.09 billion, a PE ratio of 22.27, a PEG ratio of 0.91 and a beta of 1.00. Global Payments Inc. has a one year low of $91.60 and a one year high of $141.77. The company has a quick ratio of 0.93, a current ratio of 0.93 and a debt-to-equity ratio of 0.65. The stock has a 50-day moving average of $107.01 and a two-hundred day moving average of $103.89.

Global Payments Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, December 13th will be given a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a dividend yield of 0.85%. The ex-dividend date is Friday, December 13th. Global Payments's payout ratio is 18.83%.

Analyst Ratings Changes

A number of analysts have issued reports on the stock. BMO Capital Markets reduced their target price on shares of Global Payments from $126.00 to $122.00 and set a "market perform" rating for the company in a research note on Wednesday, September 25th. The Goldman Sachs Group increased their target price on shares of Global Payments from $135.00 to $155.00 and gave the stock a "buy" rating in a research report on Monday. Monness Crespi & Hardt lowered their price objective on Global Payments from $165.00 to $155.00 and set a "buy" rating on the stock in a report on Wednesday, September 25th. Oppenheimer began coverage on Global Payments in a research report on Tuesday, October 1st. They set a "market perform" rating for the company. Finally, William Blair lowered shares of Global Payments from an "outperform" rating to a "market perform" rating in a research report on Wednesday, September 25th. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating and seventeen have assigned a buy rating to the stock. According to MarketBeat, Global Payments has a consensus rating of "Moderate Buy" and a consensus target price of $137.41.

Read Our Latest Analysis on Global Payments

Global Payments Company Profile

(

Free Report)

Global Payments Inc provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific. It operates through two segments, Merchant Solutions and Issuer Solutions. The Merchant Solutions segment offers authorization, settlement and funding, customer support, chargeback resolution, terminal rental, sales and deployment, payment security, and consolidated billing and reporting services.

See Also

Before you consider Global Payments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Payments wasn't on the list.

While Global Payments currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.