Verition Fund Management LLC grew its position in shares of CarGurus, Inc. (NASDAQ:CARG - Free Report) by 177.0% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 42,262 shares of the company's stock after purchasing an additional 27,005 shares during the period. Verition Fund Management LLC's holdings in CarGurus were worth $1,269,000 at the end of the most recent quarter.

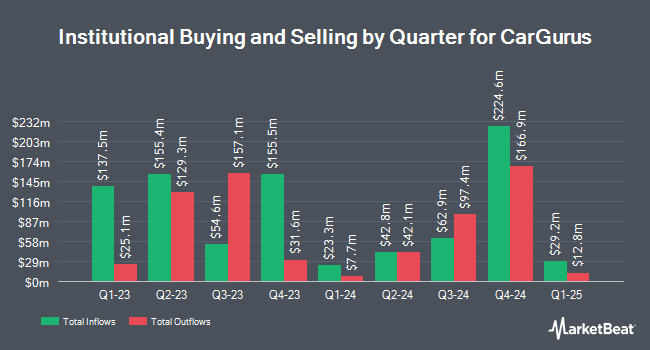

Several other hedge funds and other institutional investors have also recently bought and sold shares of CARG. Price T Rowe Associates Inc. MD grew its holdings in CarGurus by 4.9% in the first quarter. Price T Rowe Associates Inc. MD now owns 56,448 shares of the company's stock valued at $1,303,000 after purchasing an additional 2,655 shares during the period. GAMMA Investing LLC increased its holdings in shares of CarGurus by 25.9% during the 2nd quarter. GAMMA Investing LLC now owns 2,066 shares of the company's stock worth $54,000 after buying an additional 425 shares during the last quarter. CWM LLC raised its position in shares of CarGurus by 54.1% in the 2nd quarter. CWM LLC now owns 1,381 shares of the company's stock worth $36,000 after buying an additional 485 shares during the period. AlphaMark Advisors LLC acquired a new position in CarGurus in the second quarter valued at $360,000. Finally, Assenagon Asset Management S.A. purchased a new position in shares of CarGurus in the 2nd quarter worth about $1,338,000. 86.90% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at CarGurus

In related news, CMO Dafna Sarnoff sold 4,127 shares of CarGurus stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $29.94, for a total value of $123,562.38. Following the sale, the chief marketing officer now directly owns 119,330 shares in the company, valued at $3,572,740.20. This trade represents a 3.34 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, COO Samuel Zales sold 25,168 shares of the business's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $31.62, for a total transaction of $795,812.16. Following the transaction, the chief operating officer now directly owns 449,821 shares of the company's stock, valued at $14,223,340.02. The trade was a 5.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 67,958 shares of company stock valued at $2,268,035. Corporate insiders own 17.20% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have weighed in on CARG. Jefferies Financial Group lifted their price target on shares of CarGurus from $35.00 to $38.00 and gave the company a "buy" rating in a research report on Tuesday, October 22nd. B. Riley raised their target price on shares of CarGurus from $30.00 to $40.00 and gave the company a "buy" rating in a research note on Monday, November 11th. JMP Securities upped their price target on shares of CarGurus from $41.00 to $46.00 and gave the stock a "market outperform" rating in a research report on Friday, November 22nd. Citigroup upgraded CarGurus from a "hold" rating to a "strong-buy" rating in a report on Monday, November 11th. Finally, Oppenheimer boosted their price objective on CarGurus from $32.00 to $44.00 and gave the stock an "outperform" rating in a research note on Friday, November 8th. Two equities research analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, CarGurus presently has a consensus rating of "Moderate Buy" and an average target price of $37.86.

Read Our Latest Report on CarGurus

CarGurus Trading Down 0.1 %

NASDAQ CARG traded down $0.02 on Friday, hitting $38.36. 725,222 shares of the stock traded hands, compared to its average volume of 723,698. The company has a market capitalization of $3.98 billion, a P/E ratio of -83.39, a price-to-earnings-growth ratio of 2.04 and a beta of 1.57. The stock has a 50-day moving average of $33.44 and a 200 day moving average of $28.80. CarGurus, Inc. has a twelve month low of $21.12 and a twelve month high of $39.10.

CarGurus Company Profile

(

Free Report)

CarGurus, Inc operates an online automotive platform for buying and selling vehicles in the United States and internationally. It operates through two segments, U.S. Marketplace and Digital Wholesale. The company provides an online automotive marketplace where customers can search for new and used car listings from its dealers and sell their car to dealers and other consumers; and paid listings subscriptions for enhanced access to its marketplace that connects dealers to a large audience of informed and engaged consumers.

Read More

Before you consider CarGurus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarGurus wasn't on the list.

While CarGurus currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.