Verition Fund Management LLC bought a new position in Broadridge Financial Solutions, Inc. (NYSE:BR - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor bought 10,814 shares of the business services provider's stock, valued at approximately $2,325,000.

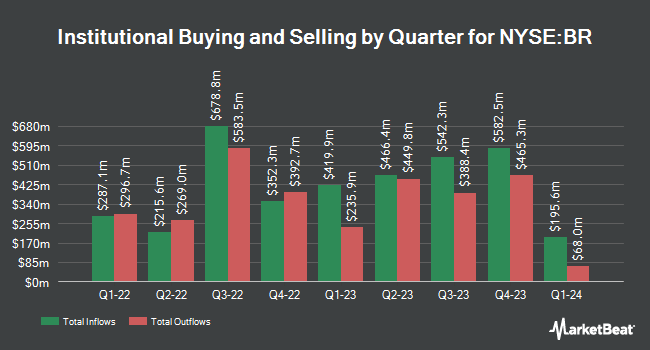

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in shares of Broadridge Financial Solutions in the third quarter valued at about $44,746,000. Assenagon Asset Management S.A. lifted its holdings in Broadridge Financial Solutions by 3,197.8% in the 3rd quarter. Assenagon Asset Management S.A. now owns 204,366 shares of the business services provider's stock worth $43,945,000 after purchasing an additional 198,169 shares in the last quarter. International Assets Investment Management LLC bought a new position in Broadridge Financial Solutions in the 3rd quarter worth approximately $274,650,000. BNP Paribas Financial Markets grew its holdings in Broadridge Financial Solutions by 97.7% during the 3rd quarter. BNP Paribas Financial Markets now owns 198,878 shares of the business services provider's stock valued at $42,765,000 after buying an additional 98,275 shares in the last quarter. Finally, Dimensional Fund Advisors LP raised its position in shares of Broadridge Financial Solutions by 8.3% during the second quarter. Dimensional Fund Advisors LP now owns 941,125 shares of the business services provider's stock valued at $185,417,000 after buying an additional 72,018 shares during the last quarter. Institutional investors own 90.03% of the company's stock.

Insider Activity

In related news, President Christopher John Perry sold 17,534 shares of the business's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $213.41, for a total value of $3,741,930.94. Following the completion of the transaction, the president now directly owns 50,237 shares in the company, valued at $10,721,078.17. The trade was a 25.87 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, insider Douglas Richard Deschutter sold 24,185 shares of the firm's stock in a transaction on Thursday, November 7th. The shares were sold at an average price of $220.21, for a total transaction of $5,325,778.85. Following the sale, the insider now owns 27,137 shares in the company, valued at approximately $5,975,838.77. This represents a 47.12 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 72,066 shares of company stock valued at $16,006,777 in the last ninety days. Insiders own 1.30% of the company's stock.

Analyst Ratings Changes

A number of research firms have issued reports on BR. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $246.00 price objective on shares of Broadridge Financial Solutions in a research note on Wednesday, November 6th. StockNews.com downgraded shares of Broadridge Financial Solutions from a "buy" rating to a "hold" rating in a research note on Saturday, November 9th. JPMorgan Chase & Co. lifted their price objective on shares of Broadridge Financial Solutions from $224.00 to $225.00 and gave the stock a "neutral" rating in a research note on Tuesday, August 20th. UBS Group started coverage on shares of Broadridge Financial Solutions in a report on Thursday, November 21st. They issued a "neutral" rating and a $250.00 target price on the stock. Finally, Morgan Stanley increased their price target on shares of Broadridge Financial Solutions from $200.00 to $207.00 and gave the company an "equal weight" rating in a report on Wednesday, November 6th. Five research analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $222.43.

Read Our Latest Research Report on BR

Broadridge Financial Solutions Stock Down 0.2 %

Shares of BR traded down $0.48 during midday trading on Friday, hitting $235.43. 389,430 shares of the company's stock traded hands, compared to its average volume of 521,354. The firm's fifty day moving average is $222.41 and its 200-day moving average is $211.58. The company has a current ratio of 1.39, a quick ratio of 1.39 and a debt-to-equity ratio of 1.63. Broadridge Financial Solutions, Inc. has a 1 year low of $188.30 and a 1 year high of $237.96. The stock has a market capitalization of $27.52 billion, a price-to-earnings ratio of 40.73 and a beta of 1.07.

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The business services provider reported $1.00 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.97 by $0.03. The business had revenue of $1.42 billion during the quarter, compared to analysts' expectations of $1.48 billion. Broadridge Financial Solutions had a net margin of 10.57% and a return on equity of 41.79%. The business's quarterly revenue was down .6% on a year-over-year basis. During the same quarter last year, the company posted $1.09 earnings per share. As a group, sell-side analysts anticipate that Broadridge Financial Solutions, Inc. will post 8.52 earnings per share for the current year.

Broadridge Financial Solutions Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Friday, December 13th will be paid a dividend of $0.88 per share. This represents a $3.52 annualized dividend and a yield of 1.50%. The ex-dividend date of this dividend is Friday, December 13th. Broadridge Financial Solutions's payout ratio is 60.90%.

Broadridge Financial Solutions Company Profile

(

Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

Featured Stories

Before you consider Broadridge Financial Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadridge Financial Solutions wasn't on the list.

While Broadridge Financial Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.