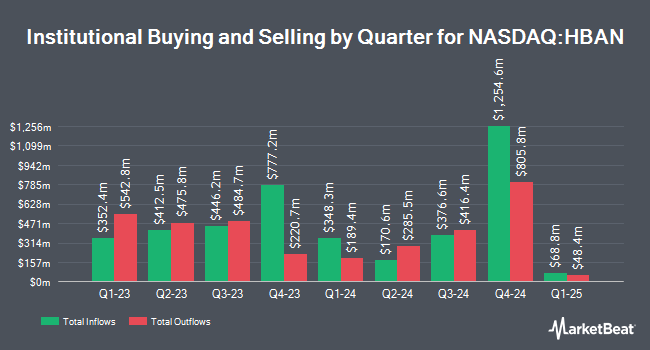

Verity & Verity LLC bought a new stake in Huntington Bancshares Incorporated (NASDAQ:HBAN - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 38,964 shares of the bank's stock, valued at approximately $634,000.

A number of other large investors have also bought and sold shares of HBAN. Asset Dedication LLC raised its position in shares of Huntington Bancshares by 200.7% during the third quarter. Asset Dedication LLC now owns 1,801 shares of the bank's stock worth $26,000 after acquiring an additional 1,202 shares during the last quarter. Peoples Bank KS bought a new stake in Huntington Bancshares in the third quarter valued at about $29,000. Future Financial Wealth Managment LLC acquired a new stake in shares of Huntington Bancshares in the 3rd quarter valued at approximately $31,000. Fortitude Family Office LLC bought a new position in shares of Huntington Bancshares during the third quarter worth $32,000. Finally, UMB Bank n.a. raised its position in shares of Huntington Bancshares by 19.1% during the third quarter. UMB Bank n.a. now owns 4,545 shares of the bank's stock worth $67,000 after purchasing an additional 728 shares during the period. 80.72% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on HBAN shares. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $20.00 price target on shares of Huntington Bancshares in a research note on Monday, December 23rd. Keefe, Bruyette & Woods upped their target price on shares of Huntington Bancshares from $16.00 to $19.00 and gave the stock a "market perform" rating in a research note on Wednesday, December 4th. Citigroup lifted their price target on Huntington Bancshares from $18.00 to $21.00 and gave the company a "buy" rating in a research note on Tuesday, November 19th. JPMorgan Chase & Co. reiterated an "overweight" rating and set a $20.00 price objective (up from $18.50) on shares of Huntington Bancshares in a report on Wednesday, December 4th. Finally, The Goldman Sachs Group boosted their target price on Huntington Bancshares from $16.25 to $20.00 and gave the company a "buy" rating in a research note on Tuesday, November 26th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and thirteen have assigned a buy rating to the company. According to MarketBeat, Huntington Bancshares has a consensus rating of "Moderate Buy" and an average price target of $17.76.

Get Our Latest Stock Report on HBAN

Huntington Bancshares Stock Performance

Shares of HBAN stock traded up $0.17 during trading on Friday, reaching $17.01. 31,298,513 shares of the company's stock were exchanged, compared to its average volume of 13,238,144. The firm's fifty day moving average price is $17.06 and its 200-day moving average price is $15.47. Huntington Bancshares Incorporated has a twelve month low of $12.02 and a twelve month high of $18.44. The stock has a market capitalization of $24.71 billion, a PE ratio of 16.36, a PEG ratio of 2.51 and a beta of 1.07. The company has a quick ratio of 0.87, a current ratio of 0.88 and a debt-to-equity ratio of 0.86.

Huntington Bancshares (NASDAQ:HBAN - Get Free Report) last issued its quarterly earnings data on Friday, January 17th. The bank reported $0.34 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.31 by $0.03. Huntington Bancshares had a net margin of 14.19% and a return on equity of 10.72%. During the same quarter in the prior year, the firm earned $0.27 earnings per share. As a group, sell-side analysts anticipate that Huntington Bancshares Incorporated will post 1.22 EPS for the current year.

Huntington Bancshares Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, April 1st. Investors of record on Tuesday, March 18th will be paid a $0.155 dividend. This represents a $0.62 annualized dividend and a dividend yield of 3.64%. Huntington Bancshares's dividend payout ratio (DPR) is presently 59.62%.

Insider Buying and Selling

In related news, VP Scott D. Kleinman sold 28,600 shares of the firm's stock in a transaction on Wednesday, November 13th. The stock was sold at an average price of $17.67, for a total value of $505,362.00. Following the transaction, the vice president now owns 496,076 shares in the company, valued at approximately $8,765,662.92. This trade represents a 5.45 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Zachary Jacob Wasserman sold 8,644 shares of the company's stock in a transaction dated Wednesday, November 13th. The stock was sold at an average price of $17.63, for a total transaction of $152,393.72. Following the sale, the chief financial officer now directly owns 259,943 shares of the company's stock, valued at $4,582,795.09. This represents a 3.22 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 43,699 shares of company stock valued at $757,356. 0.92% of the stock is owned by company insiders.

Huntington Bancshares Profile

(

Free Report)

Huntington Bancshares Incorporated operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States. The company offers financial products and services to consumer and business customers, including deposits, lending, payments, mortgage banking, dealer financing, investment management, trust, brokerage, insurance, and other financial products and services.

Read More

Before you consider Huntington Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Bancshares wasn't on the list.

While Huntington Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.