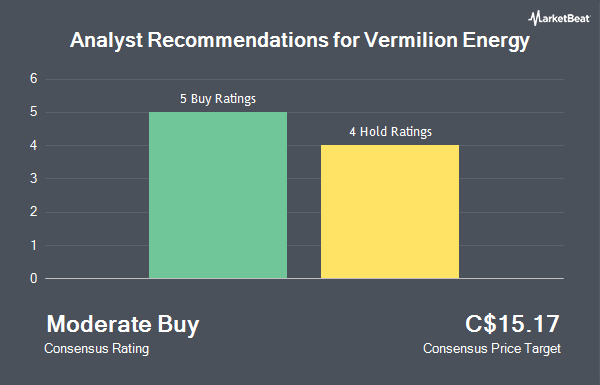

Vermilion Energy Inc. (TSE:VET - Get Free Report) NYSE: VET has received an average rating of "Moderate Buy" from the eleven ratings firms that are covering the firm, MarketBeat.com reports. Three investment analysts have rated the stock with a hold recommendation and eight have assigned a buy recommendation to the company. The average 1 year price objective among brokers that have issued ratings on the stock in the last year is C$19.36.

A number of analysts have recently weighed in on the company. JPMorgan Chase & Co. lowered their price objective on Vermilion Energy from C$18.00 to C$15.00 in a research report on Thursday, September 12th. Canaccord Genuity Group dropped their price objective on shares of Vermilion Energy from C$20.00 to C$19.00 in a report on Tuesday, October 22nd. BMO Capital Markets lowered Vermilion Energy from an "outperform" rating to a "market perform" rating and reduced their target price for the stock from C$20.00 to C$16.00 in a research note on Friday, October 4th. TD Securities lowered their price target on Vermilion Energy from C$20.00 to C$18.00 in a research report on Tuesday, October 1st. Finally, Desjardins cut their price objective on shares of Vermilion Energy from C$21.00 to C$20.00 and set a "buy" rating on the stock in a research note on Tuesday, August 6th.

Read Our Latest Stock Report on VET

Insider Buying and Selling

In related news, Director Myron Maurice Stadnyk acquired 5,000 shares of Vermilion Energy stock in a transaction that occurred on Wednesday, August 21st. The shares were purchased at an average price of C$13.54 per share, for a total transaction of C$67,700.00. 0.16% of the stock is currently owned by insiders.

Vermilion Energy Trading Down 1.5 %

VET stock traded down C$0.21 during mid-day trading on Monday, reaching C$13.51. The company had a trading volume of 598,661 shares, compared to its average volume of 769,470. The firm has a 50 day moving average of C$13.32 and a 200 day moving average of C$14.59. The company has a debt-to-equity ratio of 36.63, a current ratio of 1.09 and a quick ratio of 0.40. Vermilion Energy has a 12 month low of C$11.87 and a 12 month high of C$18.53. The company has a market capitalization of C$2.11 billion, a PE ratio of -2.68, a price-to-earnings-growth ratio of -0.02 and a beta of 2.60.

Vermilion Energy (TSE:VET - Get Free Report) NYSE: VET last released its quarterly earnings data on Wednesday, November 6th. The company reported C$0.33 earnings per share for the quarter, missing analysts' consensus estimates of C$0.45 by C($0.12). The business had revenue of C$490.10 million during the quarter, compared to analysts' expectations of C$497.45 million. Vermilion Energy had a negative return on equity of 24.83% and a negative net margin of 45.56%. On average, equities analysts predict that Vermilion Energy will post 1.3956262 earnings per share for the current fiscal year.

Vermilion Energy Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be given a dividend of $0.12 per share. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $0.48 annualized dividend and a dividend yield of 3.55%. Vermilion Energy's dividend payout ratio (DPR) is presently -9.39%.

Vermilion Energy Company Profile

(

Get Free ReportVermilion Energy Inc, together with its subsidiaries, engages in the acquisition, exploration, development, and production of petroleum and natural gas. The company has properties in West Central Alberta, southeast Saskatchewan, Manitoba, and West Pembina in Canada; Wyoming in the United States; southwest Bordeaux and Paris Basin in France; the Netherlands; Germany; Ireland; Croatia; Slovakia; and Australia.

See Also

Before you consider Vermilion Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vermilion Energy wasn't on the list.

While Vermilion Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.