Versor Investments LP bought a new position in shares of DNOW Inc. (NYSE:DNOW - Free Report) during the third quarter, according to its most recent filing with the SEC. The fund bought 35,834 shares of the oil and gas company's stock, valued at approximately $463,000.

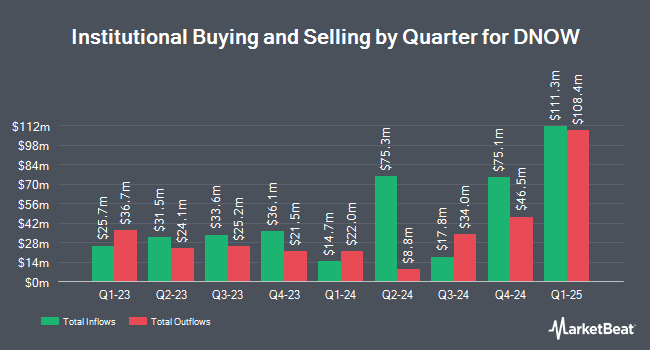

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Allspring Global Investments Holdings LLC boosted its position in shares of DNOW by 1,062.7% during the second quarter. Allspring Global Investments Holdings LLC now owns 2,802 shares of the oil and gas company's stock valued at $38,000 after buying an additional 2,561 shares during the last quarter. Headlands Technologies LLC purchased a new stake in shares of DNOW during the 1st quarter worth $44,000. Quarry LP raised its stake in DNOW by 75.6% in the second quarter. Quarry LP now owns 4,433 shares of the oil and gas company's stock valued at $61,000 after buying an additional 1,908 shares during the last quarter. Innealta Capital LLC purchased a new stake in DNOW in the second quarter valued at about $67,000. Finally, nVerses Capital LLC acquired a new stake in DNOW during the third quarter worth about $78,000. 97.63% of the stock is currently owned by institutional investors.

DNOW Stock Performance

Shares of DNOW traded down $0.22 during mid-day trading on Friday, reaching $14.37. 518,642 shares of the company's stock traded hands, compared to its average volume of 936,079. DNOW Inc. has a 12 month low of $9.44 and a 12 month high of $15.65. The stock has a market capitalization of $1.52 billion, a P/E ratio of 7.80 and a beta of 1.45. The business's 50-day moving average price is $12.60 and its 200-day moving average price is $13.31.

DNOW (NYSE:DNOW - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The oil and gas company reported $0.21 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.19 by $0.02. DNOW had a net margin of 8.70% and a return on equity of 8.90%. The company had revenue of $606.00 million for the quarter, compared to the consensus estimate of $614.92 million. During the same quarter in the previous year, the firm posted $0.25 EPS. The business's revenue was up 3.1% compared to the same quarter last year. Equities research analysts anticipate that DNOW Inc. will post 0.84 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on DNOW shares. StockNews.com raised DNOW from a "hold" rating to a "buy" rating in a research note on Thursday, August 15th. Stifel Nicolaus boosted their target price on DNOW from $16.00 to $17.00 and gave the stock a "buy" rating in a research report on Thursday, July 18th.

View Our Latest Stock Analysis on DNOW

DNOW Profile

(

Free Report)

DNOW Inc distributes downstream energy and industrial products for petroleum refining, chemical processing, LNG terminals, power generation utilities, and customer on-site locations in the United States, Canada, and internationally. The company provides consumable maintenance, repair, and operating supplies; pipes, manual and automated valves, fittings, flanges, gaskets, fasteners, electrical instrumentations, artificial lift, pumping solutions, valve actuation and modular process, and measurement and control equipment; and mill supplies, tools, safety supplies, and personal protective equipment, as well as artificial lift systems, coatings, and miscellaneous expendable items.

Featured Stories

Before you consider DNOW, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DNOW wasn't on the list.

While DNOW currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.