Versor Investments LP increased its stake in shares of T. Rowe Price Group, Inc. (NASDAQ:TROW - Free Report) by 80.8% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 23,500 shares of the asset manager's stock after acquiring an additional 10,500 shares during the period. T. Rowe Price Group comprises approximately 0.4% of Versor Investments LP's investment portfolio, making the stock its 25th largest holding. Versor Investments LP's holdings in T. Rowe Price Group were worth $2,560,000 as of its most recent SEC filing.

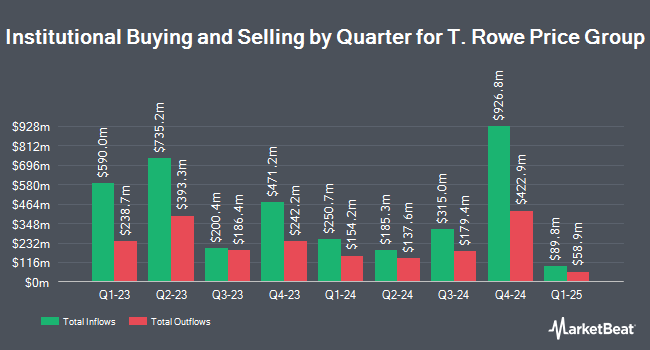

Other hedge funds have also recently bought and sold shares of the company. Iron Horse Wealth Management LLC raised its holdings in shares of T. Rowe Price Group by 90.9% in the 3rd quarter. Iron Horse Wealth Management LLC now owns 231 shares of the asset manager's stock valued at $25,000 after purchasing an additional 110 shares during the period. Lynx Investment Advisory acquired a new stake in shares of T. Rowe Price Group in the second quarter valued at approximately $29,000. Hexagon Capital Partners LLC boosted its stake in shares of T. Rowe Price Group by 54.7% during the 3rd quarter. Hexagon Capital Partners LLC now owns 294 shares of the asset manager's stock worth $32,000 after acquiring an additional 104 shares during the period. Family Firm Inc. bought a new stake in T. Rowe Price Group in the 2nd quarter valued at $36,000. Finally, Versant Capital Management Inc lifted its holdings in T. Rowe Price Group by 660.5% during the 2nd quarter. Versant Capital Management Inc now owns 327 shares of the asset manager's stock valued at $38,000 after purchasing an additional 284 shares during the last quarter. 73.39% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

TROW has been the topic of several research analyst reports. Deutsche Bank Aktiengesellschaft increased their price objective on shares of T. Rowe Price Group from $115.00 to $120.00 and gave the company a "hold" rating in a research report on Monday. JPMorgan Chase & Co. decreased their target price on T. Rowe Price Group from $116.00 to $115.00 and set an "underweight" rating on the stock in a research report on Monday, November 4th. Wells Fargo & Company boosted their price target on T. Rowe Price Group from $109.00 to $112.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 9th. Keefe, Bruyette & Woods reissued a "market perform" rating and set a $120.00 target price (down previously from $121.00) on shares of T. Rowe Price Group in a report on Monday, July 29th. Finally, Morgan Stanley upped their price target on shares of T. Rowe Price Group from $127.00 to $129.00 and gave the company an "equal weight" rating in a research note on Monday, November 4th. Four investment analysts have rated the stock with a sell rating and eight have given a hold rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $115.55.

Check Out Our Latest Stock Report on T. Rowe Price Group

T. Rowe Price Group Price Performance

TROW stock traded up $0.31 during trading on Monday, reaching $117.93. 943,775 shares of the company were exchanged, compared to its average volume of 1,262,443. T. Rowe Price Group, Inc. has a twelve month low of $91.40 and a twelve month high of $122.27. The company has a market capitalization of $26.20 billion, a price-to-earnings ratio of 13.04, a P/E/G ratio of 1.71 and a beta of 1.41. The company has a 50-day moving average of $109.33 and a two-hundred day moving average of $111.93.

T. Rowe Price Group (NASDAQ:TROW - Get Free Report) last announced its quarterly earnings results on Friday, November 1st. The asset manager reported $2.57 EPS for the quarter, beating analysts' consensus estimates of $2.36 by $0.21. T. Rowe Price Group had a return on equity of 20.35% and a net margin of 30.35%. The company had revenue of $1.79 billion during the quarter, compared to analysts' expectations of $1.84 billion. During the same period in the prior year, the company earned $2.17 EPS. T. Rowe Price Group's revenue was up 6.9% compared to the same quarter last year. On average, analysts forecast that T. Rowe Price Group, Inc. will post 9.32 EPS for the current year.

T. Rowe Price Group Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, December 13th will be issued a dividend of $1.24 per share. This represents a $4.96 annualized dividend and a dividend yield of 4.21%. The ex-dividend date is Friday, December 13th. T. Rowe Price Group's dividend payout ratio (DPR) is currently 54.27%.

Insider Activity

In other news, VP Andrew Justin Mackenzi Thomson sold 11,969 shares of T. Rowe Price Group stock in a transaction on Friday, September 6th. The shares were sold at an average price of $102.83, for a total transaction of $1,230,772.27. Following the transaction, the vice president now owns 123,624 shares in the company, valued at approximately $12,712,255.92. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. In other T. Rowe Price Group news, insider Jessica M. Hiebler sold 484 shares of the stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $104.73, for a total transaction of $50,689.32. Following the completion of the sale, the insider now owns 13,939 shares of the company's stock, valued at approximately $1,459,831.47. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, VP Andrew Justin Mackenzi Thomson sold 11,969 shares of the company's stock in a transaction on Friday, September 6th. The shares were sold at an average price of $102.83, for a total transaction of $1,230,772.27. Following the completion of the sale, the vice president now directly owns 123,624 shares in the company, valued at approximately $12,712,255.92. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.00% of the stock is currently owned by insiders.

T. Rowe Price Group Company Profile

(

Free Report)

T. Rowe Price Group, Inc is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe.

Featured Stories

Before you consider T. Rowe Price Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T. Rowe Price Group wasn't on the list.

While T. Rowe Price Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.