Versor Investments LP decreased its holdings in shares of Workday, Inc. (NASDAQ:WDAY - Free Report) by 87.4% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,000 shares of the software maker's stock after selling 6,958 shares during the period. Versor Investments LP's holdings in Workday were worth $244,000 as of its most recent filing with the Securities and Exchange Commission.

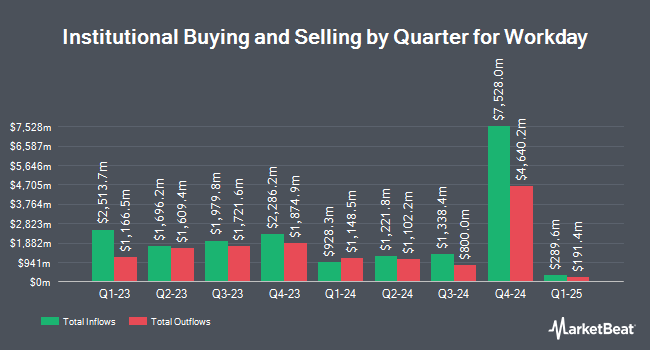

Several other hedge funds also recently made changes to their positions in WDAY. Capital Performance Advisors LLP acquired a new stake in shares of Workday during the third quarter worth $26,000. Crewe Advisors LLC acquired a new stake in Workday during the 1st quarter worth about $27,000. SouthState Corp lifted its stake in Workday by 614.3% during the second quarter. SouthState Corp now owns 150 shares of the software maker's stock valued at $34,000 after buying an additional 129 shares in the last quarter. Goodman Advisory Group LLC acquired a new position in shares of Workday in the second quarter worth about $35,000. Finally, Asset Dedication LLC purchased a new position in shares of Workday in the second quarter worth approximately $36,000. Institutional investors and hedge funds own 89.81% of the company's stock.

Workday Stock Performance

NASDAQ:WDAY traded down $12.08 during mid-day trading on Friday, hitting $259.41. 2,036,260 shares of the company's stock traded hands, compared to its average volume of 1,592,770. The firm has a market capitalization of $68.74 billion, a price-to-earnings ratio of 45.19, a price-to-earnings-growth ratio of 5.15 and a beta of 1.35. The firm has a 50 day moving average of $246.74 and a two-hundred day moving average of $236.54. The company has a current ratio of 2.04, a quick ratio of 2.04 and a debt-to-equity ratio of 0.36. Workday, Inc. has a 12 month low of $199.81 and a 12 month high of $311.28.

Workday (NASDAQ:WDAY - Get Free Report) last announced its quarterly earnings data on Thursday, August 22nd. The software maker reported $1.75 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.65 by $0.10. Workday had a net margin of 19.59% and a return on equity of 5.34%. The business had revenue of $2.09 billion for the quarter, compared to the consensus estimate of $2.07 billion. During the same quarter last year, the company posted $0.40 earnings per share. Workday's quarterly revenue was up 16.5% on a year-over-year basis. On average, equities analysts forecast that Workday, Inc. will post 2.4 earnings per share for the current fiscal year.

Insider Activity

In other Workday news, major shareholder David A. Duffield sold 56,000 shares of Workday stock in a transaction on Monday, October 14th. The shares were sold at an average price of $242.01, for a total transaction of $13,552,560.00. Following the sale, the insider now owns 281,000 shares in the company, valued at $68,004,810. The trade was a 16.62 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director George J. Still, Jr. sold 7,500 shares of the stock in a transaction on Monday, August 26th. The shares were sold at an average price of $260.32, for a total transaction of $1,952,400.00. Following the completion of the transaction, the director now owns 97,500 shares of the company's stock, valued at approximately $25,381,200. This represents a 7.14 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 370,575 shares of company stock valued at $91,506,897. Insiders own 20.00% of the company's stock.

Wall Street Analyst Weigh In

WDAY has been the subject of several research analyst reports. Evercore ISI reduced their price target on shares of Workday from $300.00 to $290.00 and set an "outperform" rating for the company in a research report on Tuesday, August 20th. JMP Securities reaffirmed a "market outperform" rating and issued a $315.00 target price on shares of Workday in a research report on Thursday, September 19th. Stifel Nicolaus upped their price target on Workday from $250.00 to $270.00 and gave the company a "hold" rating in a research report on Friday, August 23rd. DA Davidson increased their price objective on Workday from $255.00 to $270.00 and gave the stock a "neutral" rating in a research note on Friday, August 23rd. Finally, Canaccord Genuity Group reaffirmed a "buy" rating and set a $300.00 target price on shares of Workday in a research note on Friday, September 13th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and twenty-one have issued a buy rating to the company's stock. According to data from MarketBeat, Workday currently has an average rating of "Moderate Buy" and an average price target of $287.59.

Read Our Latest Stock Analysis on Workday

Workday Profile

(

Free Report)

Workday, Inc provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. The company offers a suite of financial management applications to maintain accounting information in the general ledger; manage financial processes, such as payables and receivables; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations.

Featured Stories

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.