Versor Investments LP purchased a new position in Victoria's Secret & Co. (NYSE:VSCO - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 35,300 shares of the company's stock, valued at approximately $907,000.

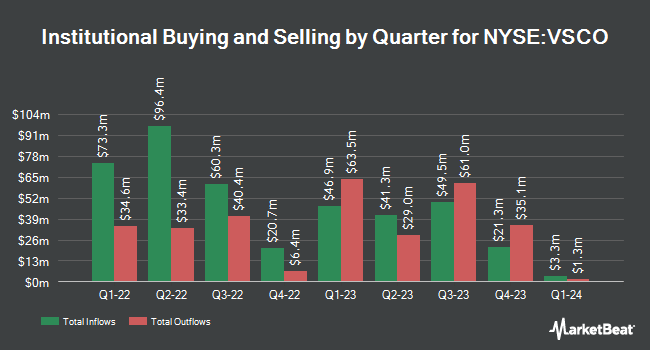

A number of other hedge funds and other institutional investors have also recently modified their holdings of VSCO. Natixis lifted its holdings in shares of Victoria's Secret & Co. by 1,100,000.0% during the 1st quarter. Natixis now owns 275,025 shares of the company's stock valued at $5,330,000 after buying an additional 275,000 shares during the period. Dark Forest Capital Management LP bought a new position in Victoria's Secret & Co. in the second quarter valued at about $589,000. Aristeia Capital L.L.C. purchased a new position in Victoria's Secret & Co. in the second quarter worth about $1,171,000. Alpha DNA Investment Management LLC bought a new stake in shares of Victoria's Secret & Co. during the 2nd quarter valued at about $408,000. Finally, Bank of New York Mellon Corp increased its position in shares of Victoria's Secret & Co. by 16.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 652,439 shares of the company's stock valued at $11,529,000 after purchasing an additional 91,712 shares during the last quarter. 90.29% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on the stock. Bank of America boosted their target price on shares of Victoria's Secret & Co. from $18.00 to $21.00 and gave the company an "underperform" rating in a research report on Friday, August 30th. TD Cowen upped their price objective on Victoria's Secret & Co. from $20.00 to $26.00 and gave the stock a "hold" rating in a research note on Friday, August 30th. Telsey Advisory Group reiterated a "market perform" rating and set a $27.00 target price on shares of Victoria's Secret & Co. in a research report on Thursday, October 17th. Barclays upgraded Victoria's Secret & Co. from an "underweight" rating to an "equal weight" rating and upped their price target for the stock from $23.00 to $25.00 in a research report on Wednesday, September 18th. Finally, Wells Fargo & Company boosted their price objective on Victoria's Secret & Co. from $30.00 to $33.00 and gave the company an "overweight" rating in a research note on Monday, October 21st. Three equities research analysts have rated the stock with a sell rating, four have assigned a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $26.30.

Get Our Latest Analysis on Victoria's Secret & Co.

Victoria's Secret & Co. Price Performance

NYSE VSCO traded up $0.16 during trading hours on Wednesday, reaching $35.94. The company's stock had a trading volume of 1,654,918 shares, compared to its average volume of 2,749,805. Victoria's Secret & Co. has a 1 year low of $15.12 and a 1 year high of $37.62. The company has a quick ratio of 0.31, a current ratio of 1.00 and a debt-to-equity ratio of 2.27. The company has a market capitalization of $2.82 billion, a price-to-earnings ratio of 20.90 and a beta of 2.10. The firm's 50-day moving average price is $27.37 and its 200-day moving average price is $22.41.

Victoria's Secret & Co. (NYSE:VSCO - Get Free Report) last released its earnings results on Wednesday, August 28th. The company reported $0.40 EPS for the quarter, topping the consensus estimate of $0.38 by $0.02. The firm had revenue of $1.42 billion for the quarter, compared to the consensus estimate of $1.41 billion. Victoria's Secret & Co. had a net margin of 2.25% and a return on equity of 44.06%. On average, equities research analysts predict that Victoria's Secret & Co. will post 1.96 EPS for the current fiscal year.

About Victoria's Secret & Co.

(

Free Report)

Victoria's Secret & Co operates as a specialty retailer of women's intimate, and other apparel and beauty products worldwide. It offers bras, panties, lingerie, casual sleepwear, and athleisure and swim, as well as fragrances and body care; and loungewear, knit tops, activewear, and accessories and beauty under the Victoria's Secret, PINK, and Adore Me brands.

See Also

Before you consider Victoria's Secret & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Victoria's Secret & Co. wasn't on the list.

While Victoria's Secret & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.