Versor Investments LP purchased a new position in Sysco Co. (NYSE:SYY - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 18,000 shares of the company's stock, valued at approximately $1,405,000.

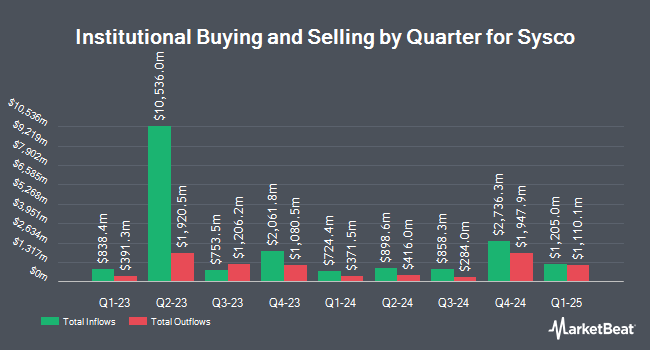

Other hedge funds and other institutional investors have also made changes to their positions in the company. National Pension Service raised its holdings in shares of Sysco by 15.6% in the third quarter. National Pension Service now owns 1,237,017 shares of the company's stock worth $96,562,000 after buying an additional 166,798 shares during the last quarter. ORG Partners LLC raised its holdings in shares of Sysco by 3,159.0% in the second quarter. ORG Partners LLC now owns 7,072 shares of the company's stock worth $495,000 after buying an additional 6,855 shares during the last quarter. Mizuho Markets Americas LLC increased its stake in shares of Sysco by 102.1% in the first quarter. Mizuho Markets Americas LLC now owns 139,875 shares of the company's stock worth $11,355,000 after acquiring an additional 70,660 shares during the period. Wedge Capital Management L L P NC increased its stake in shares of Sysco by 11.6% in the second quarter. Wedge Capital Management L L P NC now owns 176,170 shares of the company's stock worth $12,577,000 after acquiring an additional 18,296 shares during the period. Finally, Shell Asset Management Co. increased its stake in shares of Sysco by 205.0% in the first quarter. Shell Asset Management Co. now owns 14,305 shares of the company's stock worth $1,161,000 after acquiring an additional 9,615 shares during the period. Hedge funds and other institutional investors own 83.41% of the company's stock.

Sysco Price Performance

Shares of NYSE SYY traded up $0.55 during trading on Monday, hitting $77.94. The company had a trading volume of 2,148,752 shares, compared to its average volume of 3,167,218. The stock has a fifty day simple moving average of $76.14 and a two-hundred day simple moving average of $74.72. Sysco Co. has a fifty-two week low of $66.87 and a fifty-two week high of $82.89. The firm has a market capitalization of $38.29 billion, a price-to-earnings ratio of 19.89, a price-to-earnings-growth ratio of 2.03 and a beta of 1.20. The company has a quick ratio of 0.73, a current ratio of 1.26 and a debt-to-equity ratio of 5.38.

Sysco (NYSE:SYY - Get Free Report) last announced its earnings results on Tuesday, October 29th. The company reported $1.09 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.13 by ($0.04). Sysco had a net margin of 2.44% and a return on equity of 101.04%. The company had revenue of $20.48 billion during the quarter, compared to analyst estimates of $20.47 billion. During the same quarter last year, the business earned $1.07 EPS. The firm's revenue for the quarter was up 4.4% compared to the same quarter last year. On average, research analysts expect that Sysco Co. will post 4.57 earnings per share for the current year.

Sysco Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, October 25th. Stockholders of record on Friday, October 4th were paid a $0.51 dividend. This represents a $2.04 annualized dividend and a dividend yield of 2.62%. The ex-dividend date was Friday, October 4th. Sysco's dividend payout ratio is currently 52.44%.

Wall Street Analyst Weigh In

SYY has been the topic of a number of research reports. Barclays increased their price objective on shares of Sysco from $85.00 to $88.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 31st. Bank of America cut their price objective on shares of Sysco from $91.00 to $87.00 and set a "buy" rating on the stock in a research note on Thursday, July 18th. JPMorgan Chase & Co. increased their price objective on shares of Sysco from $85.00 to $88.00 and gave the stock an "overweight" rating in a research note on Monday, September 16th. Morgan Stanley dropped their price target on shares of Sysco from $82.00 to $81.00 and set an "equal weight" rating on the stock in a research report on Tuesday, July 16th. Finally, StockNews.com lowered shares of Sysco from a "strong-buy" rating to a "buy" rating in a research report on Monday, October 21st. Two equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $85.77.

Read Our Latest Stock Report on SYY

Insider Transactions at Sysco

In other news, SVP Eve M. Mcfadden sold 4,036 shares of the firm's stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $75.10, for a total value of $303,103.60. Following the transaction, the senior vice president now directly owns 48,451 shares of the company's stock, valued at approximately $3,638,670.10. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Insiders own 0.54% of the company's stock.

About Sysco

(

Free Report)

Sysco Corporation, through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally. It operates through U.S. Foodservice Operations, International Foodservice Operations, SYGMA, and Other segments.

Recommended Stories

Before you consider Sysco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sysco wasn't on the list.

While Sysco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.