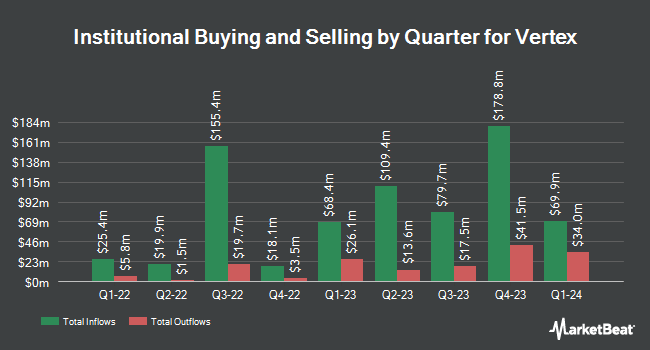

Loomis Sayles & Co. L P lowered its holdings in Vertex, Inc. (NASDAQ:VERX - Free Report) by 2.2% in the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 1,565,994 shares of the company's stock after selling 35,921 shares during the period. Loomis Sayles & Co. L P owned approximately 1.01% of Vertex worth $60,307,000 at the end of the most recent reporting period.

Several other large investors have also recently added to or reduced their stakes in the business. Banque Pictet & Cie SA raised its position in Vertex by 551.9% in the 2nd quarter. Banque Pictet & Cie SA now owns 949,540 shares of the company's stock valued at $34,231,000 after purchasing an additional 803,881 shares in the last quarter. Driehaus Capital Management LLC acquired a new stake in Vertex in the second quarter valued at approximately $22,173,000. Brown Capital Management LLC acquired a new stake in Vertex in the third quarter valued at approximately $20,938,000. Premier Fund Managers Ltd lifted its stake in Vertex by 787.0% in the third quarter. Premier Fund Managers Ltd now owns 524,775 shares of the company's stock worth $19,280,000 after acquiring an additional 465,610 shares during the last quarter. Finally, Geneva Capital Management LLC grew its holdings in Vertex by 40.1% during the 3rd quarter. Geneva Capital Management LLC now owns 1,450,599 shares of the company's stock worth $55,863,000 after acquiring an additional 414,945 shares in the last quarter. 59.10% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other news, major shareholder Item Second Irr. Trust Fbo Kyl sold 40,966 shares of the business's stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $52.16, for a total transaction of $2,136,786.56. Following the transaction, the insider now directly owns 1,389,134 shares in the company, valued at $72,457,229.44. The trade was a 2.86 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, major shareholder Jeffrey Westphal sold 1,225,000 shares of the firm's stock in a transaction dated Thursday, October 3rd. The shares were sold at an average price of $39.42, for a total transaction of $48,289,500.00. Following the completion of the sale, the insider now owns 7,895 shares of the company's stock, valued at approximately $311,220.90. The trade was a 99.36 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 4,171,822 shares of company stock valued at $191,086,808. Company insiders own 44.58% of the company's stock.

Vertex Stock Performance

NASDAQ:VERX traded up $1.05 during trading hours on Monday, reaching $54.88. 1,379,726 shares of the company's stock were exchanged, compared to its average volume of 790,592. The company has a quick ratio of 1.04, a current ratio of 1.04 and a debt-to-equity ratio of 1.29. The firm has a market capitalization of $8.56 billion, a price-to-earnings ratio of 304.89, a P/E/G ratio of 10.10 and a beta of 0.67. Vertex, Inc. has a 1-year low of $23.31 and a 1-year high of $55.25. The company has a 50-day moving average of $43.09 and a 200 day moving average of $38.22.

Vertex (NASDAQ:VERX - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $0.16 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.14 by $0.02. The firm had revenue of $170.40 million for the quarter, compared to analyst estimates of $165.70 million. Vertex had a return on equity of 24.92% and a net margin of 4.73%. The business's revenue was up 17.5% on a year-over-year basis. During the same quarter last year, the company posted $0.06 earnings per share. Research analysts anticipate that Vertex, Inc. will post 0.38 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently weighed in on VERX shares. BMO Capital Markets raised their price objective on shares of Vertex from $42.00 to $52.00 and gave the company a "market perform" rating in a report on Thursday, November 7th. Morgan Stanley upped their price objective on Vertex from $50.00 to $62.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 13th. Robert W. Baird raised their target price on Vertex from $43.00 to $57.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Stifel Nicolaus upped their price target on Vertex from $41.00 to $52.00 and gave the company a "buy" rating in a report on Thursday, November 7th. Finally, Needham & Company LLC raised their price objective on shares of Vertex from $45.00 to $60.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Three equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $52.30.

Read Our Latest Analysis on Vertex

Vertex Profile

(

Free Report)

Vertex, Inc, together with its subsidiaries, provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally. The company offers tax determination; compliance and reporting, including workflow management tools, role-based security, and event logging; tax data management; document management; analytics and insights; pre-built integration that includes mapping data fields, and business logic and configurations; industry-specific solutions; and technology specific solutions, such as chain flow accelerator and SAP-specific tools.

Featured Articles

Before you consider Vertex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex wasn't on the list.

While Vertex currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.