Huntington National Bank lowered its stake in shares of Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX - Free Report) by 2.8% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 39,229 shares of the pharmaceutical company's stock after selling 1,118 shares during the quarter. Huntington National Bank's holdings in Vertex Pharmaceuticals were worth $18,245,000 at the end of the most recent reporting period.

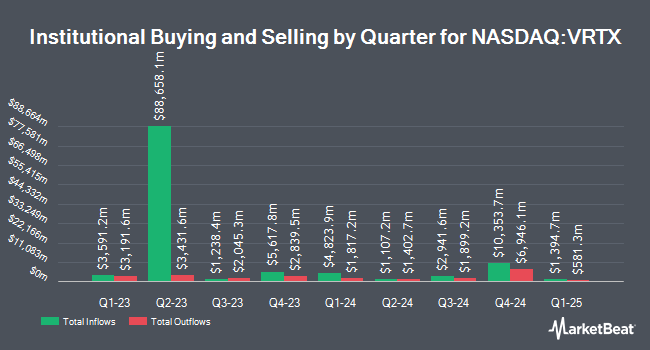

A number of other institutional investors have also recently added to or reduced their stakes in the stock. ICICI Prudential Asset Management Co Ltd increased its stake in shares of Vertex Pharmaceuticals by 18.9% in the third quarter. ICICI Prudential Asset Management Co Ltd now owns 3,369 shares of the pharmaceutical company's stock valued at $1,567,000 after purchasing an additional 535 shares during the period. Kovack Advisors Inc. increased its position in Vertex Pharmaceuticals by 3.7% in the 3rd quarter. Kovack Advisors Inc. now owns 1,257 shares of the pharmaceutical company's stock valued at $585,000 after acquiring an additional 45 shares during the period. Pinnacle Financial Partners Inc raised its stake in Vertex Pharmaceuticals by 985.1% during the 3rd quarter. Pinnacle Financial Partners Inc now owns 6,641 shares of the pharmaceutical company's stock valued at $3,089,000 after acquiring an additional 6,029 shares in the last quarter. MQS Management LLC boosted its position in Vertex Pharmaceuticals by 4.8% during the 3rd quarter. MQS Management LLC now owns 1,358 shares of the pharmaceutical company's stock worth $632,000 after acquiring an additional 62 shares during the period. Finally, Souders Financial Advisors grew its stake in shares of Vertex Pharmaceuticals by 2.1% in the third quarter. Souders Financial Advisors now owns 1,466 shares of the pharmaceutical company's stock worth $682,000 after purchasing an additional 30 shares in the last quarter. 90.96% of the stock is currently owned by institutional investors.

Vertex Pharmaceuticals Stock Down 3.8 %

NASDAQ VRTX traded down $18.26 during trading on Friday, reaching $465.70. 2,581,324 shares of the company's stock were exchanged, compared to its average volume of 1,179,486. The firm has a market capitalization of $119.93 billion, a PE ratio of -235.63 and a beta of 0.39. Vertex Pharmaceuticals Incorporated has a fifty-two week low of $341.90 and a fifty-two week high of $519.88. The company has a current ratio of 2.47, a quick ratio of 2.20 and a debt-to-equity ratio of 0.01. The company's fifty day simple moving average is $476.44 and its 200-day simple moving average is $470.57.

Vertex Pharmaceuticals (NASDAQ:VRTX - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The pharmaceutical company reported $4.38 EPS for the quarter, beating analysts' consensus estimates of $3.61 by $0.77. The firm had revenue of $2.77 billion for the quarter, compared to the consensus estimate of $2.69 billion. Vertex Pharmaceuticals had a negative net margin of 4.52% and a negative return on equity of 1.91%. The firm's revenue was up 11.6% on a year-over-year basis. During the same period in the previous year, the firm posted $3.67 earnings per share. Sell-side analysts predict that Vertex Pharmaceuticals Incorporated will post -1.82 EPS for the current year.

Insider Transactions at Vertex Pharmaceuticals

In other news, Chairman Jeffrey M. Leiden sold 3,784 shares of the company's stock in a transaction dated Friday, August 30th. The stock was sold at an average price of $499.00, for a total transaction of $1,888,216.00. Following the completion of the sale, the chairman now owns 9,994 shares in the company, valued at approximately $4,987,006. This represents a 27.46 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Sangeeta N. Bhatia sold 646 shares of the firm's stock in a transaction that occurred on Friday, August 30th. The shares were sold at an average price of $500.00, for a total value of $323,000.00. Following the completion of the transaction, the director now directly owns 4,435 shares in the company, valued at $2,217,500. The trade was a 12.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.20% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on VRTX shares. Oppenheimer cut their price objective on shares of Vertex Pharmaceuticals from $550.00 to $540.00 and set an "outperform" rating on the stock in a research note on Wednesday, October 30th. Raymond James reaffirmed a "market perform" rating on shares of Vertex Pharmaceuticals in a research note on Thursday, October 10th. Royal Bank of Canada increased their price objective on shares of Vertex Pharmaceuticals from $437.00 to $451.00 and gave the company a "sector perform" rating in a report on Tuesday, November 5th. Morgan Stanley boosted their target price on Vertex Pharmaceuticals from $473.00 to $476.00 and gave the stock an "equal weight" rating in a report on Tuesday, November 5th. Finally, Canaccord Genuity Group increased their price target on Vertex Pharmaceuticals from $361.00 to $408.00 and gave the company a "sell" rating in a research note on Wednesday, November 6th. Three investment analysts have rated the stock with a sell rating, nine have given a hold rating, seventeen have issued a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat.com, Vertex Pharmaceuticals presently has a consensus rating of "Moderate Buy" and an average target price of $499.12.

View Our Latest Stock Report on Vertex Pharmaceuticals

Vertex Pharmaceuticals Company Profile

(

Free Report)

Vertex Pharmaceuticals Incorporated, a biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF). It markets TRIKAFTA/KAFTRIO for people with CF with at least one F508del mutation for 2 years of age or older; SYMDEKO/SYMKEVI for people with CF for 6 years of age or older; ORKAMBI for CF patients 1 year or older; and KALYDECO for the treatment of patients with 1 year or older who have CF with ivacaftor.

Recommended Stories

Before you consider Vertex Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex Pharmaceuticals wasn't on the list.

While Vertex Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.