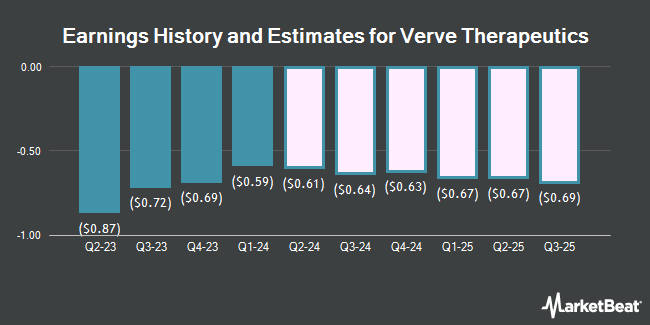

Verve Therapeutics, Inc. (NASDAQ:VERV - Free Report) - Equities researchers at Cantor Fitzgerald upped their FY2024 earnings per share estimates for Verve Therapeutics in a report released on Monday, November 11th. Cantor Fitzgerald analyst R. Bienkowski now forecasts that the company will post earnings of ($2.53) per share for the year, up from their previous estimate of ($2.79). The consensus estimate for Verve Therapeutics' current full-year earnings is ($2.53) per share.

Several other equities research analysts have also recently commented on the company. Royal Bank of Canada lowered their price target on Verve Therapeutics from $20.00 to $17.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. HC Wainwright dropped their price target on shares of Verve Therapeutics from $15.00 to $14.00 and set a "buy" rating on the stock in a research report on Wednesday, November 6th. Finally, Canaccord Genuity Group boosted their target price on shares of Verve Therapeutics from $29.00 to $32.00 and gave the stock a "buy" rating in a research report on Wednesday, November 6th.

Get Our Latest Report on Verve Therapeutics

Verve Therapeutics Trading Down 0.9 %

NASDAQ:VERV traded down $0.05 on Thursday, hitting $5.74. 560,915 shares of the company's stock traded hands, compared to its average volume of 1,318,199. The firm has a 50-day moving average price of $5.47 and a 200-day moving average price of $5.68. Verve Therapeutics has a 1 year low of $4.30 and a 1 year high of $19.34. The company has a market cap of $485.95 million, a PE ratio of -2.35 and a beta of 1.75.

Verve Therapeutics (NASDAQ:VERV - Get Free Report) last released its earnings results on Tuesday, November 5th. The company reported ($0.59) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.70) by $0.11. Verve Therapeutics had a negative return on equity of 35.23% and a negative net margin of 807.65%. The firm had revenue of $6.87 million for the quarter, compared to analyst estimates of $2.75 million. During the same period in the previous year, the company earned ($0.72) earnings per share. Verve Therapeutics's revenue was up 120.2% compared to the same quarter last year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in VERV. Susquehanna Fundamental Investments LLC acquired a new position in Verve Therapeutics during the 1st quarter worth about $191,000. ProShare Advisors LLC increased its holdings in shares of Verve Therapeutics by 31.0% in the first quarter. ProShare Advisors LLC now owns 17,696 shares of the company's stock worth $235,000 after acquiring an additional 4,184 shares in the last quarter. Vanguard Group Inc. raised its holdings in shares of Verve Therapeutics by 15.7% during the first quarter. Vanguard Group Inc. now owns 6,331,312 shares of the company's stock worth $84,080,000 after acquiring an additional 859,382 shares during the period. American International Group Inc. boosted its stake in Verve Therapeutics by 25.1% in the 1st quarter. American International Group Inc. now owns 32,468 shares of the company's stock worth $431,000 after purchasing an additional 6,517 shares during the period. Finally, Price T Rowe Associates Inc. MD boosted its stake in Verve Therapeutics by 28.3% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 25,366 shares of the company's stock worth $337,000 after purchasing an additional 5,600 shares during the period. Institutional investors and hedge funds own 97.11% of the company's stock.

Verve Therapeutics Company Profile

(

Get Free Report)

Verve Therapeutics, Inc, a clinical stage genetic medicines company, engages in developing gene editing medicines for patients to treat cardiovascular diseases in the United States. The company's lead product candidate is VERVE-101, a single-course gene editing treatment that permanently turns off the PCSK9 gene in the liver; and VERVE-102, a product candidate that targets the PCSK9 gene for the treatment of HeFH.

Read More

Before you consider Verve Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verve Therapeutics wasn't on the list.

While Verve Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.