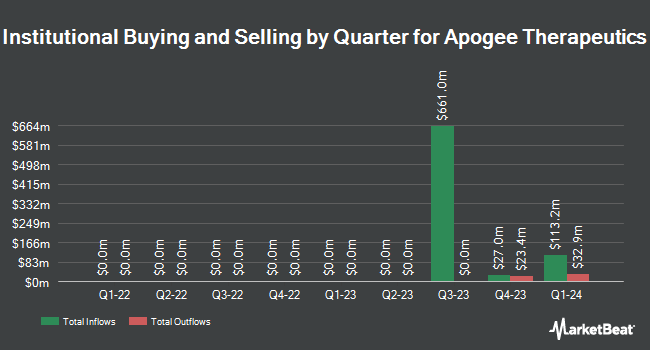

Vestal Point Capital LP bought a new position in Apogee Therapeutics, Inc. (NASDAQ:APGE - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 136,500 shares of the company's stock, valued at approximately $8,018,000. Vestal Point Capital LP owned about 0.30% of Apogee Therapeutics at the end of the most recent reporting period.

Other hedge funds also recently bought and sold shares of the company. Zurcher Kantonalbank Zurich Cantonalbank purchased a new stake in Apogee Therapeutics in the 3rd quarter worth approximately $71,000. Mirae Asset Global Investments Co. Ltd. lifted its stake in Apogee Therapeutics by 21.2% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,628 shares of the company's stock worth $94,000 after acquiring an additional 285 shares during the period. Allspring Global Investments Holdings LLC bought a new stake in Apogee Therapeutics in the second quarter valued at $143,000. Kennedy Capital Management LLC purchased a new position in Apogee Therapeutics during the 1st quarter valued at $212,000. Finally, Arizona State Retirement System raised its holdings in Apogee Therapeutics by 4.5% in the 2nd quarter. Arizona State Retirement System now owns 5,993 shares of the company's stock worth $236,000 after purchasing an additional 258 shares in the last quarter. Hedge funds and other institutional investors own 79.04% of the company's stock.

Insider Transactions at Apogee Therapeutics

In other news, CEO Michael Thomas Henderson sold 15,000 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $59.22, for a total transaction of $888,300.00. Following the sale, the chief executive officer now owns 1,339,487 shares in the company, valued at $79,324,420.14. This represents a 1.11 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider Carl Dambkowski sold 6,665 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $59.12, for a total transaction of $394,034.80. Following the sale, the insider now directly owns 267,463 shares of the company's stock, valued at $15,812,412.56. This trade represents a 2.43 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 114,995 shares of company stock valued at $6,128,295. Insiders own 36.10% of the company's stock.

Apogee Therapeutics Price Performance

APGE stock traded up $0.45 on Friday, reaching $45.15. 207,993 shares of the company traded hands, compared to its average volume of 493,423. The firm has a fifty day simple moving average of $53.67 and a 200-day simple moving average of $48.51. The company has a market cap of $2.03 billion, a P/E ratio of -18.80 and a beta of 2.93. Apogee Therapeutics, Inc. has a one year low of $17.17 and a one year high of $72.29.

Wall Street Analysts Forecast Growth

Several equities analysts recently issued reports on the stock. Wedbush reiterated an "outperform" rating and set a $87.00 price target on shares of Apogee Therapeutics in a research report on Tuesday, November 12th. Canaccord Genuity Group assumed coverage on Apogee Therapeutics in a report on Monday. They set a "buy" rating and a $89.00 target price on the stock. Guggenheim lifted their price target on Apogee Therapeutics from $95.00 to $110.00 and gave the company a "buy" rating in a research report on Wednesday. Finally, Canaccord Genuity Group assumed coverage on Apogee Therapeutics in a research note on Monday. They issued a "buy" rating and a $89.00 price target on the stock. Eight analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company has a consensus rating of "Buy" and an average target price of $83.50.

Get Our Latest Report on Apogee Therapeutics

Apogee Therapeutics Company Profile

(

Free Report)

Apogee Therapeutics, Inc, through its subsidiary, operates as a biotechnology company that develops biologics for the treatment of atopic dermatitis (AD), asthma, chronic obstructive pulmonary disease (COPD), and related inflammatory and immunology indications. The company primarily develops APG777, a subcutaneous (SQ) extended half-life monoclonal antibody (mAb) for AD; and APG808, an SQ extended half-life mAb for COPD.

Featured Articles

Before you consider Apogee Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apogee Therapeutics wasn't on the list.

While Apogee Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.