Vestal Point Capital LP reduced its stake in Nurix Therapeutics, Inc. (NASDAQ:NRIX - Free Report) by 15.0% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 425,000 shares of the company's stock after selling 75,000 shares during the period. Vestal Point Capital LP owned 0.60% of Nurix Therapeutics worth $9,550,000 at the end of the most recent quarter.

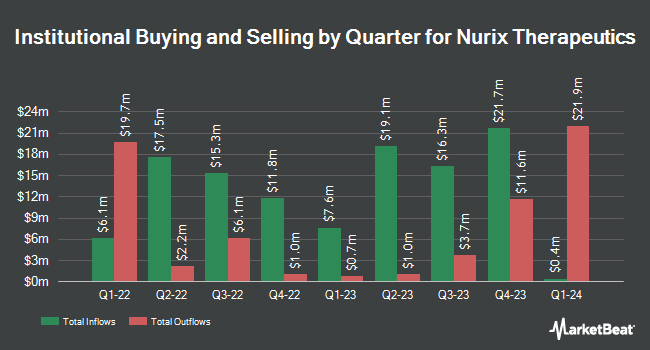

Other hedge funds and other institutional investors have also made changes to their positions in the company. Driehaus Capital Management LLC acquired a new position in Nurix Therapeutics in the second quarter valued at about $26,778,000. Candriam S.C.A. increased its stake in shares of Nurix Therapeutics by 30.5% in the 2nd quarter. Candriam S.C.A. now owns 1,164,246 shares of the company's stock valued at $24,297,000 after acquiring an additional 272,136 shares during the last quarter. Affinity Asset Advisors LLC raised its position in shares of Nurix Therapeutics by 12.6% in the 2nd quarter. Affinity Asset Advisors LLC now owns 912,000 shares of the company's stock valued at $19,033,000 after acquiring an additional 101,747 shares during the period. Millennium Management LLC boosted its stake in Nurix Therapeutics by 60.2% during the 2nd quarter. Millennium Management LLC now owns 599,623 shares of the company's stock worth $12,514,000 after acquiring an additional 225,374 shares during the last quarter. Finally, FMR LLC grew its holdings in Nurix Therapeutics by 675.9% during the third quarter. FMR LLC now owns 586,902 shares of the company's stock valued at $13,188,000 after purchasing an additional 511,256 shares during the period.

Insider Buying and Selling

In other news, insider Christine Ring sold 3,290 shares of the company's stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $25.00, for a total value of $82,250.00. Following the transaction, the insider now owns 24,592 shares of the company's stock, valued at approximately $614,800. This represents a 11.80 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Houte Hans Van sold 3,546 shares of the company's stock in a transaction on Friday, November 1st. The shares were sold at an average price of $24.28, for a total value of $86,096.88. Following the completion of the transaction, the chief financial officer now directly owns 33,724 shares in the company, valued at approximately $818,818.72. This represents a 9.51 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 27,451 shares of company stock worth $663,160. Company insiders own 7.20% of the company's stock.

Analysts Set New Price Targets

NRIX has been the topic of a number of recent analyst reports. Jefferies Financial Group began coverage on shares of Nurix Therapeutics in a research report on Friday, October 11th. They set a "buy" rating and a $41.00 price target on the stock. Oppenheimer lifted their target price on Nurix Therapeutics from $27.00 to $30.00 and gave the stock an "outperform" rating in a report on Wednesday, September 4th. HC Wainwright increased their price target on Nurix Therapeutics from $26.00 to $30.00 and gave the stock a "buy" rating in a report on Monday, October 21st. UBS Group initiated coverage on Nurix Therapeutics in a report on Thursday, October 24th. They set a "buy" rating and a $35.00 price objective on the stock. Finally, Royal Bank of Canada lowered their target price on Nurix Therapeutics from $27.00 to $26.00 and set an "outperform" rating for the company in a research note on Monday, October 14th. One investment analyst has rated the stock with a hold rating and fourteen have issued a buy rating to the stock. Based on data from MarketBeat.com, Nurix Therapeutics presently has an average rating of "Moderate Buy" and an average price target of $29.40.

View Our Latest Report on NRIX

Nurix Therapeutics Trading Up 4.1 %

Shares of Nurix Therapeutics stock traded up $0.88 on Friday, reaching $22.11. 378,726 shares of the company were exchanged, compared to its average volume of 902,338. Nurix Therapeutics, Inc. has a one year low of $5.95 and a one year high of $29.56. The company has a 50-day moving average of $24.09 and a 200 day moving average of $21.70. The company has a market capitalization of $1.57 billion, a price-to-earnings ratio of -7.30 and a beta of 2.20.

Nurix Therapeutics (NASDAQ:NRIX - Get Free Report) last announced its quarterly earnings results on Friday, October 11th. The company reported ($0.67) EPS for the quarter, meeting analysts' consensus estimates of ($0.67). The firm had revenue of $12.59 million during the quarter, compared to analysts' expectations of $13.85 million. Nurix Therapeutics had a negative net margin of 313.65% and a negative return on equity of 63.39%. Analysts predict that Nurix Therapeutics, Inc. will post -2.81 earnings per share for the current year.

Nurix Therapeutics Company Profile

(

Free Report)

Nurix Therapeutics, Inc, a clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and cell therapies for the treatment of cancer, inflammatory conditions, and other diseases. The company develops NX-2127, an orally bioavailable Bruton's tyrosine kinase (BTK) degrader for the treatment of relapsed or refractory B-cell malignancies; NX-5948, an orally bioavailable BTK degrader for the treatment of relapsed or refractory B-cell malignancies and autoimmune diseases; and NX-1607, an orally bioavailable Casitas B-lineage lymphoma proto-oncogene-B (CBL-B) inhibitor for immuno-oncology indications.

Featured Articles

Before you consider Nurix Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nurix Therapeutics wasn't on the list.

While Nurix Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.