Vestal Point Capital LP purchased a new stake in Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund purchased 205,000 shares of the company's stock, valued at approximately $10,476,000. Vestal Point Capital LP owned approximately 0.26% of Crinetics Pharmaceuticals as of its most recent SEC filing.

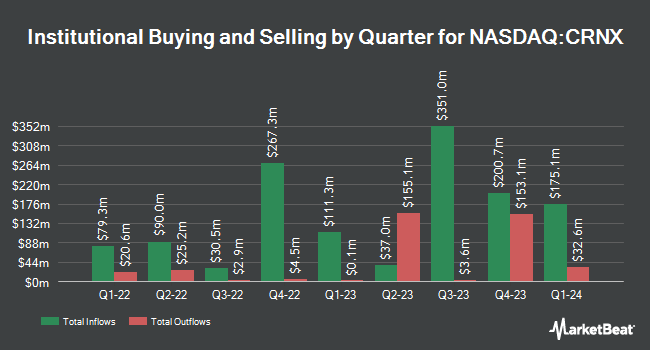

Other large investors also recently bought and sold shares of the company. Vanguard Group Inc. boosted its position in Crinetics Pharmaceuticals by 2.1% during the first quarter. Vanguard Group Inc. now owns 3,575,076 shares of the company's stock worth $167,349,000 after acquiring an additional 72,624 shares during the last quarter. Public Employees Retirement Association of Colorado acquired a new stake in shares of Crinetics Pharmaceuticals in the first quarter valued at $499,000. California State Teachers Retirement System increased its stake in Crinetics Pharmaceuticals by 11.1% during the first quarter. California State Teachers Retirement System now owns 64,292 shares of the company's stock worth $3,010,000 after purchasing an additional 6,421 shares during the period. Comerica Bank acquired a new stake in Crinetics Pharmaceuticals during the 1st quarter worth approximately $33,000. Finally, SG Americas Securities LLC boosted its stake in shares of Crinetics Pharmaceuticals by 1,224.8% in the 2nd quarter. SG Americas Securities LLC now owns 79,051 shares of the company's stock valued at $3,541,000 after buying an additional 73,084 shares during the period. Institutional investors and hedge funds own 98.51% of the company's stock.

Insider Buying and Selling

In related news, CFO Marc Wilson sold 25,000 shares of the stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $51.11, for a total transaction of $1,277,750.00. Following the sale, the chief financial officer now owns 111,092 shares of the company's stock, valued at $5,677,912.12. This trade represents a 18.37 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Stephen F. Betz sold 1,035 shares of the company's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $51.50, for a total transaction of $53,302.50. Following the completion of the transaction, the insider now owns 68,576 shares in the company, valued at approximately $3,531,664. This trade represents a 1.49 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 40,911 shares of company stock worth $2,144,675 in the last three months. Corporate insiders own 6.00% of the company's stock.

Crinetics Pharmaceuticals Trading Down 0.8 %

Shares of Crinetics Pharmaceuticals stock traded down $0.47 on Friday, reaching $57.20. 299,632 shares of the stock were exchanged, compared to its average volume of 777,499. The firm has a market capitalization of $5.30 billion, a PE ratio of -15.46 and a beta of 0.62. Crinetics Pharmaceuticals, Inc. has a 1-year low of $31.35 and a 1-year high of $62.53. The business has a fifty day moving average price of $55.65 and a two-hundred day moving average price of $51.79.

Crinetics Pharmaceuticals (NASDAQ:CRNX - Get Free Report) last released its earnings results on Tuesday, November 12th. The company reported ($0.96) EPS for the quarter, missing analysts' consensus estimates of ($0.91) by ($0.05). During the same quarter in the prior year, the business earned ($1.01) earnings per share. Research analysts expect that Crinetics Pharmaceuticals, Inc. will post -3.75 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on CRNX shares. JMP Securities restated a "market outperform" rating and issued a $80.00 price target on shares of Crinetics Pharmaceuticals in a research note on Friday, September 27th. Oppenheimer reaffirmed an "outperform" rating and issued a $73.00 price target (down from $74.00) on shares of Crinetics Pharmaceuticals in a report on Friday, August 9th. Citigroup boosted their price objective on shares of Crinetics Pharmaceuticals from $70.00 to $74.00 and gave the stock a "buy" rating in a research report on Thursday, November 14th. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $90.00 target price on shares of Crinetics Pharmaceuticals in a research report on Monday, September 16th. Finally, HC Wainwright lifted their price target on Crinetics Pharmaceuticals from $69.00 to $81.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. One investment analyst has rated the stock with a hold rating and ten have given a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $70.18.

Get Our Latest Report on CRNX

About Crinetics Pharmaceuticals

(

Free Report)

Crinetics Pharmaceuticals, Inc, a clinical-stage pharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutics for rare endocrine diseases and endocrine-related tumors. The company's lead product candidate is paltusotine, an oral selective nonpeptide somatostatin receptor type 2 agonist, which is in Phase 3 trial for the treatment of acromegaly; and Phase 2 trial for treating carcinoid syndrome associated with neuroendocrine tumors.

Featured Articles

Before you consider Crinetics Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crinetics Pharmaceuticals wasn't on the list.

While Crinetics Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.