Vestcor Inc purchased a new position in Essent Group Ltd. (NYSE:ESNT - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 8,172 shares of the financial services provider's stock, valued at approximately $445,000.

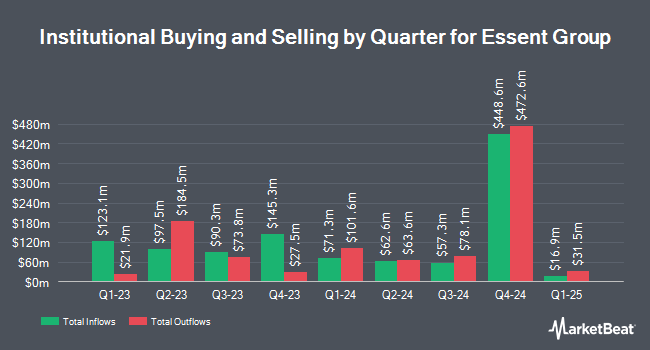

Several other institutional investors have also recently made changes to their positions in ESNT. KBC Group NV increased its holdings in shares of Essent Group by 15.8% in the 3rd quarter. KBC Group NV now owns 3,009 shares of the financial services provider's stock worth $193,000 after buying an additional 410 shares during the last quarter. Natixis Advisors LLC increased its stake in Essent Group by 22.7% in the third quarter. Natixis Advisors LLC now owns 13,706 shares of the financial services provider's stock valued at $881,000 after acquiring an additional 2,532 shares during the last quarter. Jennison Associates LLC increased its stake in Essent Group by 1.4% in the third quarter. Jennison Associates LLC now owns 750,778 shares of the financial services provider's stock valued at $48,268,000 after acquiring an additional 10,684 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. raised its position in Essent Group by 561.3% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 56,983 shares of the financial services provider's stock valued at $3,663,000 after purchasing an additional 48,366 shares in the last quarter. Finally, Advisors Asset Management Inc. lifted its stake in Essent Group by 53.9% during the third quarter. Advisors Asset Management Inc. now owns 1,362 shares of the financial services provider's stock worth $88,000 after purchasing an additional 477 shares during the last quarter. Institutional investors own 93.00% of the company's stock.

Analysts Set New Price Targets

A number of brokerages recently weighed in on ESNT. JPMorgan Chase & Co. decreased their price objective on Essent Group from $67.00 to $60.00 and set a "neutral" rating on the stock in a report on Monday, December 9th. Royal Bank of Canada restated an "outperform" rating and issued a $67.00 price objective on shares of Essent Group in a report on Tuesday, February 18th. Keefe, Bruyette & Woods decreased their target price on shares of Essent Group from $72.00 to $71.00 and set an "outperform" rating on the stock in a research report on Tuesday, February 18th. Finally, Barclays downgraded shares of Essent Group from an "overweight" rating to an "equal weight" rating and lowered their price target for the stock from $69.00 to $58.00 in a research note on Monday, January 6th. Four research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $62.57.

Check Out Our Latest Research Report on ESNT

Essent Group Stock Down 0.6 %

Shares of NYSE:ESNT traded down $0.34 during midday trading on Friday, hitting $55.51. 3,073,859 shares of the stock traded hands, compared to its average volume of 578,604. The business's 50 day moving average is $56.85 and its two-hundred day moving average is $58.23. The stock has a market capitalization of $5.76 billion, a PE ratio of 8.12, a P/E/G ratio of 2.70 and a beta of 1.09. Essent Group Ltd. has a one year low of $52.22 and a one year high of $65.34.

Essent Group (NYSE:ESNT - Get Free Report) last released its quarterly earnings results on Friday, February 14th. The financial services provider reported $1.58 EPS for the quarter, missing analysts' consensus estimates of $1.67 by ($0.09). The business had revenue of $315.00 million for the quarter, compared to the consensus estimate of $313.88 million. Essent Group had a net margin of 58.69% and a return on equity of 13.35%. The company's revenue for the quarter was up 6.0% on a year-over-year basis. During the same period in the previous year, the company earned $1.64 EPS. As a group, sell-side analysts forecast that Essent Group Ltd. will post 6.88 earnings per share for the current year.

Essent Group Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, March 24th. Stockholders of record on Friday, March 14th will be paid a $0.31 dividend. This represents a $1.24 dividend on an annualized basis and a dividend yield of 2.23%. The ex-dividend date is Friday, March 14th. This is a boost from Essent Group's previous quarterly dividend of $0.28. Essent Group's dividend payout ratio (DPR) is presently 18.13%.

Essent Group Company Profile

(

Free Report)

Essent Group Ltd., through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States. Its mortgage insurance products include primary, pool, and master policy. The company also provides information technology maintenance and development services; customer support-related services; underwriting consulting; and contract underwriting services, as well as risk management products and title insurance and settlement services.

Recommended Stories

Before you consider Essent Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essent Group wasn't on the list.

While Essent Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.