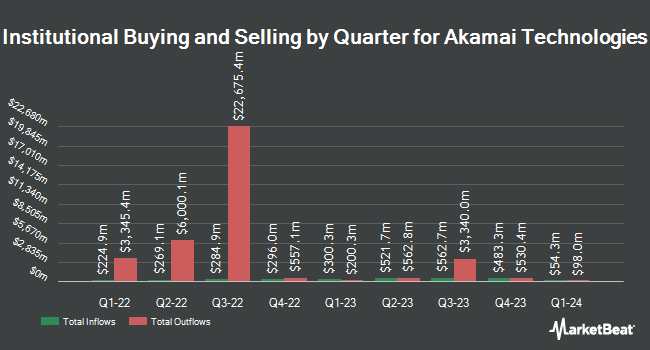

Vestcor Inc cut its holdings in shares of Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 80.5% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 2,992 shares of the technology infrastructure company's stock after selling 12,351 shares during the quarter. Vestcor Inc's holdings in Akamai Technologies were worth $302,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also modified their holdings of the company. Dimensional Fund Advisors LP boosted its stake in Akamai Technologies by 25.1% during the second quarter. Dimensional Fund Advisors LP now owns 1,732,750 shares of the technology infrastructure company's stock worth $156,088,000 after buying an additional 347,626 shares in the last quarter. Empyrean Capital Partners LP bought a new position in shares of Akamai Technologies during the 2nd quarter worth about $15,314,000. Renaissance Technologies LLC increased its stake in Akamai Technologies by 33.3% in the second quarter. Renaissance Technologies LLC now owns 651,400 shares of the technology infrastructure company's stock valued at $58,678,000 after acquiring an additional 162,700 shares during the period. Distillate Capital Partners LLC acquired a new position in Akamai Technologies in the second quarter worth about $14,130,000. Finally, Worldquant Millennium Advisors LLC bought a new position in Akamai Technologies during the third quarter worth about $13,313,000. Institutional investors and hedge funds own 94.28% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have recently weighed in on the company. Scotiabank lowered their price objective on Akamai Technologies from $115.00 to $112.00 and set a "sector outperform" rating on the stock in a research note on Friday, November 8th. Tigress Financial reiterated a "strong-buy" rating and issued a $140.00 price target on shares of Akamai Technologies in a research report on Thursday, August 29th. Hsbc Global Res raised Akamai Technologies from a "hold" rating to a "strong-buy" rating in a report on Monday, November 11th. HSBC raised shares of Akamai Technologies from a "hold" rating to a "buy" rating and set a $121.00 target price on the stock in a report on Monday, November 11th. Finally, Robert W. Baird cut their price target on shares of Akamai Technologies from $120.00 to $115.00 and set an "outperform" rating for the company in a report on Monday, November 11th. One investment analyst has rated the stock with a sell rating, five have given a hold rating, thirteen have given a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $117.61.

Check Out Our Latest Analysis on Akamai Technologies

Akamai Technologies Trading Down 0.8 %

NASDAQ AKAM traded down $0.76 during trading hours on Friday, hitting $99.24. The company's stock had a trading volume of 1,564,642 shares, compared to its average volume of 1,676,197. Akamai Technologies, Inc. has a twelve month low of $84.70 and a twelve month high of $129.17. The firm has a market capitalization of $14.91 billion, a P/E ratio of 29.36, a PEG ratio of 3.83 and a beta of 0.65. The company has a quick ratio of 1.33, a current ratio of 1.33 and a debt-to-equity ratio of 0.50. The stock has a fifty day moving average of $98.19 and a 200 day moving average of $96.53.

Insider Buying and Selling at Akamai Technologies

In other Akamai Technologies news, CTO Robert Blumofe sold 2,500 shares of the stock in a transaction on Friday, November 15th. The shares were sold at an average price of $88.61, for a total value of $221,525.00. Following the sale, the chief technology officer now directly owns 19,510 shares in the company, valued at approximately $1,728,781.10. This trade represents a 11.36 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, EVP Paul C. Joseph sold 4,000 shares of the business's stock in a transaction on Friday, November 15th. The shares were sold at an average price of $88.63, for a total transaction of $354,520.00. Following the completion of the transaction, the executive vice president now directly owns 26,703 shares of the company's stock, valued at $2,366,686.89. This trade represents a 13.03 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 7,500 shares of company stock worth $669,425. Insiders own 1.80% of the company's stock.

About Akamai Technologies

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

See Also

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.