Vestcor Inc boosted its stake in Plains GP Holdings, L.P. (NYSE:PAGP - Free Report) by 79.1% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 78,442 shares of the pipeline company's stock after buying an additional 34,633 shares during the quarter. Vestcor Inc's holdings in Plains GP were worth $1,451,000 as of its most recent SEC filing.

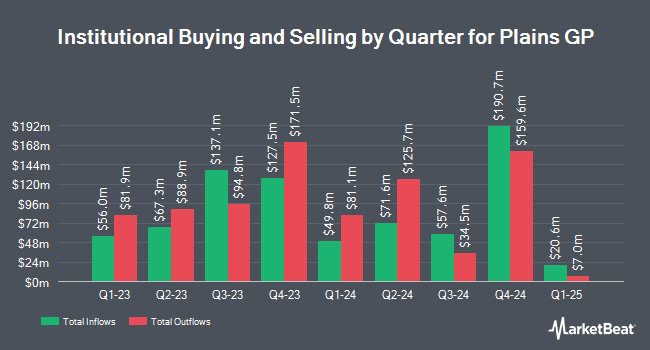

Several other large investors have also bought and sold shares of PAGP. ORG Partners LLC bought a new stake in Plains GP during the second quarter worth $44,000. CWM LLC raised its stake in shares of Plains GP by 61.0% during the 2nd quarter. CWM LLC now owns 3,028 shares of the pipeline company's stock worth $57,000 after purchasing an additional 1,147 shares during the period. Hara Capital LLC purchased a new position in shares of Plains GP in the 3rd quarter worth about $57,000. Unique Wealth Strategies LLC bought a new position in Plains GP during the second quarter valued at about $70,000. Finally, Eastern Bank bought a new position in Plains GP during the third quarter valued at about $76,000. 88.30% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

PAGP has been the subject of a number of research reports. Morgan Stanley downgraded shares of Plains GP from an "overweight" rating to an "equal weight" rating and reduced their target price for the company from $22.00 to $19.00 in a research report on Friday, October 25th. Wolfe Research raised Plains GP to a "hold" rating in a report on Wednesday, September 18th. Finally, StockNews.com raised Plains GP from a "hold" rating to a "buy" rating in a research report on Friday, November 8th. Two analysts have rated the stock with a sell rating, three have given a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, Plains GP currently has a consensus rating of "Hold" and a consensus target price of $19.88.

Read Our Latest Research Report on Plains GP

Plains GP Price Performance

Plains GP stock traded up $0.03 during midday trading on Thursday, reaching $19.32. 3,021,113 shares of the stock were exchanged, compared to its average volume of 1,725,654. Plains GP Holdings, L.P. has a 52 week low of $14.94 and a 52 week high of $20.10. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.92 and a current ratio of 1.01. The firm has a market cap of $3.82 billion, a PE ratio of 22.81 and a beta of 1.57. The company's fifty day moving average is $18.64 and its 200-day moving average is $18.69.

Plains GP Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, November 14th. Investors of record on Thursday, October 31st were paid a dividend of $0.3175 per share. This represents a $1.27 annualized dividend and a yield of 6.57%. The ex-dividend date was Thursday, October 31st. Plains GP's dividend payout ratio is 149.41%.

About Plains GP

(

Free Report)

Plains GP Holdings, L.P., through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada. It operates in two segments, Crude Oil and Natural Gas Liquids (NGLs). The company engages in the gathering and transporting crude oil and NGLs using pipelines, gathering systems, and trucks.

Read More

Before you consider Plains GP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains GP wasn't on the list.

While Plains GP currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.