Vestcor Inc acquired a new stake in shares of Gentex Co. (NASDAQ:GNTX - Free Report) during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm acquired 18,522 shares of the auto parts company's stock, valued at approximately $550,000.

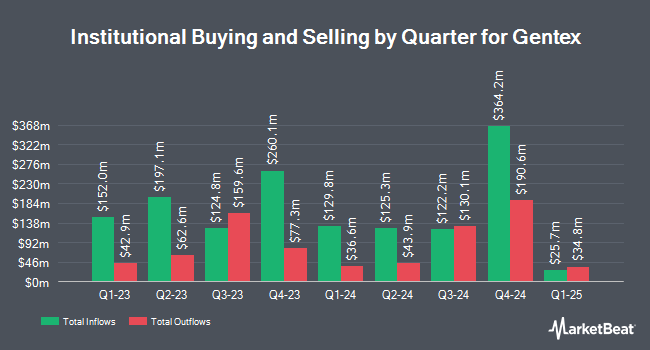

Other institutional investors also recently bought and sold shares of the company. SG Americas Securities LLC lifted its position in shares of Gentex by 15.9% during the second quarter. SG Americas Securities LLC now owns 10,124 shares of the auto parts company's stock valued at $341,000 after buying an additional 1,387 shares during the last quarter. Wealth Enhancement Advisory Services LLC grew its holdings in Gentex by 31.9% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 35,286 shares of the auto parts company's stock worth $1,189,000 after purchasing an additional 8,536 shares during the last quarter. Envestnet Portfolio Solutions Inc. increased its position in shares of Gentex by 50.6% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 9,485 shares of the auto parts company's stock worth $320,000 after purchasing an additional 3,187 shares in the last quarter. Assenagon Asset Management S.A. lifted its holdings in shares of Gentex by 8.0% during the 2nd quarter. Assenagon Asset Management S.A. now owns 60,871 shares of the auto parts company's stock valued at $2,052,000 after purchasing an additional 4,492 shares during the last quarter. Finally, Blue Trust Inc. boosted its position in shares of Gentex by 4.0% in the 2nd quarter. Blue Trust Inc. now owns 12,434 shares of the auto parts company's stock worth $449,000 after purchasing an additional 475 shares in the last quarter. 86.76% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on GNTX shares. Guggenheim decreased their price target on Gentex from $35.00 to $34.00 and set a "buy" rating for the company in a research note on Thursday, November 21st. Robert W. Baird increased their price objective on shares of Gentex from $35.00 to $37.00 and gave the company an "outperform" rating in a research report on Monday, October 28th. The Goldman Sachs Group dropped their target price on shares of Gentex from $33.00 to $31.00 and set a "neutral" rating on the stock in a research report on Tuesday, October 1st. UBS Group started coverage on shares of Gentex in a report on Wednesday, September 4th. They issued a "neutral" rating and a $34.00 price target for the company. Finally, Bank of America dropped their price objective on shares of Gentex from $39.00 to $35.00 and set a "neutral" rating on the stock in a report on Monday, October 14th. Six analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, Gentex presently has an average rating of "Hold" and an average target price of $35.13.

Get Our Latest Research Report on Gentex

Gentex Price Performance

Gentex stock traded up $0.01 during midday trading on Friday, reaching $30.59. The company had a trading volume of 1,297,627 shares, compared to its average volume of 1,441,084. Gentex Co. has a 12-month low of $28.30 and a 12-month high of $37.58. The firm's fifty day simple moving average is $30.13 and its 200-day simple moving average is $31.21. The company has a market capitalization of $6.96 billion, a P/E ratio of 16.36, a P/E/G ratio of 1.09 and a beta of 0.91.

Gentex Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 22nd. Investors of record on Wednesday, January 8th will be given a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 1.57%. The ex-dividend date is Wednesday, January 8th. Gentex's payout ratio is 25.67%.

Gentex Profile

(

Free Report)

Gentex Corporation designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, Germany, Japan, Mexico, Republic of Korea, and internationally. It operates through Automotive Products and Other segments. The company offers automotive products, including interior and exterior electrochromic automatic-dimming rearview mirrors, automotive electronics, and non-automatic-dimming rearview mirrors for automotive passenger cars, light trucks, pick-up trucks, sport utility vehicles, and vans for original equipment manufacturers, automotive suppliers, and various aftermarket and accessory customers.

Read More

Before you consider Gentex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gentex wasn't on the list.

While Gentex currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.