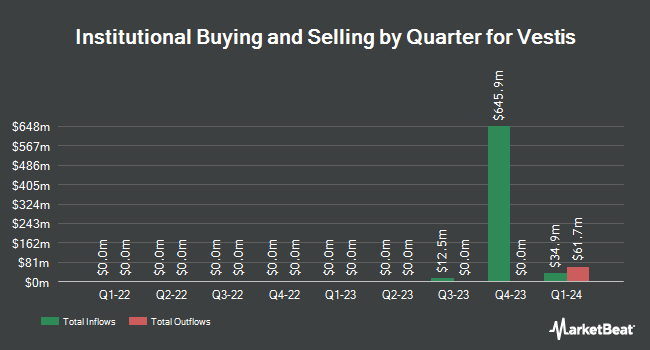

Principal Financial Group Inc. reduced its position in Vestis Co. (NYSE:VSTS - Free Report) by 16.3% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 540,049 shares of the company's stock after selling 105,273 shares during the quarter. Principal Financial Group Inc. owned approximately 0.41% of Vestis worth $8,047,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently modified their holdings of VSTS. Canada Pension Plan Investment Board bought a new position in Vestis during the second quarter worth $44,000. GAMMA Investing LLC boosted its stake in Vestis by 143.5% during the third quarter. GAMMA Investing LLC now owns 3,960 shares of the company's stock worth $59,000 after acquiring an additional 2,334 shares in the last quarter. Copeland Capital Management LLC bought a new position in Vestis during the third quarter worth $60,000. nVerses Capital LLC bought a new position in Vestis during the second quarter worth $61,000. Finally, Quarry LP boosted its stake in Vestis by 346.0% during the second quarter. Quarry LP now owns 6,556 shares of the company's stock worth $80,000 after acquiring an additional 5,086 shares in the last quarter. 97.40% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research analysts recently issued reports on VSTS shares. Robert W. Baird lowered shares of Vestis from an "outperform" rating to a "neutral" rating and set a $13.00 target price on the stock. in a research note on Thursday, August 8th. Baird R W downgraded shares of Vestis from a "strong-buy" rating to a "hold" rating in a report on Thursday, August 8th. Finally, The Goldman Sachs Group upped their price objective on shares of Vestis from $12.50 to $13.80 and gave the stock a "neutral" rating in a report on Tuesday, August 20th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $16.69.

Check Out Our Latest Analysis on VSTS

Vestis Stock Down 1.0 %

Shares of NYSE VSTS traded down $0.14 during mid-day trading on Wednesday, hitting $13.27. The company had a trading volume of 1,078,082 shares, compared to its average volume of 2,116,245. The company has a debt-to-equity ratio of 1.67, a current ratio of 2.37 and a quick ratio of 2.02. Vestis Co. has a 1 year low of $8.92 and a 1 year high of $22.37. The stock's 50-day moving average price is $14.59 and its 200-day moving average price is $13.25.

Vestis Company Profile

(

Free Report)

Vestis Corporation provides uniform rentals and workplace supplies in the United States and Canada. Its products include uniform options, such as shirts, pants, outerwear, gowns, scrubs, high visibility garments, particulate-free garments, and flame-resistant garments, as well as shoes and accessories; and workplace supplies, including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, and linens.

Featured Articles

Before you consider Vestis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vestis wasn't on the list.

While Vestis currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.