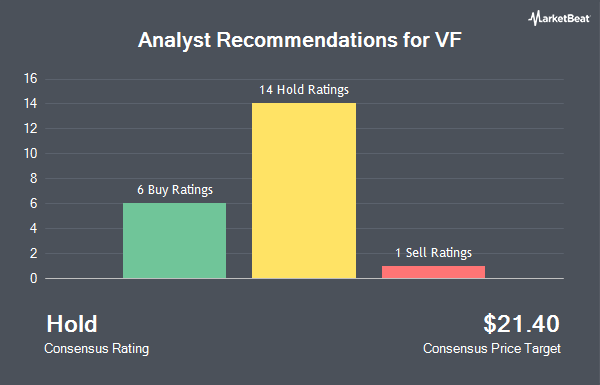

VF Corporation (NYSE:VFC - Get Free Report) has been assigned a consensus rating of "Hold" from the nineteen brokerages that are covering the company, MarketBeat reports. Three research analysts have rated the stock with a sell rating, thirteen have issued a hold rating and three have assigned a buy rating to the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $18.29.

A number of brokerages have weighed in on VFC. Argus upgraded shares of VF to a "hold" rating in a research report on Wednesday, August 28th. Truist Financial assumed coverage on VF in a report on Thursday. They issued a "hold" rating and a $20.00 price target for the company. UBS Group raised their price objective on VF from $12.00 to $17.00 and gave the company a "neutral" rating in a report on Friday, August 16th. TD Cowen upped their target price on VF from $16.00 to $19.00 and gave the stock a "hold" rating in a research note on Tuesday, October 29th. Finally, Wells Fargo & Company cut shares of VF from an "equal weight" rating to an "underweight" rating and dropped their price target for the company from $16.00 to $15.00 in a research note on Monday, October 14th.

Get Our Latest Stock Report on VF

VF Price Performance

VF stock traded up $0.62 during midday trading on Friday, hitting $21.05. 5,304,005 shares of the company were exchanged, compared to its average volume of 4,693,526. The business has a fifty day simple moving average of $19.94 and a two-hundred day simple moving average of $17.16. The company has a quick ratio of 0.88, a current ratio of 1.30 and a debt-to-equity ratio of 2.86. VF has a fifty-two week low of $11.00 and a fifty-two week high of $23.09.

VF (NYSE:VFC - Get Free Report) last issued its quarterly earnings data on Monday, October 28th. The textile maker reported $0.60 EPS for the quarter, topping analysts' consensus estimates of $0.41 by $0.19. VF had a negative net margin of 6.68% and a positive return on equity of 12.53%. The business had revenue of $2.76 billion for the quarter, compared to analysts' expectations of $2.72 billion. During the same quarter last year, the company earned $0.63 EPS. The business's revenue was down 5.6% on a year-over-year basis. Research analysts forecast that VF will post 0.48 earnings per share for the current year.

VF Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Tuesday, December 10th will be given a $0.09 dividend. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $0.36 dividend on an annualized basis and a dividend yield of 1.71%. VF's dividend payout ratio (DPR) is presently -20.81%.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Future Financial Wealth Managment LLC acquired a new position in VF in the third quarter valued at approximately $40,000. Abich Financial Wealth Management LLC acquired a new stake in shares of VF during the 2nd quarter worth about $60,000. Banque Cantonale Vaudoise increased its position in shares of VF by 113.3% during the 2nd quarter. Banque Cantonale Vaudoise now owns 6,860 shares of the textile maker's stock worth $93,000 after purchasing an additional 3,644 shares during the last quarter. 1620 Investment Advisors Inc. purchased a new stake in VF in the 2nd quarter valued at about $103,000. Finally, Kessler Investment Group LLC lifted its position in VF by 49.2% in the second quarter. Kessler Investment Group LLC now owns 9,347 shares of the textile maker's stock valued at $126,000 after buying an additional 3,084 shares during the last quarter. Hedge funds and other institutional investors own 86.84% of the company's stock.

About VF

(

Get Free ReportV.F. Corporation, together with its subsidiaries, engages in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific. It operates through three segments: Outdoor, Active, and Work.

Recommended Stories

Before you consider VF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VF wasn't on the list.

While VF currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.