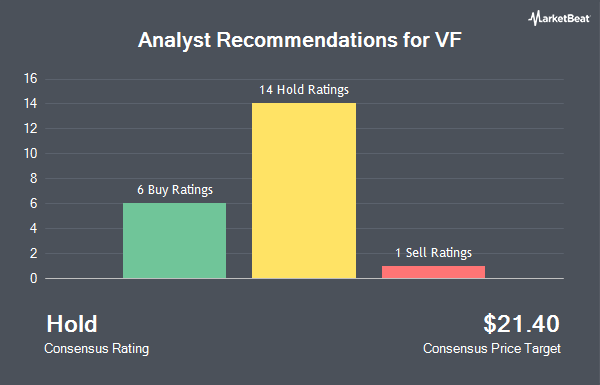

Shares of VF Corporation (NYSE:VFC - Get Free Report) have been given a consensus rating of "Hold" by the eighteen ratings firms that are currently covering the stock, Marketbeat.com reports. Three investment analysts have rated the stock with a sell recommendation, twelve have issued a hold recommendation and three have assigned a buy recommendation to the company. The average 12-month price objective among brokers that have issued ratings on the stock in the last year is $18.19.

A number of analysts recently issued reports on the stock. StockNews.com raised shares of VF from a "sell" rating to a "hold" rating in a research report on Saturday, October 26th. Wedbush reaffirmed a "neutral" rating and set a $13.00 price target on shares of VF in a research report on Monday, August 5th. Argus upgraded VF to a "hold" rating in a research note on Wednesday, August 28th. Wells Fargo & Company downgraded VF from an "equal weight" rating to an "underweight" rating and decreased their target price for the stock from $16.00 to $15.00 in a research report on Monday, October 14th. Finally, TD Cowen boosted their price target on VF from $16.00 to $19.00 and gave the stock a "hold" rating in a research report on Tuesday, October 29th.

Get Our Latest Analysis on VF

Insider Buying and Selling

In other VF news, Director Richard Carucci bought 15,000 shares of the stock in a transaction on Thursday, August 22nd. The stock was purchased at an average price of $16.70 per share, for a total transaction of $250,500.00. Following the completion of the purchase, the director now directly owns 230,178 shares in the company, valued at approximately $3,843,972.60. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 0.70% of the stock is currently owned by company insiders.

Institutional Trading of VF

Hedge funds have recently made changes to their positions in the stock. V Square Quantitative Management LLC raised its stake in VF by 8.9% during the 2nd quarter. V Square Quantitative Management LLC now owns 10,803 shares of the textile maker's stock valued at $146,000 after acquiring an additional 879 shares in the last quarter. EverSource Wealth Advisors LLC lifted its holdings in VF by 50.1% in the first quarter. EverSource Wealth Advisors LLC now owns 2,681 shares of the textile maker's stock worth $41,000 after purchasing an additional 895 shares during the period. Teachers Retirement System of The State of Kentucky increased its stake in VF by 0.9% during the 1st quarter. Teachers Retirement System of The State of Kentucky now owns 106,281 shares of the textile maker's stock valued at $1,630,000 after buying an additional 959 shares during the period. Arkadios Wealth Advisors lifted its stake in shares of VF by 5.3% in the 3rd quarter. Arkadios Wealth Advisors now owns 24,108 shares of the textile maker's stock worth $481,000 after acquiring an additional 1,217 shares during the period. Finally, Arizona State Retirement System boosted its holdings in shares of VF by 1.9% in the second quarter. Arizona State Retirement System now owns 92,524 shares of the textile maker's stock valued at $1,249,000 after acquiring an additional 1,681 shares in the last quarter. Institutional investors own 86.84% of the company's stock.

VF Price Performance

VF stock traded down $0.27 during trading on Wednesday, reaching $20.00. The company had a trading volume of 6,935,883 shares, compared to its average volume of 8,264,161. The company has a debt-to-equity ratio of 2.86, a current ratio of 1.30 and a quick ratio of 0.88. VF has a 12-month low of $11.00 and a 12-month high of $23.09. The stock's 50 day moving average price is $19.28 and its two-hundred day moving average price is $16.24.

VF (NYSE:VFC - Get Free Report) last issued its earnings results on Monday, October 28th. The textile maker reported $0.60 earnings per share for the quarter, topping the consensus estimate of $0.41 by $0.19. VF had a positive return on equity of 12.53% and a negative net margin of 6.68%. The business had revenue of $2.76 billion for the quarter, compared to analyst estimates of $2.72 billion. During the same period last year, the company posted $0.63 EPS. The business's quarterly revenue was down 5.6% on a year-over-year basis. As a group, sell-side analysts forecast that VF will post 0.48 earnings per share for the current year.

VF Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Tuesday, December 10th will be issued a $0.09 dividend. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $0.36 dividend on an annualized basis and a dividend yield of 1.80%. VF's dividend payout ratio (DPR) is -20.81%.

About VF

(

Get Free ReportV.F. Corporation, together with its subsidiaries, engages in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific. It operates through three segments: Outdoor, Active, and Work.

Recommended Stories

Before you consider VF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VF wasn't on the list.

While VF currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.