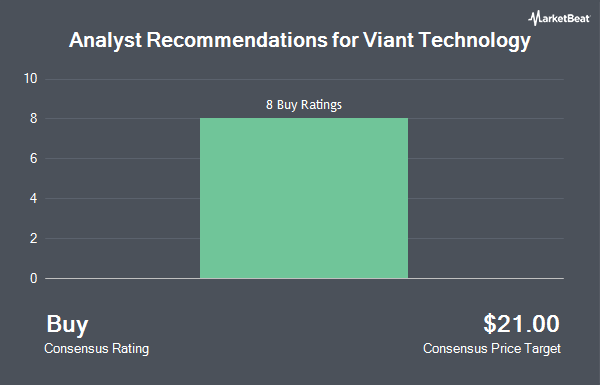

Shares of Viant Technology Inc. (NASDAQ:DSP - Get Free Report) have received a consensus recommendation of "Buy" from the eight research firms that are currently covering the firm, MarketBeat Ratings reports. Eight equities research analysts have rated the stock with a buy recommendation. The average 12 month price objective among brokers that have issued a report on the stock in the last year is $17.75.

DSP has been the subject of a number of research analyst reports. Craig Hallum increased their target price on Viant Technology from $14.00 to $18.00 and gave the company a "buy" rating in a report on Wednesday, November 13th. Needham & Company LLC upped their price objective on Viant Technology from $12.00 to $18.00 and gave the company a "buy" rating in a report on Wednesday, November 13th. Canaccord Genuity Group upgraded shares of Viant Technology from a "hold" rating to a "buy" rating and boosted their price objective for the company from $13.00 to $18.00 in a report on Wednesday, November 13th. Canaccord Genuity Group increased their target price on Viant Technology from $18.00 to $22.00 and gave the stock a "buy" rating in a research note on Monday, December 2nd. Finally, JMP Securities increased their price target on Viant Technology from $12.00 to $17.00 and gave the company a "market outperform" rating in a research report on Wednesday, November 13th.

Read Our Latest Stock Analysis on Viant Technology

Viant Technology Price Performance

Shares of NASDAQ:DSP traded down $0.04 during trading on Friday, reaching $20.35. 197,357 shares of the company were exchanged, compared to its average volume of 275,210. Viant Technology has a 12-month low of $6.31 and a 12-month high of $21.07. The firm has a market capitalization of $1.28 billion, a PE ratio of 339.22 and a beta of 1.00. The business's fifty day simple moving average is $14.14 and its 200-day simple moving average is $11.64.

Insider Buying and Selling

In related news, CFO Larry Madden sold 2,768 shares of the firm's stock in a transaction that occurred on Friday, October 11th. The shares were sold at an average price of $11.23, for a total transaction of $31,084.64. Following the sale, the chief financial officer now owns 529,848 shares in the company, valued at approximately $5,950,193.04. This trade represents a 0.52 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders have sold 114,450 shares of company stock valued at $1,799,992 over the last quarter. Company insiders own 28.80% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of the business. Allspring Global Investments Holdings LLC acquired a new position in shares of Viant Technology in the 2nd quarter valued at $47,000. FMR LLC lifted its stake in shares of Viant Technology by 77.9% in the 3rd quarter. FMR LLC now owns 7,134 shares of the company's stock valued at $79,000 after purchasing an additional 3,123 shares in the last quarter. Ashton Thomas Private Wealth LLC purchased a new stake in shares of Viant Technology during the 2nd quarter worth about $84,000. Summit Global Investments acquired a new stake in Viant Technology during the 2nd quarter worth approximately $111,000. Finally, Mackenzie Financial Corp purchased a new position in Viant Technology in the second quarter valued at approximately $112,000. 11.38% of the stock is currently owned by institutional investors and hedge funds.

Viant Technology Company Profile

(

Get Free ReportViant Technology Inc operates as an advertising technology company. It provides Household ID, a people-based innovation that combines digital and personal identifiers into a normalized household profile; AI Bid Optimizer, solution that uses AI to analyze historical bid opportunities to predict the lowest media cost for desired advertisement; and Viant Data Platform, which offers marketers control over their own data with actionable insights into their marketing initiatives within a single platform.

Featured Articles

Before you consider Viant Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viant Technology wasn't on the list.

While Viant Technology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.