Quantinno Capital Management LP lifted its holdings in shares of VICI Properties Inc. (NYSE:VICI - Free Report) by 87.1% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 38,298 shares of the company's stock after acquiring an additional 17,825 shares during the quarter. Quantinno Capital Management LP's holdings in VICI Properties were worth $1,276,000 at the end of the most recent quarter.

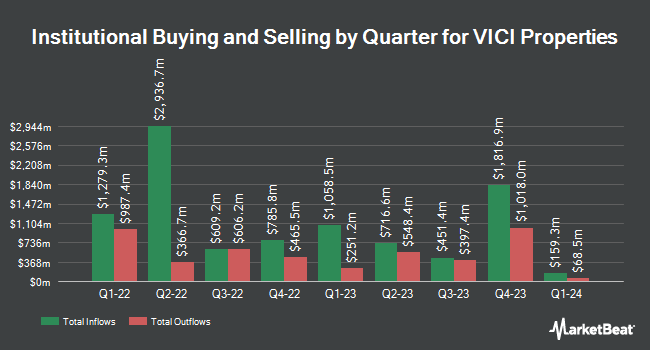

A number of other hedge funds have also bought and sold shares of the business. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its holdings in shares of VICI Properties by 599.3% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 8,936,815 shares of the company's stock worth $297,685,000 after purchasing an additional 7,658,819 shares during the period. Los Angeles Capital Management LLC raised its stake in shares of VICI Properties by 367.8% in the third quarter. Los Angeles Capital Management LLC now owns 2,219,378 shares of the company's stock valued at $73,927,000 after buying an additional 1,744,939 shares during the period. Canada Pension Plan Investment Board lifted its position in shares of VICI Properties by 101.4% during the 2nd quarter. Canada Pension Plan Investment Board now owns 3,453,547 shares of the company's stock valued at $98,910,000 after buying an additional 1,739,147 shares during the last quarter. Hsbc Holdings PLC grew its stake in shares of VICI Properties by 35.5% during the 2nd quarter. Hsbc Holdings PLC now owns 4,520,598 shares of the company's stock worth $129,321,000 after acquiring an additional 1,185,463 shares during the period. Finally, Charles Schwab Investment Management Inc. increased its holdings in VICI Properties by 7.0% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 11,823,688 shares of the company's stock worth $393,847,000 after acquiring an additional 770,195 shares during the last quarter. 97.71% of the stock is currently owned by institutional investors.

VICI Properties Price Performance

Shares of VICI stock traded up $0.04 on Friday, reaching $31.13. The company's stock had a trading volume of 3,343,219 shares, compared to its average volume of 5,601,486. VICI Properties Inc. has a 12-month low of $27.08 and a 12-month high of $34.29. The stock's 50 day simple moving average is $32.06 and its 200-day simple moving average is $31.24. The company has a quick ratio of 2.61, a current ratio of 2.61 and a debt-to-equity ratio of 0.63. The company has a market capitalization of $32.82 billion, a P/E ratio of 11.53, a PEG ratio of 4.15 and a beta of 0.93.

VICI Properties Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Stockholders of record on Tuesday, December 17th will be given a dividend of $0.4325 per share. The ex-dividend date is Tuesday, December 17th. This represents a $1.73 dividend on an annualized basis and a dividend yield of 5.56%. VICI Properties's dividend payout ratio (DPR) is presently 64.07%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on VICI shares. Evercore ISI lifted their target price on shares of VICI Properties from $36.00 to $37.00 and gave the stock an "outperform" rating in a research note on Monday, September 16th. JMP Securities reiterated a "market outperform" rating and issued a $35.00 price objective on shares of VICI Properties in a research note on Wednesday. Mizuho lowered their target price on shares of VICI Properties from $34.00 to $33.00 and set an "outperform" rating on the stock in a report on Thursday, November 14th. Finally, Wells Fargo & Company reaffirmed an "overweight" rating and issued a $36.00 price target (up from $33.00) on shares of VICI Properties in a report on Tuesday, October 1st. Two research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $34.00.

View Our Latest Report on VICI

VICI Properties Company Profile

(

Free Report)

VICI Properties Inc is an S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Further Reading

Before you consider VICI Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VICI Properties wasn't on the list.

While VICI Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.