Victory Capital Management Inc. increased its stake in Daktronics, Inc. (NASDAQ:DAKT - Free Report) by 31.6% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 191,799 shares of the technology company's stock after purchasing an additional 46,104 shares during the quarter. Victory Capital Management Inc. owned 0.41% of Daktronics worth $2,476,000 at the end of the most recent quarter.

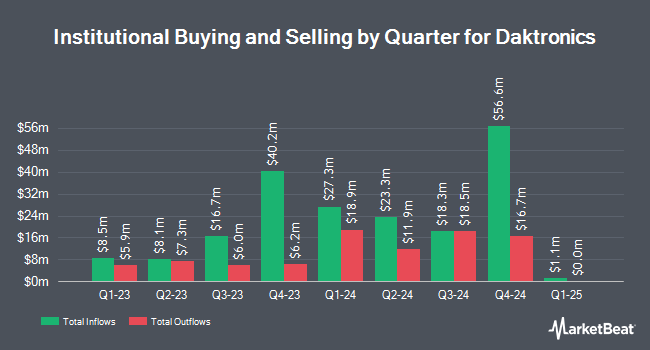

Several other hedge funds and other institutional investors have also recently made changes to their positions in the stock. Progeny 3 Inc. increased its position in shares of Daktronics by 140.0% in the second quarter. Progeny 3 Inc. now owns 1,794,908 shares of the technology company's stock valued at $25,039,000 after buying an additional 1,047,156 shares in the last quarter. Duquesne Family Office LLC lifted its holdings in shares of Daktronics by 20.3% in the second quarter. Duquesne Family Office LLC now owns 2,493,605 shares of the technology company's stock valued at $34,786,000 after purchasing an additional 420,161 shares in the last quarter. American Century Companies Inc. grew its position in shares of Daktronics by 27.5% in the second quarter. American Century Companies Inc. now owns 869,837 shares of the technology company's stock valued at $12,134,000 after purchasing an additional 187,486 shares during the last quarter. Privium Fund Management UK Ltd acquired a new stake in shares of Daktronics in the second quarter valued at approximately $1,338,000. Finally, Inspire Investing LLC purchased a new position in shares of Daktronics during the 2nd quarter worth approximately $998,000. Institutional investors and hedge funds own 61.69% of the company's stock.

Daktronics Trading Up 3.8 %

NASDAQ DAKT traded up $0.54 during mid-day trading on Friday, reaching $14.88. 312,083 shares of the stock were exchanged, compared to its average volume of 367,497. The stock has a market capitalization of $689.57 million, a PE ratio of 186.00, a PEG ratio of 0.53 and a beta of 1.14. The company has a debt-to-equity ratio of 0.48, a quick ratio of 1.48 and a current ratio of 2.17. Daktronics, Inc. has a 1-year low of $7.20 and a 1-year high of $15.97. The business's fifty day simple moving average is $13.47 and its 200 day simple moving average is $13.18.

Daktronics (NASDAQ:DAKT - Get Free Report) last posted its quarterly earnings data on Wednesday, September 4th. The technology company reported $0.36 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.30 by $0.06. Daktronics had a return on equity of 19.92% and a net margin of 1.29%. The business had revenue of $226.09 million for the quarter, compared to analysts' expectations of $216.84 million. On average, research analysts anticipate that Daktronics, Inc. will post 0.89 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on DAKT shares. StockNews.com upgraded Daktronics from a "hold" rating to a "buy" rating in a report on Monday, October 14th. Singular Research upgraded Daktronics to a "strong-buy" rating in a research report on Monday, September 9th.

Read Our Latest Stock Analysis on Daktronics

Insider Activity

In other Daktronics news, VP Matthew John Kurtenbach sold 15,400 shares of the business's stock in a transaction dated Thursday, October 3rd. The stock was sold at an average price of $13.28, for a total transaction of $204,512.00. Following the completion of the sale, the vice president now owns 2,500 shares of the company's stock, valued at approximately $33,200. The trade was a 86.03 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Bradley T. Wiemann sold 25,000 shares of Daktronics stock in a transaction dated Friday, September 27th. The shares were sold at an average price of $12.89, for a total value of $322,250.00. Following the completion of the transaction, the executive vice president now directly owns 85,446 shares in the company, valued at $1,101,398.94. This represents a 22.64 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 8.10% of the company's stock.

Daktronics Profile

(

Free Report)

Daktronics, Inc designs, manufactures, and sells electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial, and transportation applications in the United States and internationally. It operates through Commercial, Live Events, High School Park and Recreation, Transportation, and International segments.

Featured Articles

Before you consider Daktronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Daktronics wasn't on the list.

While Daktronics currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.