Victory Capital Management Inc. boosted its stake in shares of Grocery Outlet Holding Corp. (NASDAQ:GO - Free Report) by 23.2% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 915,119 shares of the company's stock after buying an additional 172,050 shares during the period. Victory Capital Management Inc. owned 0.93% of Grocery Outlet worth $16,060,000 at the end of the most recent quarter.

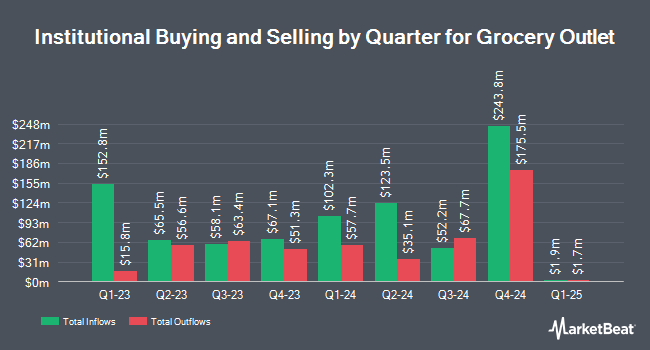

Several other large investors also recently added to or reduced their stakes in the stock. Capital World Investors raised its holdings in shares of Grocery Outlet by 281.4% in the 1st quarter. Capital World Investors now owns 3,579,683 shares of the company's stock valued at $103,023,000 after buying an additional 2,641,016 shares during the period. Millennium Management LLC increased its stake in Grocery Outlet by 677.6% during the second quarter. Millennium Management LLC now owns 1,981,558 shares of the company's stock worth $43,832,000 after purchasing an additional 1,726,741 shares during the period. Solel Partners LP acquired a new stake in shares of Grocery Outlet during the second quarter worth about $35,980,000. American Century Companies Inc. boosted its stake in shares of Grocery Outlet by 889.9% in the second quarter. American Century Companies Inc. now owns 1,010,785 shares of the company's stock valued at $22,359,000 after purchasing an additional 908,680 shares during the period. Finally, Dimensional Fund Advisors LP grew its holdings in shares of Grocery Outlet by 22.1% in the second quarter. Dimensional Fund Advisors LP now owns 3,613,617 shares of the company's stock valued at $79,933,000 after purchasing an additional 655,065 shares in the last quarter. 99.87% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several brokerages have recently weighed in on GO. Telsey Advisory Group cut their target price on Grocery Outlet from $19.00 to $18.00 and set a "market perform" rating on the stock in a research report on Wednesday, November 6th. Bank of America cut shares of Grocery Outlet from a "buy" rating to a "neutral" rating and cut their price objective for the stock from $29.00 to $17.00 in a report on Wednesday, October 30th. Roth Mkm lowered their target price on shares of Grocery Outlet from $20.00 to $16.00 and set a "neutral" rating for the company in a report on Wednesday, November 6th. Craig Hallum reduced their price target on shares of Grocery Outlet from $20.00 to $17.00 and set a "hold" rating for the company in a research report on Wednesday, November 6th. Finally, TD Cowen lowered Grocery Outlet from a "buy" rating to a "hold" rating and dropped their price objective for the stock from $25.00 to $16.00 in a report on Wednesday, November 6th. One research analyst has rated the stock with a sell rating, eight have given a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $18.00.

View Our Latest Stock Report on Grocery Outlet

Grocery Outlet Trading Down 1.0 %

GO traded down $0.19 during trading on Wednesday, hitting $18.44. 1,611,518 shares of the company's stock were exchanged, compared to its average volume of 1,850,333. The stock has a 50 day moving average price of $16.71 and a 200 day moving average price of $19.15. Grocery Outlet Holding Corp. has a 1 year low of $13.60 and a 1 year high of $29.80. The company has a current ratio of 1.46, a quick ratio of 0.33 and a debt-to-equity ratio of 0.34. The firm has a market cap of $1.79 billion, a P/E ratio of 36.16, a price-to-earnings-growth ratio of 4.45 and a beta of 0.13.

Grocery Outlet (NASDAQ:GO - Get Free Report) last posted its earnings results on Tuesday, November 5th. The company reported $0.28 EPS for the quarter, topping analysts' consensus estimates of $0.27 by $0.01. The business had revenue of $1.11 billion for the quarter, compared to analysts' expectations of $1.10 billion. Grocery Outlet had a net margin of 1.20% and a return on equity of 5.25%. The business's revenue for the quarter was up 10.4% compared to the same quarter last year. During the same period in the previous year, the company posted $0.25 earnings per share. As a group, analysts expect that Grocery Outlet Holding Corp. will post 0.63 EPS for the current fiscal year.

Insiders Place Their Bets

In other Grocery Outlet news, Director Erik D. Ragatz purchased 110,000 shares of the stock in a transaction dated Friday, November 15th. The shares were bought at an average cost of $18.25 per share, with a total value of $2,007,500.00. Following the completion of the acquisition, the director now owns 539,785 shares of the company's stock, valued at approximately $9,851,076.25. This trade represents a 25.59 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Eric J. Jr. Lindberg sold 200,095 shares of the business's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $16.29, for a total transaction of $3,259,547.55. Following the sale, the director now owns 70,938 shares in the company, valued at $1,155,580.02. This trade represents a 73.83 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 4.50% of the stock is owned by corporate insiders.

About Grocery Outlet

(

Free Report)

Grocery Outlet Holding Corp. operates as a retailer of consumables and fresh products sold through independently operated stores in the United States. Its stores offer products in various categories, such as dairy and deli, produce, floral, fresh meat, seafood products, grocery, general merchandise, health and beauty care, frozen food, beer and wine, and ethnic products.

Featured Articles

Before you consider Grocery Outlet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grocery Outlet wasn't on the list.

While Grocery Outlet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.