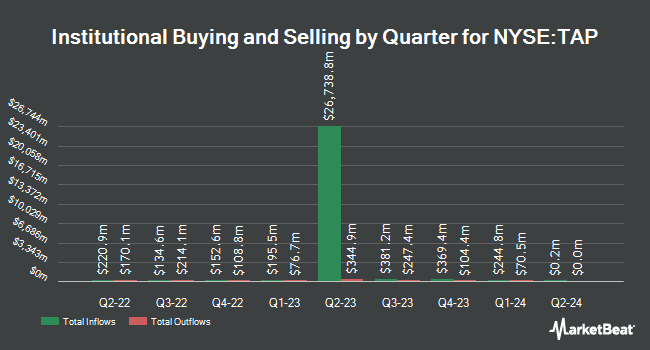

Victory Capital Management Inc. increased its position in shares of Molson Coors Beverage (NYSE:TAP - Free Report) by 92.8% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 434,047 shares of the company's stock after purchasing an additional 208,974 shares during the period. Victory Capital Management Inc. owned approximately 0.21% of Molson Coors Beverage worth $24,966,000 at the end of the most recent quarter.

Several other hedge funds also recently added to or reduced their stakes in TAP. Farther Finance Advisors LLC lifted its position in shares of Molson Coors Beverage by 11.8% during the third quarter. Farther Finance Advisors LLC now owns 1,720 shares of the company's stock valued at $99,000 after buying an additional 182 shares during the last quarter. Perpetual Ltd lifted its position in Molson Coors Beverage by 1.0% during the third quarter. Perpetual Ltd now owns 20,543 shares of the company's stock valued at $1,182,000 after acquiring an additional 197 shares during the last quarter. SkyView Investment Advisors LLC boosted its stake in Molson Coors Beverage by 1.8% in the second quarter. SkyView Investment Advisors LLC now owns 15,102 shares of the company's stock valued at $768,000 after acquiring an additional 274 shares in the last quarter. Private Advisor Group LLC grew its holdings in Molson Coors Beverage by 0.9% in the third quarter. Private Advisor Group LLC now owns 32,080 shares of the company's stock worth $1,845,000 after purchasing an additional 277 shares during the last quarter. Finally, Focus Financial Network Inc. increased its position in shares of Molson Coors Beverage by 7.0% during the third quarter. Focus Financial Network Inc. now owns 4,276 shares of the company's stock worth $246,000 after purchasing an additional 280 shares in the last quarter. 78.46% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on TAP shares. Wells Fargo & Company upgraded Molson Coors Beverage from an "underweight" rating to an "overweight" rating and boosted their price target for the stock from $52.00 to $74.00 in a research note on Friday, November 8th. Deutsche Bank Aktiengesellschaft upped their target price on Molson Coors Beverage from $56.00 to $57.00 and gave the stock a "hold" rating in a research note on Wednesday, August 7th. UBS Group boosted their price target on Molson Coors Beverage from $55.00 to $58.00 and gave the company a "neutral" rating in a report on Wednesday, August 7th. Piper Sandler raised their price objective on shares of Molson Coors Beverage from $57.00 to $59.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 7th. Finally, Barclays boosted their target price on shares of Molson Coors Beverage from $49.00 to $51.00 and gave the company an "underweight" rating in a research note on Monday, November 11th. Two investment analysts have rated the stock with a sell rating, nine have issued a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, Molson Coors Beverage currently has a consensus rating of "Hold" and an average price target of $60.31.

Get Our Latest Stock Analysis on Molson Coors Beverage

Molson Coors Beverage Price Performance

NYSE TAP traded down $0.39 during mid-day trading on Monday, hitting $62.03. The stock had a trading volume of 617,278 shares, compared to its average volume of 1,914,993. The firm's 50 day moving average is $56.23 and its 200 day moving average is $54.32. The company has a debt-to-equity ratio of 0.46, a current ratio of 0.99 and a quick ratio of 0.74. The stock has a market capitalization of $12.85 billion, a price-to-earnings ratio of 14.06, a PEG ratio of 2.42 and a beta of 0.82. Molson Coors Beverage has a twelve month low of $49.19 and a twelve month high of $69.18.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The company reported $1.80 earnings per share for the quarter, topping analysts' consensus estimates of $1.67 by $0.13. Molson Coors Beverage had a net margin of 6.78% and a return on equity of 9.24%. The firm had revenue of $3.04 billion for the quarter, compared to analyst estimates of $3.13 billion. During the same period in the previous year, the business posted $1.92 earnings per share. Molson Coors Beverage's quarterly revenue was down 7.8% on a year-over-year basis. Equities research analysts forecast that Molson Coors Beverage will post 5.78 earnings per share for the current fiscal year.

About Molson Coors Beverage

(

Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

Featured Articles

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.