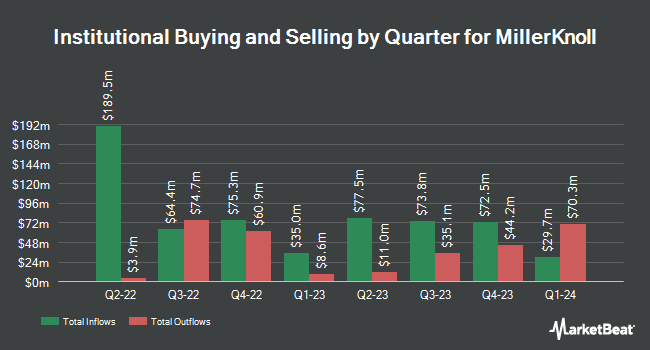

Victory Capital Management Inc. increased its stake in MillerKnoll, Inc. (NASDAQ:MLKN - Free Report) by 17.4% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 275,948 shares of the company's stock after purchasing an additional 40,928 shares during the period. Victory Capital Management Inc. owned 0.40% of MillerKnoll worth $6,234,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors also recently bought and sold shares of MLKN. Principal Financial Group Inc. boosted its stake in MillerKnoll by 1.5% in the 3rd quarter. Principal Financial Group Inc. now owns 358,529 shares of the company's stock worth $8,877,000 after purchasing an additional 5,155 shares in the last quarter. Empowered Funds LLC boosted its stake in MillerKnoll by 5.3% in the 3rd quarter. Empowered Funds LLC now owns 359,144 shares of the company's stock worth $8,892,000 after purchasing an additional 18,224 shares in the last quarter. Quest Partners LLC boosted its stake in MillerKnoll by 72.2% in the 3rd quarter. Quest Partners LLC now owns 11,360 shares of the company's stock worth $281,000 after purchasing an additional 4,763 shares in the last quarter. Meeder Asset Management Inc. acquired a new stake in MillerKnoll in the 3rd quarter worth approximately $84,000. Finally, Intech Investment Management LLC boosted its stake in MillerKnoll by 289.0% in the 3rd quarter. Intech Investment Management LLC now owns 62,473 shares of the company's stock worth $1,547,000 after purchasing an additional 46,413 shares in the last quarter. 87.50% of the stock is currently owned by institutional investors and hedge funds.

MillerKnoll Stock Performance

MLKN traded down $0.19 during trading on Tuesday, reaching $19.05. 409,619 shares of the company's stock were exchanged, compared to its average volume of 577,020. MillerKnoll, Inc. has a 1 year low of $18.87 and a 1 year high of $31.73. The company has a debt-to-equity ratio of 1.02, a current ratio of 1.60 and a quick ratio of 0.99. The stock has a market capitalization of $1.30 billion, a P/E ratio of 20.93, a price-to-earnings-growth ratio of 0.89 and a beta of 1.22. The company's fifty day simple moving average is $21.69 and its 200-day simple moving average is $23.59.

MillerKnoll (NASDAQ:MLKN - Get Free Report) last posted its quarterly earnings results on Wednesday, December 18th. The company reported $0.55 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.54 by $0.01. The company had revenue of $970.40 million during the quarter, compared to analyst estimates of $959.60 million. MillerKnoll had a net margin of 1.81% and a return on equity of 10.74%. MillerKnoll's revenue for the quarter was up 2.2% compared to the same quarter last year. During the same period last year, the firm posted $0.59 EPS. As a group, research analysts predict that MillerKnoll, Inc. will post 2.12 earnings per share for the current fiscal year.

MillerKnoll Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Saturday, March 1st will be issued a dividend of $0.1875 per share. This represents a $0.75 annualized dividend and a dividend yield of 3.94%. The ex-dividend date of this dividend is Friday, February 28th. MillerKnoll's dividend payout ratio (DPR) is 82.42%.

Wall Street Analyst Weigh In

Separately, StockNews.com raised shares of MillerKnoll from a "hold" rating to a "buy" rating in a research report on Wednesday, January 15th.

Check Out Our Latest Stock Report on MillerKnoll

MillerKnoll Profile

(

Free Report)

MillerKnoll, Inc researches, designs, manufactures, and distributes interior furnishings worldwide. It operates through three segments: Americas Contract, International Contract & Specialty, and Global Retail. The company also provides seating products, furniture systems, other freestanding furniture elements, textiles, leather, felt, home furnishings and related services, casegoods, storage products, as well as residential, education, and healthcare furniture solutions.

Further Reading

Before you consider MillerKnoll, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MillerKnoll wasn't on the list.

While MillerKnoll currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.