Victory Capital Management Inc. raised its position in Teradyne, Inc. (NASDAQ:TER - Free Report) by 6.8% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 89,431 shares of the company's stock after acquiring an additional 5,686 shares during the period. Victory Capital Management Inc. owned about 0.05% of Teradyne worth $11,977,000 as of its most recent filing with the SEC.

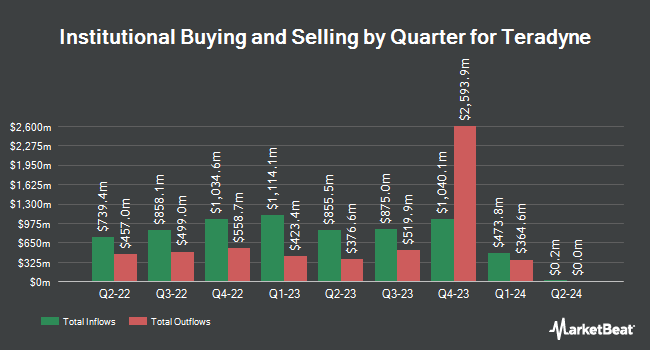

Other large investors have also added to or reduced their stakes in the company. Mitchell & Pahl Private Wealth LLC grew its position in shares of Teradyne by 1.1% during the 2nd quarter. Mitchell & Pahl Private Wealth LLC now owns 7,244 shares of the company's stock worth $1,074,000 after purchasing an additional 79 shares in the last quarter. Whittier Trust Co. increased its stake in Teradyne by 10.2% in the third quarter. Whittier Trust Co. now owns 950 shares of the company's stock valued at $127,000 after purchasing an additional 88 shares in the last quarter. Massmutual Trust Co. FSB ADV increased its stake in Teradyne by 17.3% during the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 651 shares of the company's stock valued at $97,000 after purchasing an additional 96 shares in the last quarter. Wealth Alliance raised its position in Teradyne by 3.3% in the 2nd quarter. Wealth Alliance now owns 3,044 shares of the company's stock valued at $451,000 after buying an additional 98 shares during the last quarter. Finally, Whittier Trust Co. of Nevada Inc. lifted its position in shares of Teradyne by 10.2% during the third quarter. Whittier Trust Co. of Nevada Inc. now owns 1,115 shares of the company's stock valued at $149,000 after purchasing an additional 103 shares in the last quarter. Institutional investors and hedge funds own 99.77% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts recently issued reports on TER shares. Robert W. Baird decreased their price objective on shares of Teradyne from $140.00 to $133.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Craig Hallum reduced their target price on Teradyne from $124.00 to $111.00 and set a "hold" rating for the company in a report on Friday, October 25th. Susquehanna upped their price target on shares of Teradyne from $130.00 to $145.00 and gave the stock a "positive" rating in a report on Friday, July 26th. Citigroup lowered their target price on shares of Teradyne from $185.00 to $162.00 and set a "buy" rating on the stock in a research note on Friday, July 26th. Finally, Stifel Nicolaus dropped their price target on Teradyne from $140.00 to $125.00 and set a "hold" rating for the company in a research note on Friday, October 25th. One analyst has rated the stock with a sell rating, six have given a hold rating and eight have assigned a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $142.62.

Read Our Latest Analysis on TER

Teradyne Stock Up 0.8 %

Shares of TER stock opened at $103.58 on Thursday. The company has a 50 day moving average price of $120.92 and a 200-day moving average price of $131.83. Teradyne, Inc. has a 52 week low of $90.24 and a 52 week high of $163.21. The firm has a market capitalization of $16.87 billion, a PE ratio of 32.88, a P/E/G ratio of 2.22 and a beta of 1.52.

Teradyne (NASDAQ:TER - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The company reported $0.90 EPS for the quarter, beating analysts' consensus estimates of $0.78 by $0.12. The company had revenue of $737.30 million during the quarter, compared to analysts' expectations of $716.40 million. Teradyne had a return on equity of 18.56% and a net margin of 18.75%. Teradyne's revenue for the quarter was up 4.8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.80 earnings per share. Analysts anticipate that Teradyne, Inc. will post 3.17 earnings per share for the current year.

Teradyne Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Monday, November 25th will be given a dividend of $0.12 per share. This represents a $0.48 dividend on an annualized basis and a dividend yield of 0.46%. The ex-dividend date of this dividend is Monday, November 25th. Teradyne's payout ratio is 15.24%.

Teradyne declared that its Board of Directors has approved a stock buyback plan on Monday, November 11th that allows the company to repurchase $100.00 million in outstanding shares. This repurchase authorization allows the company to purchase up to 0.6% of its stock through open market purchases. Stock repurchase plans are usually a sign that the company's leadership believes its shares are undervalued.

Insider Activity

In other news, insider Richard John Burns sold 789 shares of the stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total value of $104,779.20. Following the completion of the sale, the insider now directly owns 21,864 shares of the company's stock, valued at $2,903,539.20. This represents a 3.48 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Mercedes Johnson sold 625 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $133.49, for a total transaction of $83,431.25. Following the sale, the director now owns 16,518 shares in the company, valued at $2,204,987.82. The trade was a 3.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 8,199 shares of company stock valued at $1,080,634 in the last 90 days. Company insiders own 0.36% of the company's stock.

About Teradyne

(

Free Report)

Teradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

Featured Articles

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.