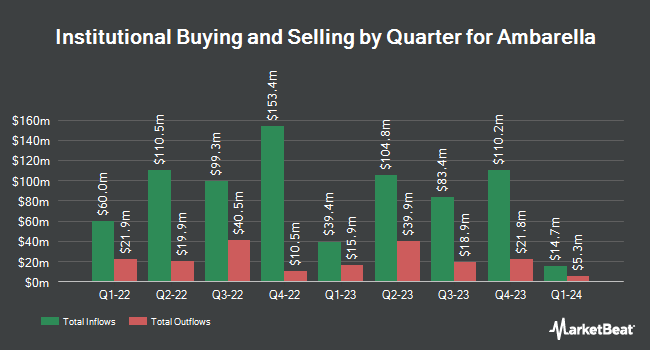

Victory Capital Management Inc. decreased its position in Ambarella, Inc. (NASDAQ:AMBA - Free Report) by 93.9% during the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 4,953 shares of the semiconductor company's stock after selling 76,260 shares during the quarter. Victory Capital Management Inc.'s holdings in Ambarella were worth $279,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also bought and sold shares of AMBA. SWS Partners increased its holdings in Ambarella by 25.3% in the 2nd quarter. SWS Partners now owns 79,522 shares of the semiconductor company's stock worth $4,290,000 after acquiring an additional 16,049 shares in the last quarter. Millennium Management LLC raised its position in shares of Ambarella by 7.0% during the 2nd quarter. Millennium Management LLC now owns 1,447,466 shares of the semiconductor company's stock valued at $78,091,000 after purchasing an additional 94,257 shares during the period. SG Americas Securities LLC bought a new stake in shares of Ambarella during the 2nd quarter valued at $841,000. Creative Planning lifted its stake in shares of Ambarella by 144.0% during the 3rd quarter. Creative Planning now owns 14,719 shares of the semiconductor company's stock valued at $830,000 after buying an additional 8,687 shares in the last quarter. Finally, Edgestream Partners L.P. boosted its holdings in Ambarella by 41.0% in the 2nd quarter. Edgestream Partners L.P. now owns 32,578 shares of the semiconductor company's stock worth $1,758,000 after buying an additional 9,465 shares during the period. 82.09% of the stock is owned by hedge funds and other institutional investors.

Ambarella Stock Down 1.2 %

NASDAQ AMBA traded down $0.89 on Friday, hitting $71.55. 989,288 shares of the stock were exchanged, compared to its average volume of 699,736. Ambarella, Inc. has a 52-week low of $39.69 and a 52-week high of $81.32. The stock has a fifty day moving average price of $59.27 and a two-hundred day moving average price of $55.37.

Insider Activity at Ambarella

In related news, CFO John Alexander Young sold 2,139 shares of the firm's stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $53.54, for a total value of $114,522.06. Following the transaction, the chief financial officer now owns 103,529 shares of the company's stock, valued at $5,542,942.66. This trade represents a 2.02 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, VP Yun-Lung Chen sold 5,963 shares of the business's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $57.56, for a total transaction of $343,230.28. Following the completion of the sale, the vice president now directly owns 62,026 shares of the company's stock, valued at approximately $3,570,216.56. This trade represents a 8.77 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 24,423 shares of company stock worth $1,356,402. Insiders own 5.70% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently commented on the company. Roth Mkm restated a "neutral" rating and issued a $60.00 price objective on shares of Ambarella in a research report on Wednesday, August 28th. Craig Hallum increased their price objective on shares of Ambarella from $85.00 to $90.00 and gave the company a "buy" rating in a report on Wednesday. Bank of America boosted their target price on shares of Ambarella from $57.00 to $65.00 and gave the stock an "underperform" rating in a report on Wednesday. Rosenblatt Securities reaffirmed a "buy" rating and set a $85.00 target price on shares of Ambarella in a research note on Friday, August 23rd. Finally, Northland Securities reiterated an "outperform" rating and issued a $95.00 price target (up previously from $75.00) on shares of Ambarella in a research note on Wednesday. Two investment analysts have rated the stock with a sell rating, three have assigned a hold rating and eight have assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $81.67.

Get Our Latest Report on Ambarella

About Ambarella

(

Free Report)

Ambarella, Inc develops semiconductor solutions that enable high-definition (HD) and ultra HD compression, image signal processing, and artificial intelligence processing worldwide. The company's system-on-a-chip designs integrated HD video processing, image processing, artificial intelligence computer vision algorithms, audio processing, and system functions onto a single chip for delivering video and image quality, differentiated functionality, and low power consumption.

Read More

Before you consider Ambarella, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambarella wasn't on the list.

While Ambarella currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.