Victory Capital Management Inc. reduced its holdings in Clear Secure, Inc. (NYSE:YOU - Free Report) by 49.4% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 447,644 shares of the company's stock after selling 437,681 shares during the period. Victory Capital Management Inc. owned about 0.32% of Clear Secure worth $14,835,000 at the end of the most recent quarter.

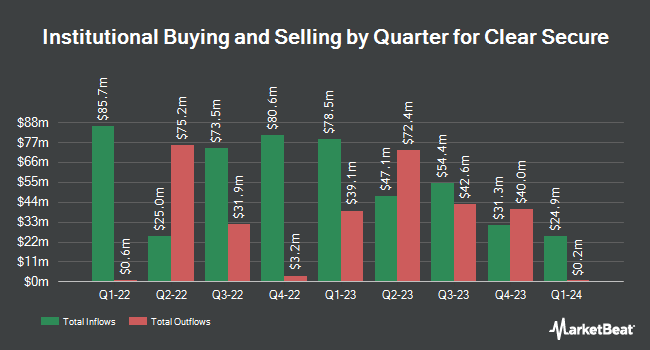

Several other institutional investors also recently bought and sold shares of YOU. Capital Performance Advisors LLP purchased a new position in shares of Clear Secure in the third quarter valued at approximately $26,000. Future Financial Wealth Managment LLC acquired a new stake in shares of Clear Secure in the third quarter valued at $33,000. University of Texas Texas AM Investment Management Co. acquired a new stake in shares of Clear Secure in the second quarter valued at $26,000. NBC Securities Inc. acquired a new stake in shares of Clear Secure in the third quarter valued at $105,000. Finally, Plato Investment Management Ltd grew its stake in Clear Secure by 10,535.4% during the 2nd quarter. Plato Investment Management Ltd now owns 5,105 shares of the company's stock worth $96,000 after purchasing an additional 5,057 shares in the last quarter. 73.80% of the stock is owned by institutional investors and hedge funds.

Clear Secure Trading Up 1.6 %

Clear Secure stock traded up $0.42 during midday trading on Wednesday, hitting $26.78. The stock had a trading volume of 1,422,690 shares, compared to its average volume of 1,784,405. The stock has a market cap of $3.73 billion, a P/E ratio of 31.14 and a beta of 1.63. The business has a fifty day moving average price of $32.61 and a 200 day moving average price of $25.33. Clear Secure, Inc. has a 12 month low of $16.05 and a 12 month high of $38.88.

Clear Secure (NYSE:YOU - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported $0.30 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.33 by ($0.03). The business had revenue of $198.40 million for the quarter, compared to analyst estimates of $194.62 million. Clear Secure had a return on equity of 48.28% and a net margin of 10.93%. The business's quarterly revenue was up 23.7% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.20 earnings per share. On average, equities analysts anticipate that Clear Secure, Inc. will post 1.01 EPS for the current fiscal year.

Clear Secure Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 17th. Stockholders of record on Tuesday, December 10th will be given a dividend of $0.125 per share. This represents a $0.50 dividend on an annualized basis and a dividend yield of 1.87%. The ex-dividend date is Tuesday, December 10th. This is an increase from Clear Secure's previous quarterly dividend of $0.10. Clear Secure's dividend payout ratio is 46.51%.

Insider Buying and Selling at Clear Secure

In other Clear Secure news, CFO Kenneth L. Cornick sold 79,935 shares of the company's stock in a transaction dated Thursday, August 29th. The shares were sold at an average price of $30.04, for a total transaction of $2,401,247.40. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Michael Z. Barkin sold 25,000 shares of the stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $28.64, for a total transaction of $716,000.00. Following the completion of the sale, the director now owns 7,056 shares of the company's stock, valued at approximately $202,083.84. The trade was a 77.99 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 1,006,435 shares of company stock valued at $32,173,077 in the last three months. 37.85% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

YOU has been the subject of several analyst reports. Stifel Nicolaus boosted their target price on Clear Secure from $24.00 to $32.00 and gave the stock a "hold" rating in a research note on Monday, October 28th. Telsey Advisory Group boosted their target price on Clear Secure from $34.00 to $42.00 and gave the company an "outperform" rating in a report on Friday, November 1st. The Goldman Sachs Group upped their price objective on Clear Secure from $27.00 to $31.00 and gave the company a "buy" rating in a research note on Thursday, August 8th. Needham & Company LLC reiterated a "buy" rating and set a $45.00 target price on shares of Clear Secure in a research report on Friday, November 8th. Finally, Wedbush reiterated a "neutral" rating and set a $26.00 target price (up previously from $24.00) on shares of Clear Secure in a research report on Thursday, November 7th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $32.67.

Read Our Latest Research Report on Clear Secure

Clear Secure Company Profile

(

Free Report)

Clear Secure, Inc operates a secure identity platform under the CLEAR brand name primarily in the United States. Its secure identity platform is a multi-layered infrastructure consisting of front-end, including enrollment, verification, and linking, as well as back-end. The company also offers CLEAR Plus, a consumer aviation subscription service, which enables access to predictable entry lanes in airport security checkpoints, as well as access to broader network; and CLEAR mobile app, which is used to enroll new members and improve the experience for existing members.

Read More

Before you consider Clear Secure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clear Secure wasn't on the list.

While Clear Secure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.