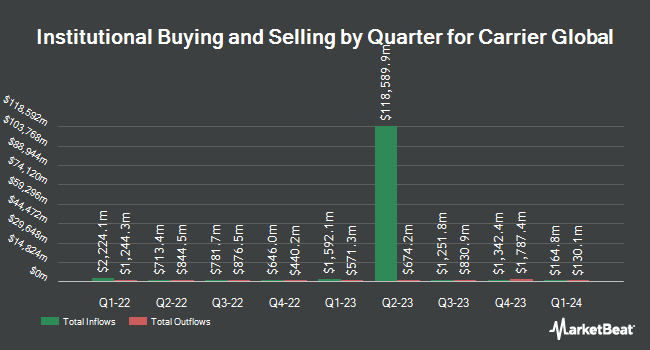

Victory Capital Management Inc. reduced its position in Carrier Global Co. (NYSE:CARR - Free Report) by 7.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 4,097,926 shares of the company's stock after selling 341,033 shares during the quarter. Victory Capital Management Inc. owned approximately 0.46% of Carrier Global worth $329,842,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Aptus Capital Advisors LLC increased its position in shares of Carrier Global by 39.4% during the third quarter. Aptus Capital Advisors LLC now owns 9,324 shares of the company's stock worth $750,000 after acquiring an additional 2,633 shares during the period. Hemenway Trust Co LLC raised its position in Carrier Global by 41.3% in the 3rd quarter. Hemenway Trust Co LLC now owns 288,023 shares of the company's stock valued at $23,183,000 after purchasing an additional 84,208 shares in the last quarter. Sumitomo Mitsui Trust Group Inc. raised its position in Carrier Global by 1.0% in the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 1,862,043 shares of the company's stock valued at $149,876,000 after purchasing an additional 19,331 shares in the last quarter. Harbour Investments Inc. boosted its stake in shares of Carrier Global by 8.5% in the 3rd quarter. Harbour Investments Inc. now owns 7,042 shares of the company's stock valued at $567,000 after buying an additional 553 shares during the period. Finally, Apollon Wealth Management LLC grew its position in shares of Carrier Global by 5.8% during the third quarter. Apollon Wealth Management LLC now owns 22,515 shares of the company's stock worth $1,812,000 after buying an additional 1,238 shares in the last quarter. 91.00% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities analysts recently commented on CARR shares. Baird R W upgraded shares of Carrier Global from a "hold" rating to a "strong-buy" rating in a research note on Monday, July 15th. Wolfe Research upgraded shares of Carrier Global from an "underperform" rating to a "peer perform" rating in a research note on Friday, September 6th. JPMorgan Chase & Co. began coverage on Carrier Global in a report on Thursday, October 10th. They set a "neutral" rating and a $83.00 price objective on the stock. Stephens reduced their target price on Carrier Global from $85.00 to $80.00 and set an "equal weight" rating for the company in a report on Monday, October 28th. Finally, Morgan Stanley initiated coverage on Carrier Global in a research report on Friday, September 6th. They set an "equal weight" rating and a $75.00 price target on the stock. Seven research analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $81.33.

Get Our Latest Analysis on Carrier Global

Carrier Global Price Performance

NYSE:CARR traded down $0.89 during trading hours on Tuesday, hitting $75.40. The company's stock had a trading volume of 4,500,487 shares, compared to its average volume of 4,152,367. The company has a market capitalization of $67.65 billion, a PE ratio of 19.31, a PEG ratio of 2.75 and a beta of 1.34. Carrier Global Co. has a 52-week low of $50.67 and a 52-week high of $83.32. The business's 50-day moving average is $77.26 and its two-hundred day moving average is $69.50. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.82 and a current ratio of 1.08.

Carrier Global Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, November 18th. Investors of record on Friday, October 25th will be paid a $0.19 dividend. This represents a $0.76 annualized dividend and a dividend yield of 1.01%. The ex-dividend date is Friday, October 25th. Carrier Global's dividend payout ratio (DPR) is 19.24%.

Carrier Global declared that its board has authorized a stock repurchase plan on Thursday, October 24th that permits the company to repurchase $3.00 billion in shares. This repurchase authorization permits the company to purchase up to 4.6% of its shares through open market purchases. Shares repurchase plans are often a sign that the company's board of directors believes its stock is undervalued.

Carrier Global Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Recommended Stories

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.