Victory Capital Management Inc. trimmed its position in DTE Energy (NYSE:DTE - Free Report) by 4.2% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 406,305 shares of the utilities provider's stock after selling 17,642 shares during the period. Victory Capital Management Inc. owned about 0.20% of DTE Energy worth $52,174,000 at the end of the most recent reporting period.

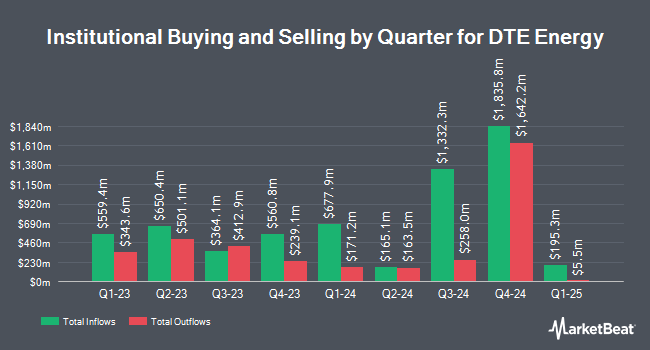

Several other institutional investors also recently bought and sold shares of DTE. UniSuper Management Pty Ltd boosted its holdings in shares of DTE Energy by 407.3% during the 1st quarter. UniSuper Management Pty Ltd now owns 10,715 shares of the utilities provider's stock worth $1,202,000 after purchasing an additional 8,603 shares during the last quarter. Mitsubishi UFJ Trust & Banking Corp boosted its holdings in shares of DTE Energy by 9.9% during the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 124,264 shares of the utilities provider's stock worth $13,934,000 after purchasing an additional 11,218 shares during the last quarter. State Board of Administration of Florida Retirement System boosted its holdings in shares of DTE Energy by 6.5% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 229,495 shares of the utilities provider's stock worth $25,139,000 after purchasing an additional 14,022 shares during the last quarter. Canada Pension Plan Investment Board boosted its holdings in shares of DTE Energy by 12.6% during the 1st quarter. Canada Pension Plan Investment Board now owns 381,985 shares of the utilities provider's stock worth $42,836,000 after purchasing an additional 42,635 shares during the last quarter. Finally, Cetera Advisors LLC acquired a new position in shares of DTE Energy during the 1st quarter worth approximately $708,000. 76.06% of the stock is currently owned by institutional investors and hedge funds.

DTE Energy Stock Up 0.4 %

DTE traded up $0.45 on Friday, reaching $119.86. 559,499 shares of the company traded hands, compared to its average volume of 1,098,570. The stock's 50 day moving average price is $124.96 and its 200-day moving average price is $119.18. DTE Energy has a 52-week low of $101.44 and a 52-week high of $131.66. The company has a market cap of $24.82 billion, a price-to-earnings ratio of 16.28, a PEG ratio of 2.19 and a beta of 0.68. The company has a debt-to-equity ratio of 1.76, a current ratio of 0.83 and a quick ratio of 0.62.

Analyst Ratings Changes

DTE has been the topic of several analyst reports. Morgan Stanley lifted their price target on shares of DTE Energy from $121.00 to $128.00 and gave the company an "overweight" rating in a research report on Wednesday, September 25th. StockNews.com raised DTE Energy from a "sell" rating to a "hold" rating in a research report on Tuesday, November 5th. Bank of America boosted their target price on DTE Energy from $131.00 to $136.00 and gave the company a "buy" rating in a research report on Thursday, August 29th. Mizuho upped their price objective on DTE Energy from $121.00 to $133.00 and gave the stock an "outperform" rating in a research report on Tuesday, September 10th. Finally, BMO Capital Markets upped their price objective on DTE Energy from $135.00 to $140.00 and gave the stock a "market perform" rating in a research report on Friday, October 18th. Six research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat.com, DTE Energy currently has a consensus rating of "Moderate Buy" and a consensus target price of $131.46.

Get Our Latest Report on DTE Energy

DTE Energy Profile

(

Free Report)

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

Read More

Before you consider DTE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DTE Energy wasn't on the list.

While DTE Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.