Victory Capital Management Inc. increased its holdings in Range Resources Co. (NYSE:RRC - Free Report) by 32.5% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 65,819 shares of the oil and gas exploration company's stock after acquiring an additional 16,134 shares during the quarter. Victory Capital Management Inc.'s holdings in Range Resources were worth $2,025,000 at the end of the most recent quarter.

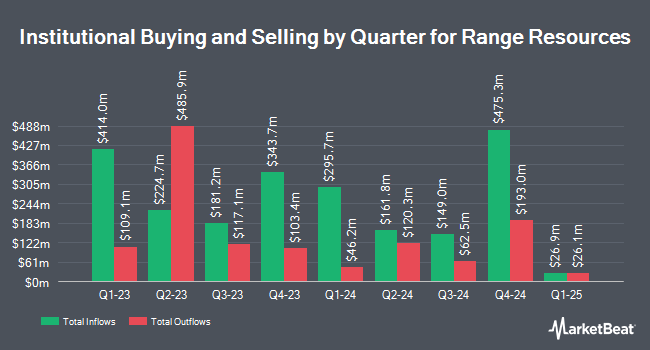

Several other hedge funds and other institutional investors also recently modified their holdings of RRC. Aptus Capital Advisors LLC raised its holdings in shares of Range Resources by 135.5% in the third quarter. Aptus Capital Advisors LLC now owns 112,008 shares of the oil and gas exploration company's stock worth $3,445,000 after acquiring an additional 64,443 shares during the last quarter. TCW Group Inc. increased its stake in Range Resources by 186.5% during the second quarter. TCW Group Inc. now owns 49,824 shares of the oil and gas exploration company's stock valued at $1,671,000 after purchasing an additional 32,433 shares during the last quarter. Mariner Investment Group LLC acquired a new position in Range Resources during the 3rd quarter worth $1,077,000. Vaughan Nelson Investment Management L.P. lifted its stake in shares of Range Resources by 26.2% in the 2nd quarter. Vaughan Nelson Investment Management L.P. now owns 1,186,310 shares of the oil and gas exploration company's stock worth $39,777,000 after acquiring an additional 246,172 shares during the period. Finally, Boston Partners raised its position in shares of Range Resources by 2.1% during the first quarter. Boston Partners now owns 6,531,086 shares of the oil and gas exploration company's stock worth $224,912,000 after purchasing an additional 133,565 shares during the period. 98.93% of the stock is currently owned by hedge funds and other institutional investors.

Range Resources Stock Up 1.7 %

RRC traded up $0.59 during midday trading on Monday, reaching $36.31. The company's stock had a trading volume of 1,812,488 shares, compared to its average volume of 2,350,173. The company has a current ratio of 0.54, a quick ratio of 0.54 and a debt-to-equity ratio of 0.28. The stock's 50-day moving average is $31.61 and its 200-day moving average is $32.53. Range Resources Co. has a 1 year low of $27.29 and a 1 year high of $39.33. The firm has a market capitalization of $8.76 billion, a price-to-earnings ratio of 18.43 and a beta of 1.80.

Range Resources (NYSE:RRC - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The oil and gas exploration company reported $0.48 earnings per share for the quarter, beating analysts' consensus estimates of $0.32 by $0.16. Range Resources had a return on equity of 13.69% and a net margin of 17.63%. The firm had revenue of $615.03 million for the quarter, compared to analysts' expectations of $617.90 million. During the same period in the previous year, the firm earned $0.43 EPS. The business's quarterly revenue was up .9% on a year-over-year basis. As a group, research analysts expect that Range Resources Co. will post 1.88 EPS for the current year.

Range Resources Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, September 27th. Investors of record on Friday, September 13th were issued a $0.08 dividend. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.88%. The ex-dividend date of this dividend was Friday, September 13th. Range Resources's dividend payout ratio (DPR) is presently 16.16%.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on RRC. Barclays raised Range Resources from an "underweight" rating to an "equal weight" rating and lowered their target price for the company from $35.00 to $34.00 in a research note on Wednesday, October 2nd. Piper Sandler decreased their price objective on Range Resources from $31.00 to $30.00 and set a "neutral" rating on the stock in a report on Monday, November 18th. Benchmark restated a "hold" rating on shares of Range Resources in a research note on Wednesday, October 23rd. Stephens raised their target price on shares of Range Resources from $36.00 to $37.00 and gave the company an "overweight" rating in a research note on Wednesday, October 23rd. Finally, Susquehanna dropped their price objective on Range Resources from $36.00 to $31.00 and set a "neutral" rating on the stock in a research note on Wednesday, September 4th. Four research analysts have rated the stock with a sell rating, twelve have assigned a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $35.00.

View Our Latest Research Report on Range Resources

Insider Transactions at Range Resources

In other Range Resources news, VP Ashley Kavanaugh sold 12,700 shares of the stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $31.45, for a total transaction of $399,415.00. Following the sale, the vice president now directly owns 9,670 shares of the company's stock, valued at approximately $304,121.50. This trade represents a 56.77 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Charles G. Griffie purchased 1,275 shares of the stock in a transaction that occurred on Thursday, October 24th. The shares were purchased at an average cost of $31.46 per share, for a total transaction of $40,111.50. Following the completion of the acquisition, the director now directly owns 5,921 shares of the company's stock, valued at $186,274.66. This represents a 27.44 % increase in their position. The disclosure for this purchase can be found here. Insiders own 2.50% of the company's stock.

Range Resources Profile

(

Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Recommended Stories

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.