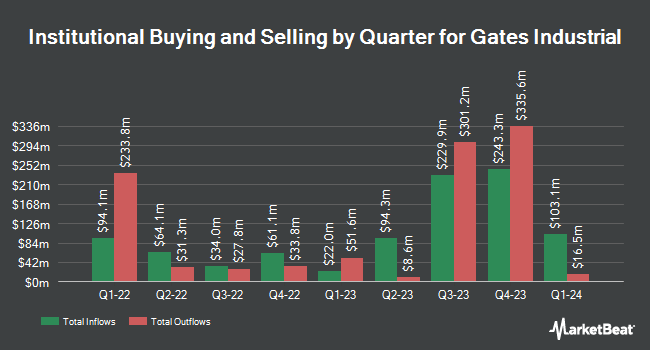

Victory Capital Management Inc. grew its stake in Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 20.1% during the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,091,408 shares of the company's stock after purchasing an additional 182,307 shares during the quarter. Victory Capital Management Inc. owned approximately 0.43% of Gates Industrial worth $19,154,000 at the end of the most recent reporting period.

Several other hedge funds also recently modified their holdings of GTES. Venturi Wealth Management LLC boosted its position in Gates Industrial by 35.9% in the third quarter. Venturi Wealth Management LLC now owns 3,079 shares of the company's stock worth $54,000 after purchasing an additional 814 shares during the last quarter. State of New Jersey Common Pension Fund D increased its holdings in Gates Industrial by 2.8% during the third quarter. State of New Jersey Common Pension Fund D now owns 110,629 shares of the company's stock worth $1,942,000 after buying an additional 3,061 shares during the last quarter. Crossmark Global Holdings Inc. boosted its stake in Gates Industrial by 7.0% in the third quarter. Crossmark Global Holdings Inc. now owns 53,079 shares of the company's stock valued at $931,000 after acquiring an additional 3,459 shares during the last quarter. Covestor Ltd grew its position in shares of Gates Industrial by 26.3% during the 3rd quarter. Covestor Ltd now owns 4,812 shares of the company's stock valued at $84,000 after acquiring an additional 1,001 shares during the period. Finally, Capital Performance Advisors LLP purchased a new position in Gates Industrial in the third quarter valued at approximately $67,000. Hedge funds and other institutional investors own 98.50% of the company's stock.

Analysts Set New Price Targets

GTES has been the topic of a number of recent research reports. Barclays upped their price target on Gates Industrial from $16.00 to $21.00 and gave the company an "equal weight" rating in a research report on Tuesday, November 5th. The Goldman Sachs Group raised their price objective on shares of Gates Industrial from $18.00 to $20.00 and gave the stock a "neutral" rating in a report on Thursday, August 1st. KeyCorp lifted their price target on Gates Industrial from $21.00 to $22.00 and gave the company an "overweight" rating in a research report on Thursday, October 31st. Royal Bank of Canada raised Gates Industrial from a "sector perform" rating to an "outperform" rating and lifted their target price for the company from $20.00 to $22.00 in a report on Monday, August 19th. Finally, Robert W. Baird lowered their price target on shares of Gates Industrial from $26.00 to $22.00 and set an "outperform" rating on the stock in a report on Thursday, August 1st. Four equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $20.30.

Get Our Latest Analysis on GTES

Gates Industrial Price Performance

Shares of GTES stock traded up $0.22 during trading hours on Tuesday, hitting $21.29. 3,873,155 shares of the company's stock were exchanged, compared to its average volume of 3,076,396. Gates Industrial Corp PLC has a 12-month low of $11.22 and a 12-month high of $21.54. The company has a market capitalization of $5.42 billion, a PE ratio of 25.40 and a beta of 1.38. The business's 50 day simple moving average is $18.50 and its 200-day simple moving average is $17.41. The company has a current ratio of 3.02, a quick ratio of 2.11 and a debt-to-equity ratio of 0.70.

Gates Industrial declared that its board has authorized a share repurchase program on Wednesday, July 31st that permits the company to buyback $250.00 million in outstanding shares. This buyback authorization permits the company to buy up to 5.4% of its stock through open market purchases. Stock buyback programs are often a sign that the company's board believes its shares are undervalued.

Insider Activity

In related news, Director Wilson S. Neely acquired 11,952 shares of Gates Industrial stock in a transaction on Wednesday, August 21st. The shares were acquired at an average cost of $16.80 per share, with a total value of $200,793.60. Following the transaction, the director now owns 6,000 shares in the company, valued at $100,800. This trade represents a -200.81 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this link. Insiders own 2.30% of the company's stock.

About Gates Industrial

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Further Reading

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.