Victory Capital Management Inc. boosted its stake in shares of Churchill Downs Incorporated (NASDAQ:CHDN - Free Report) by 44.6% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 218,191 shares of the company's stock after acquiring an additional 67,296 shares during the period. Victory Capital Management Inc. owned 0.30% of Churchill Downs worth $29,502,000 at the end of the most recent quarter.

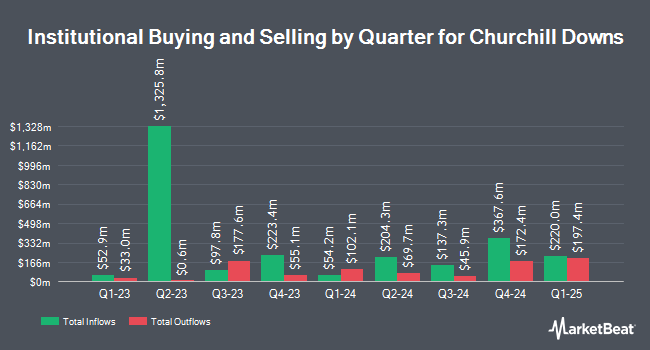

Other institutional investors and hedge funds also recently bought and sold shares of the company. Kimelman & Baird LLC purchased a new position in shares of Churchill Downs during the second quarter valued at about $42,000. CWM LLC increased its stake in Churchill Downs by 36.8% in the 2nd quarter. CWM LLC now owns 439 shares of the company's stock worth $61,000 after acquiring an additional 118 shares during the last quarter. UMB Bank n.a. raised its holdings in shares of Churchill Downs by 82.8% during the 3rd quarter. UMB Bank n.a. now owns 563 shares of the company's stock worth $76,000 after acquiring an additional 255 shares in the last quarter. Bank & Trust Co bought a new position in shares of Churchill Downs during the 2nd quarter valued at approximately $84,000. Finally, GAMMA Investing LLC grew its holdings in shares of Churchill Downs by 72.4% in the second quarter. GAMMA Investing LLC now owns 612 shares of the company's stock valued at $85,000 after purchasing an additional 257 shares in the last quarter. 82.59% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

CHDN has been the subject of several research reports. Bank of America upgraded shares of Churchill Downs from a "neutral" rating to a "buy" rating and increased their price objective for the company from $145.00 to $155.00 in a research report on Monday, August 12th. Stifel Nicolaus lifted their price target on Churchill Downs from $153.00 to $160.00 and gave the stock a "buy" rating in a research report on Monday, July 22nd. Mizuho decreased their price objective on Churchill Downs from $157.00 to $151.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 22nd. Wells Fargo & Company lifted their target price on Churchill Downs from $161.00 to $168.00 and gave the stock an "overweight" rating in a report on Thursday, October 17th. Finally, Truist Financial restated a "buy" rating and set a $165.00 price target (down previously from $166.00) on shares of Churchill Downs in a report on Friday, October 25th. One analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $160.88.

Check Out Our Latest Stock Analysis on Churchill Downs

Churchill Downs Trading Down 1.4 %

Churchill Downs stock traded down $2.00 during mid-day trading on Friday, hitting $138.91. The company's stock had a trading volume of 468,305 shares, compared to its average volume of 550,142. Churchill Downs Incorporated has a one year low of $111.10 and a one year high of $150.21. The stock has a market cap of $10.21 billion, a PE ratio of 25.30, a P/E/G ratio of 3.85 and a beta of 0.96. The company has a 50 day moving average of $139.03 and a 200-day moving average of $137.79. The company has a debt-to-equity ratio of 4.35, a quick ratio of 0.55 and a current ratio of 0.55.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last posted its quarterly earnings results on Wednesday, October 23rd. The company reported $0.97 EPS for the quarter, topping the consensus estimate of $0.96 by $0.01. The company had revenue of $628.50 million for the quarter, compared to the consensus estimate of $627.90 million. Churchill Downs had a net margin of 15.45% and a return on equity of 45.48%. The firm's revenue was up 9.8% compared to the same quarter last year. During the same quarter last year, the firm posted $0.87 EPS. On average, research analysts anticipate that Churchill Downs Incorporated will post 5.86 EPS for the current year.

Churchill Downs Increases Dividend

The company also recently disclosed an annual dividend, which will be paid on Friday, January 3rd. Investors of record on Friday, December 6th will be paid a $0.409 dividend. The ex-dividend date of this dividend is Friday, December 6th. This represents a yield of 0.29%. This is a boost from Churchill Downs's previous annual dividend of $0.38. Churchill Downs's dividend payout ratio is 6.92%.

About Churchill Downs

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Further Reading

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.