Victory Capital Management Inc. cut its holdings in Alight, Inc. (NYSE:ALIT - Free Report) by 2.7% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,996,658 shares of the company's stock after selling 163,951 shares during the quarter. Victory Capital Management Inc. owned 1.10% of Alight worth $44,375,000 as of its most recent SEC filing.

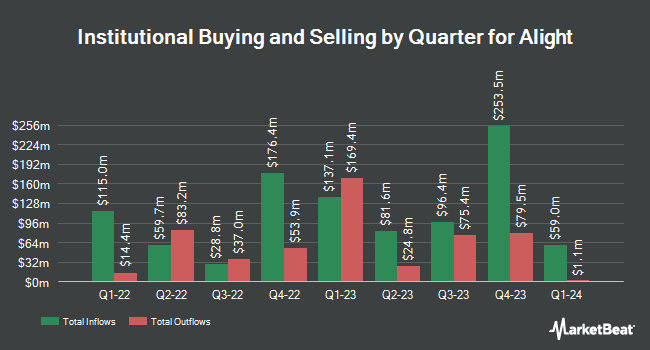

A number of other institutional investors and hedge funds have also made changes to their positions in the stock. Vanguard Group Inc. lifted its holdings in Alight by 8.1% in the 1st quarter. Vanguard Group Inc. now owns 38,041,368 shares of the company's stock valued at $374,707,000 after purchasing an additional 2,842,454 shares in the last quarter. Dimensional Fund Advisors LP grew its stake in shares of Alight by 18.9% in the second quarter. Dimensional Fund Advisors LP now owns 21,066,092 shares of the company's stock valued at $155,463,000 after buying an additional 3,342,413 shares in the last quarter. Janus Henderson Group PLC lifted its position in Alight by 1.8% during the 1st quarter. Janus Henderson Group PLC now owns 19,060,481 shares of the company's stock worth $187,745,000 after acquiring an additional 331,303 shares in the last quarter. Wolf Hill Capital Management LP raised its stake in shares of Alight by 28.4% during the first quarter. Wolf Hill Capital Management LP now owns 11,097,311 shares of the company's stock valued at $109,309,000 after purchasing an additional 2,454,870 shares during the period. Finally, River Road Asset Management LLC boosted its stake in shares of Alight by 2.9% in the third quarter. River Road Asset Management LLC now owns 9,988,254 shares of the company's stock valued at $73,913,000 after purchasing an additional 286,133 shares during the period. 96.74% of the stock is owned by institutional investors and hedge funds.

Alight Stock Performance

Shares of NYSE ALIT traded down $0.16 during mid-day trading on Friday, hitting $7.73. The company had a trading volume of 8,113,519 shares, compared to its average volume of 5,434,335. Alight, Inc. has a 12 month low of $6.15 and a 12 month high of $10.38. The stock has a market cap of $4.22 billion, a price-to-earnings ratio of -16.10 and a beta of 0.87. The company has a debt-to-equity ratio of 0.46, a current ratio of 1.30 and a quick ratio of 1.37. The firm's 50 day simple moving average is $7.28 and its two-hundred day simple moving average is $7.40.

Alight (NYSE:ALIT - Get Free Report) last posted its earnings results on Tuesday, November 12th. The company reported $0.09 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.09. Alight had a positive return on equity of 5.61% and a negative net margin of 7.95%. The company had revenue of $555.00 million for the quarter, compared to analysts' expectations of $538.39 million. During the same period last year, the business posted $0.07 earnings per share. The firm's quarterly revenue was down .4% compared to the same quarter last year. As a group, equities research analysts forecast that Alight, Inc. will post 0.42 earnings per share for the current year.

Alight Announces Dividend

The company also recently declared a -- dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be paid a $0.04 dividend. The ex-dividend date of this dividend is Monday, December 2nd.

Analyst Upgrades and Downgrades

ALIT has been the topic of a number of recent analyst reports. Needham & Company LLC boosted their price objective on shares of Alight from $9.00 to $11.00 and gave the stock a "buy" rating in a report on Wednesday. Wedbush cut their target price on Alight from $12.00 to $10.00 and set an "outperform" rating on the stock in a research report on Thursday, August 8th. Citigroup dropped their price target on shares of Alight from $12.00 to $11.00 and set a "buy" rating for the company in a research note on Thursday, August 29th. JPMorgan Chase & Co. downgraded shares of Alight from an "overweight" rating to a "neutral" rating and set a $8.00 price objective on the stock. in a research note on Tuesday, August 20th. Finally, Canaccord Genuity Group boosted their target price on shares of Alight from $11.00 to $12.00 and gave the stock a "buy" rating in a research report on Wednesday. One research analyst has rated the stock with a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat.com, Alight currently has an average rating of "Moderate Buy" and a consensus price target of $10.95.

Read Our Latest Stock Analysis on ALIT

Insider Activity

In related news, Director William P. Foley II sold 5,000,000 shares of the stock in a transaction dated Wednesday, November 13th. The shares were sold at an average price of $8.25, for a total value of $41,250,000.00. Following the completion of the transaction, the director now owns 883,323 shares in the company, valued at $7,287,414.75. This represents a 84.99 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. Corporate insiders own 5.33% of the company's stock.

Alight Company Profile

(

Free Report)

Alight, Inc provides cloud-based integrated digital human capital and business solutions worldwide. The company operates through two segments, Employer Solutions and Professional Services. The Employer Solutions segment offers employee wellbeing, integrated benefits administration, healthcare navigation, financial wellbeing, leave of absence management, retiree healthcare and payroll; and operates AI-led capabilities software.

Featured Articles

Before you consider Alight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alight wasn't on the list.

While Alight currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.