Victory Capital Management Inc. boosted its stake in shares of Nexstar Media Group, Inc. (NASDAQ:NXST - Free Report) by 41.9% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 20,571 shares of the company's stock after buying an additional 6,071 shares during the period. Victory Capital Management Inc. owned 0.06% of Nexstar Media Group worth $3,401,000 at the end of the most recent quarter.

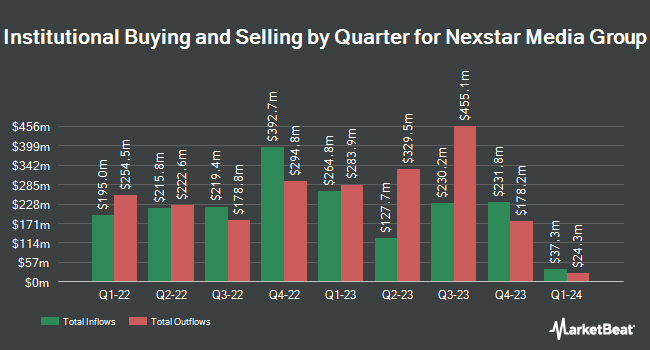

Several other large investors also recently added to or reduced their stakes in NXST. CX Institutional lifted its stake in shares of Nexstar Media Group by 5.0% in the 3rd quarter. CX Institutional now owns 1,396 shares of the company's stock valued at $231,000 after purchasing an additional 67 shares during the last quarter. Granite Group Advisors LLC lifted its position in Nexstar Media Group by 5.1% in the first quarter. Granite Group Advisors LLC now owns 1,489 shares of the company's stock valued at $257,000 after buying an additional 72 shares during the last quarter. Blue Trust Inc. boosted its stake in Nexstar Media Group by 7.3% during the third quarter. Blue Trust Inc. now owns 1,088 shares of the company's stock worth $181,000 after buying an additional 74 shares during the period. Klein Pavlis & Peasley Financial Inc. increased its position in shares of Nexstar Media Group by 0.6% during the second quarter. Klein Pavlis & Peasley Financial Inc. now owns 13,903 shares of the company's stock valued at $2,308,000 after acquiring an additional 87 shares during the last quarter. Finally, SummerHaven Investment Management LLC raised its stake in shares of Nexstar Media Group by 2.3% in the 2nd quarter. SummerHaven Investment Management LLC now owns 4,217 shares of the company's stock valued at $700,000 after acquiring an additional 96 shares during the period. 95.30% of the stock is currently owned by hedge funds and other institutional investors.

Nexstar Media Group Stock Up 0.4 %

Nexstar Media Group stock traded up $0.63 during trading on Friday, reaching $169.75. The stock had a trading volume of 374,430 shares, compared to its average volume of 399,829. The stock has a market cap of $5.27 billion, a PE ratio of 9.82, a P/E/G ratio of 0.20 and a beta of 1.48. The business has a 50 day moving average price of $168.98 and a 200 day moving average price of $167.16. Nexstar Media Group, Inc. has a 52-week low of $141.38 and a 52-week high of $191.86. The company has a quick ratio of 1.68, a current ratio of 1.68 and a debt-to-equity ratio of 2.98.

Nexstar Media Group (NASDAQ:NXST - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The company reported $5.27 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $5.51 by ($0.24). The business had revenue of $1.37 billion during the quarter, compared to analyst estimates of $1.37 billion. Nexstar Media Group had a net margin of 11.39% and a return on equity of 26.03%. The business's revenue for the quarter was up 20.7% compared to the same quarter last year. During the same period last year, the company earned $0.70 earnings per share. On average, analysts predict that Nexstar Media Group, Inc. will post 24.53 EPS for the current year.

Nexstar Media Group Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Friday, November 15th will be issued a $1.69 dividend. This represents a $6.76 annualized dividend and a dividend yield of 3.98%. The ex-dividend date of this dividend is Friday, November 15th. Nexstar Media Group's payout ratio is currently 39.10%.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on NXST shares. Barrington Research restated an "outperform" rating and set a $200.00 price target on shares of Nexstar Media Group in a research note on Thursday, November 7th. StockNews.com raised Nexstar Media Group from a "hold" rating to a "buy" rating in a research note on Friday, November 8th. Guggenheim dropped their target price on Nexstar Media Group from $200.00 to $198.00 and set a "buy" rating for the company in a research report on Friday, October 4th. Wells Fargo & Company reduced their price target on shares of Nexstar Media Group from $221.00 to $209.00 and set an "overweight" rating on the stock in a research report on Friday, August 9th. Finally, Loop Capital cut shares of Nexstar Media Group from a "buy" rating to a "hold" rating and dropped their price objective for the company from $200.00 to $190.00 in a report on Friday, November 8th. Two analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $198.50.

Get Our Latest Stock Report on Nexstar Media Group

Insider Transactions at Nexstar Media Group

In other Nexstar Media Group news, Director Charles Thomas Mcmillen sold 1,000 shares of the company's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $160.00, for a total transaction of $160,000.00. Following the completion of the sale, the director now directly owns 7,975 shares of the company's stock, valued at $1,276,000. This represents a 11.14 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Rachel Morgan sold 6,196 shares of Nexstar Media Group stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $171.30, for a total value of $1,061,374.80. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 44,903 shares of company stock worth $7,833,240. Insiders own 6.30% of the company's stock.

About Nexstar Media Group

(

Free Report)

Nexstar Media Group, Inc operates as a diversified media company that produces and distributes engaging local and national news, sports and entertainment content across the television and digital platforms in the United States. It owns, operates, programs, or provides sales and other services to various markets; and offers television programming services.

Featured Articles

Before you consider Nexstar Media Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nexstar Media Group wasn't on the list.

While Nexstar Media Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.